Thanks to renewed concerns over a hard Brexit, the pound has continued to trade lower this late in Europe, boosting the Swiss franc on haven demand. The USD/CHF, EUR/CHF and GBP/CHF were all hovering near the day’s lows at the time of writing and more losses could be on the way for these franc pairs as we head towards year end.

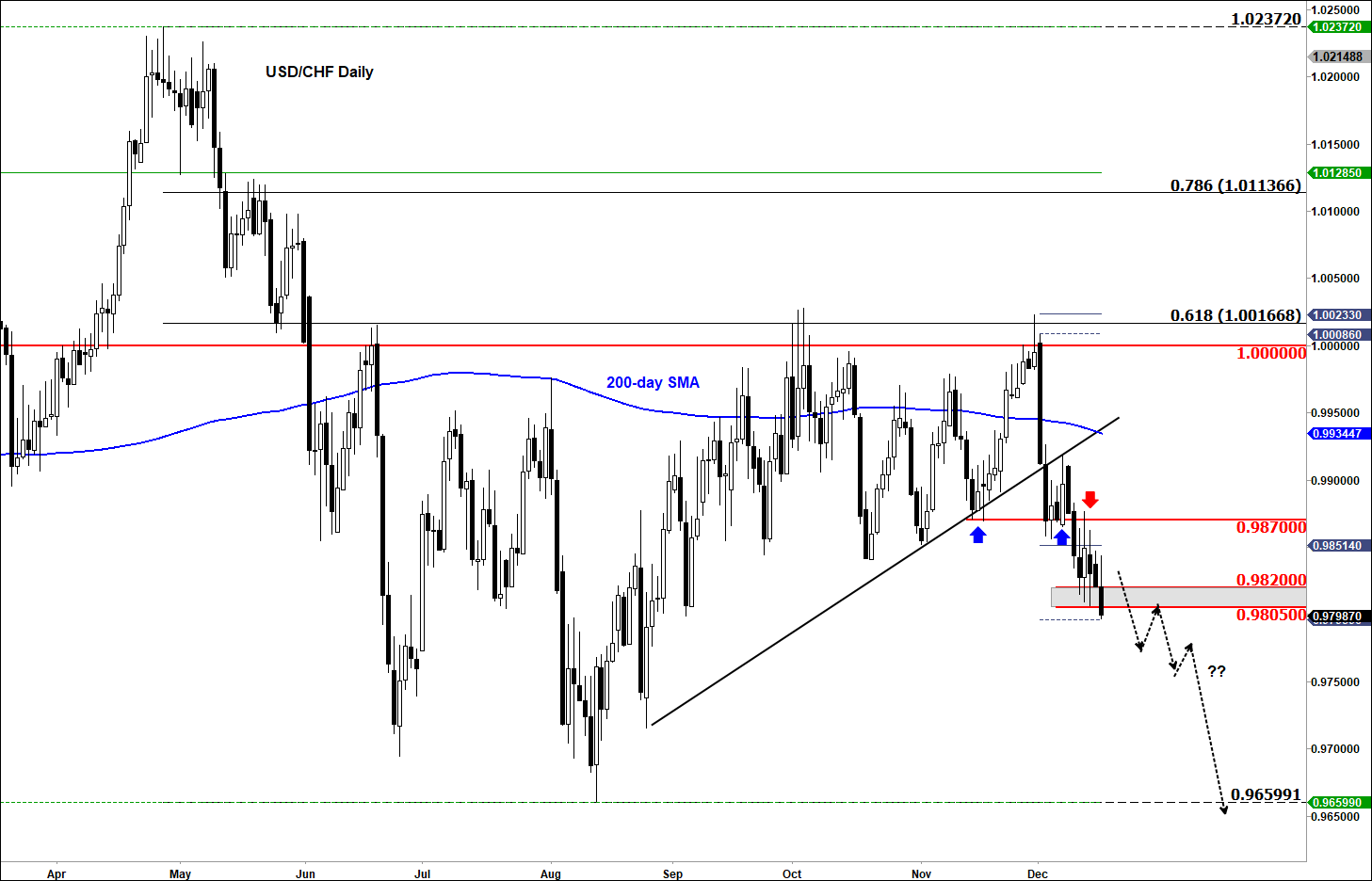

In fact, the USD/CHF has been making lower lows and lower highs since that failed breakout attempt above parity at the end of November. Rates have since broken below the 200-day average, a bullish trend line and the last low prior to that failed rally at 0.9870. This level has turned into resistance and so long as we hold below it, the path of least resistance would be to the downside.

As such, I wouldn’t be surprised if rates continued lower to eventually take out 0.9660 – this year’s low that was formed in August.

Source: eSignal and City Index.