Powell testimony, FOMC minutes and US CPI all coming up over the next 24 hours…

Today’s North American session should be very lively, with the Bank of Canada rate decision, Federal Reserve Chairman Jerome Powell’s testimony and FOMC minutes all to look forward to, ahead of US CPI tomorrow. This obviously makes the USD/CAD the pair to watch, but in truth any US or Canadian dollar pairs could move, as well as stocks and gold. This is why we want to focus on the USD/CHF today for the franc is likely to respond to the volatility in the stock markets. The Swissy has also reached a critical technical juncture, so it is next move could be very important for technically-minded market participants.

Investors will be looking to Powell for guidance. Could he suggest that a rate cut in July will be a one off? There are also some suggestions that a July cut may not be necessary after all, given, for example, the health of the labour market. However, Powell knows that if he pushes rate cuts expectations out until September then that could trigger a furious response from both Donald Trump and the dollar, while stock could fall further. Thus, he will probably err on the side of caution and offer little in the way of strong hints about policy direction in the upcoming meetings, especially as consumer inflation figures won’t be released until tomorrow. Still, the markets, as usual, will over-analyse anything he says. If Powell is more vocal about the risks facing the economy and cautious on his outlook, then the markets may interpret that as a sign that the Fed will cut interest rates, while if he is sounding more optimistic, then that could send the dollar higher as investors push back their rate cut expectations.

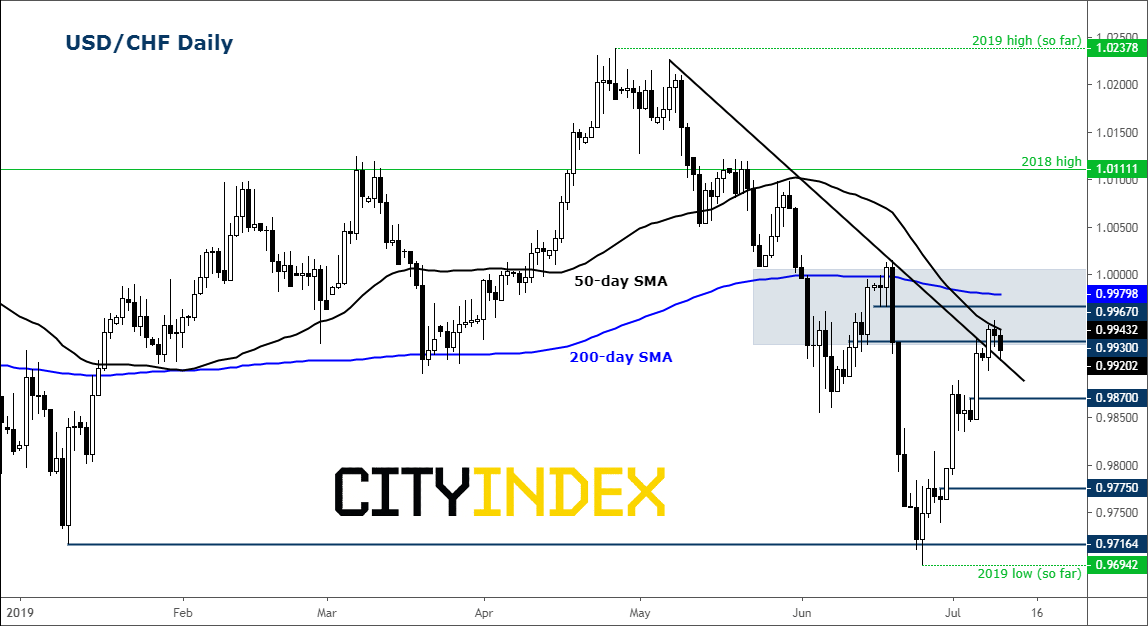

The USD/CHF has hit a major resistance zone between 0.9930 and 1.0000. This is where we have both the 50- and 200-day moving averages converge with a bearish trend line and an old support area. So we are not surprised at all to see some hesitation here, especially given the size of the recent rebound from this year’s low of 0.9695 hit on June 25. The key level of support we are watching now is at around 0.9870, a break below which could pave the way for a move towards the next key level at 0.9775. These levels were formerly resistance. Meanwhile a sustainable break above parity will end the bearish bias.

Source: Trading View and City Index.