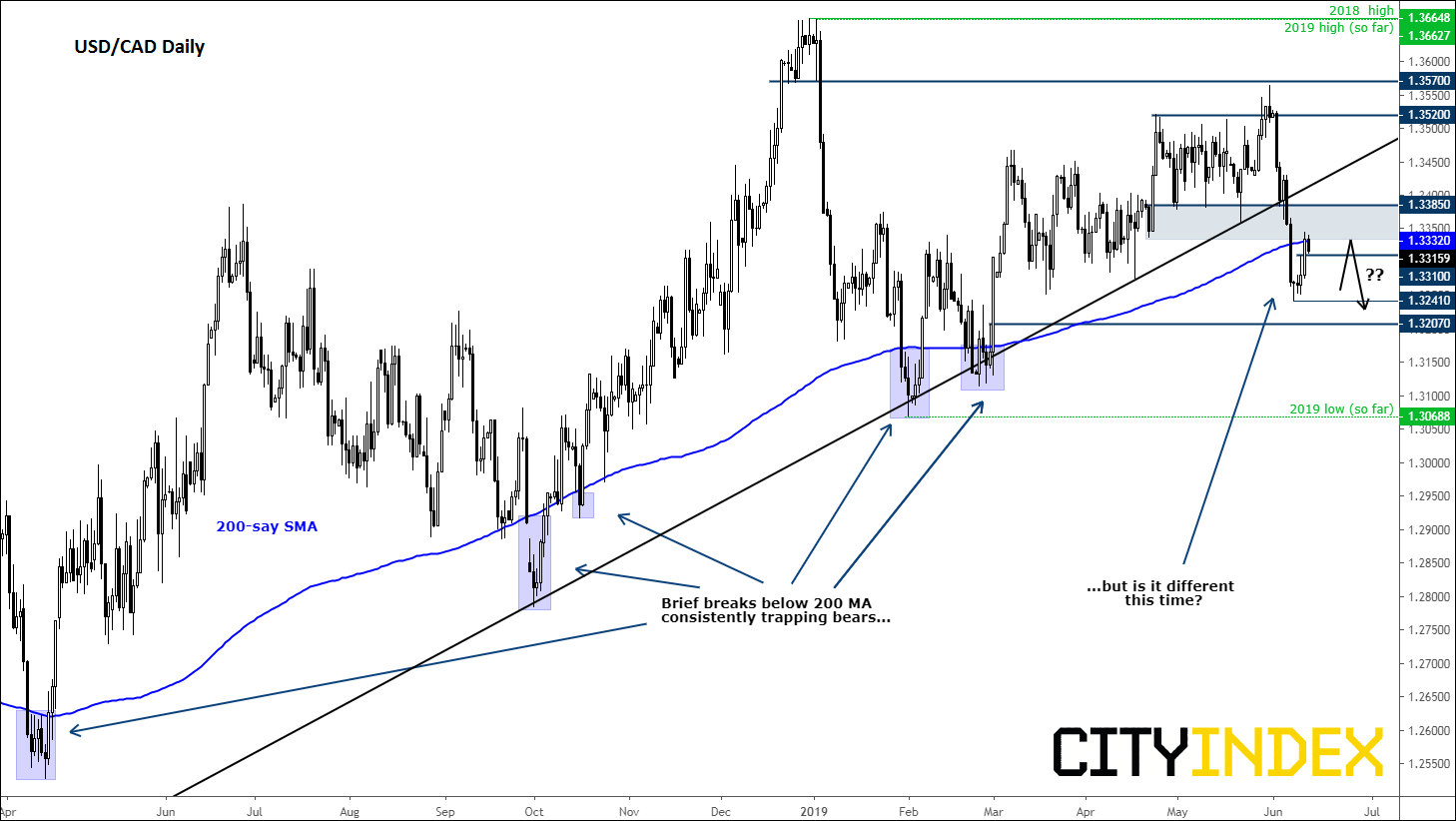

We wrote a USD/CAD piece on Monday, suggesting the popular North American pair was limping ahead of the publication of US consumer inflation data, but that there was a possibility for a short-term rebound to the 200-day moving average after it had fallen sharply the week before.

Well, as it turned out, US CPI was in fact weaker than expected but the markets shrugged off the news and the dollar rebounded on Wednesday, driving the USD/CAD to test that 200-day average, from where it has retreated again. So, our bearish view on this pair hasn’t changed, and we could see a more pronounced move lower as we head towards the end of this week.

There isn’t a lot on the agenda in terms of economic news, but the fact that oil prices have surged higher today is good news for the commodity dollar and bad for the USD/CAD. Brent crude oil was on course for its biggest single-session rally since early January after reports that two oil tankers had been attacked in the Gulf of Oman sent oil prices surging higher.

In terms of the next important macro data for this pair, traders will want to keep an eye on a raft of US macro pointers due for release on Friday, with retail sales perhaps being the most important of the lot. Next week will be even more important for this pair as we have Canadian CPI, manufacturing sales and retail sales, as well the FOMC and OPEC meetings.

As mentioned, our bearish technical view on the USD/CAD hasn’t changed much from Monday as we haven’t observed a break down in the market structure of lower lows and lower highs. So please refer to our previous report for further details.

Source: Trading View and City Index