With the Dollar Index breaking to a new 2019 high today and risk assets remaining generally supported, demand for haven assets has fallen further. Gold has broken key support in the $1485 region, triggering a cluster of stops sitting below than handle to create panic selling. Meanwhile, the USD/JPY has remained above the 108 handle, thanks not only to a firmer US dollar, but a weak yen too with the likes of GBP/JPY and CAD/JPY rising. Meanwhile the other key haven currency – the Swiss franc – has weakened too, falling even against the yen. Consequently, the USD/CHF is one where the dollar bulls are eying closely for a breakout.

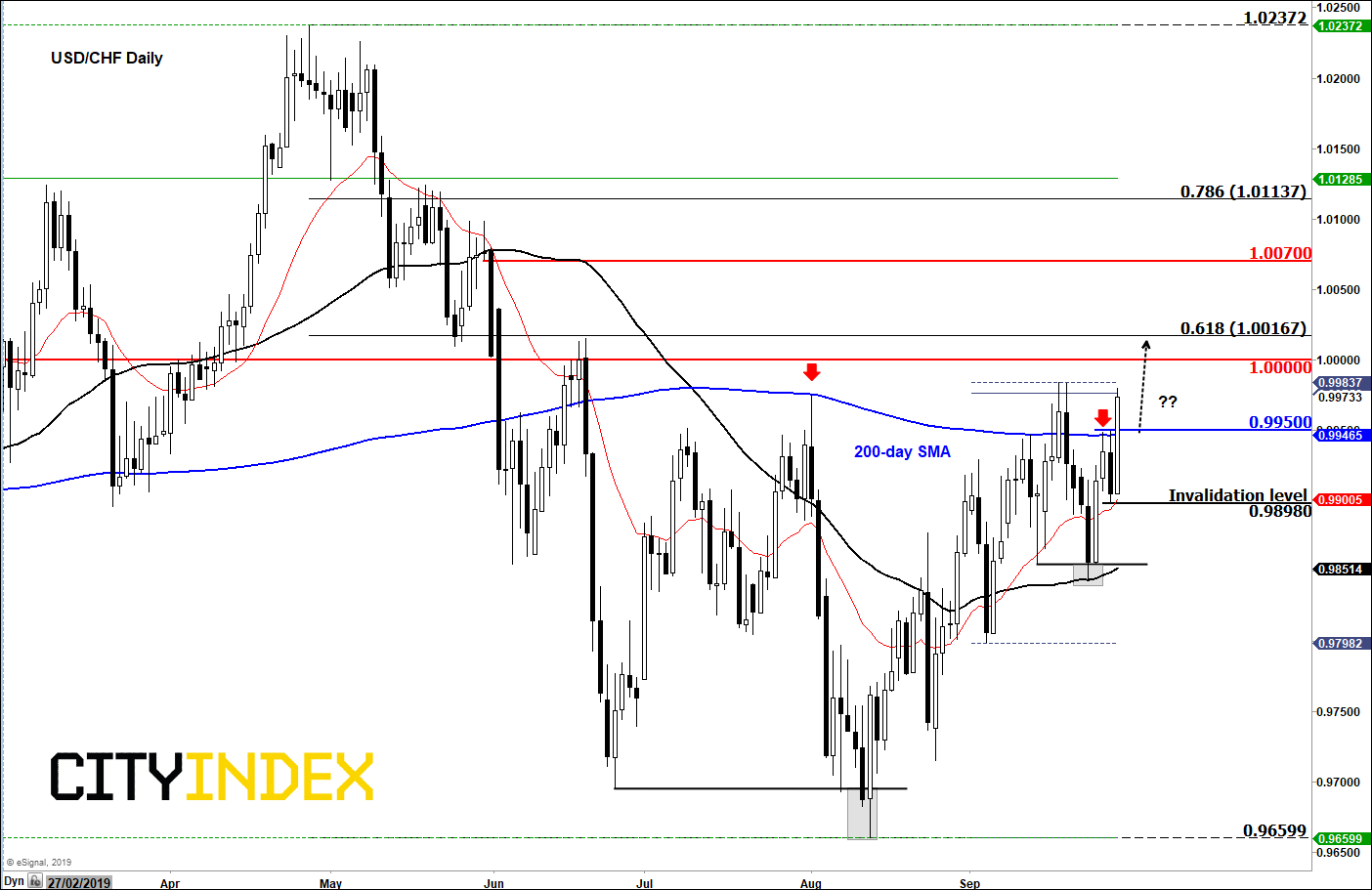

In fact, the USD/CHF has broken above the 200-day average again. Will it be third time lucky? In the previous two occasions, the breakout only lasted at most for a day, before selling pressure ensued. This time could be different given the widespread dollar strength and judging by the bullish characteristics of price action as well. On that note, the bulls will be pleased to see that Friday’s bearish engulfing candle completely failed to lure new sellers in. With the bears trapped now, any-test of Friday’s high around 0.9950 could see these participants cover their bets, adding to the buying pressure. So, 0.9950 is the most important short-term support level to watch now. But if this level fails to hold and price subsequently goes below Friday’s low at 0.9890 then in that case, the bullish setup would become invalidated again. But for now, the path of least resistance remains to the upside and a rally beyond parity looks imminent.

Source: eSignal and City Index.