USD/CAD Breaking Down Ahead of BOC and US/CA Job Reports

So far, the FX theme of the day is strength in the commodity dollars (CAD, AUD, and NZD) at the expense of “safe haven” currencies like the Swiss franc, Japanese yen, and US dollar. At a high level, traders are generally more confident that the developed world is finally getting a grip on the spread of COVID-19, opening the door for a global economic reopening and the attendant uptick in demand for raw materials.

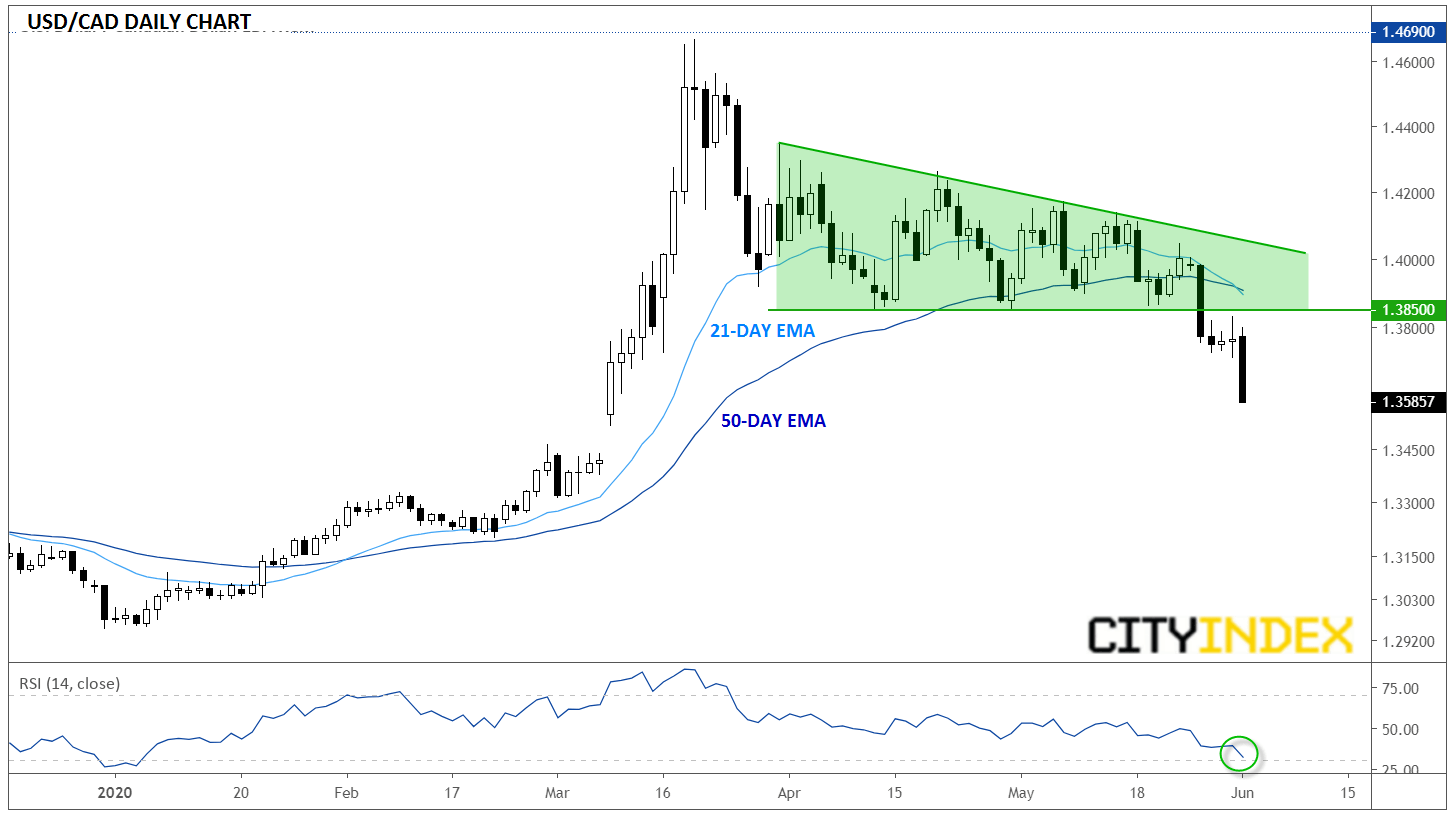

Zooming in on the North American pairing, USD/CAD, reveals a big technical breakdown in progress. After slicing through the post-COVID low near 1.3850 midway through last week, the pair spent the latter half of last week consolidating in the 1.3700s. Now, with today’s big drop, the pair is trading at its lowest level since early March, and traders are starting to eye the unfilled bullish gap around 1.3500:

Source: TradingView, GAIN Capital

With the 21-day EMA crossing back below its 50-day EMA, the trend has clearly shifted in favor of the bears. That said, the daily RSI indicator is nearing both its yearly low and the classic “oversold” level at 30, suggesting that it may not be prudent for bears to “chase” the breakdown in progress.

Instead, bearish-inclined traders may want to wait for an intraday bounce back toward 1.3700 to shift the risk-reward ratio back into balance. Whether or not we see a short-term bounce, the ultimate bearish objective could be set around 1.3400, which represents the “measured move” objective of the descending triangle pattern and the opportunity to fill the previous bullish gap from March. At this point, only a move back above 1.3850 would erase the near-term bearish bias.

As a final note, USD/CAD traders should keep an eye on this week’s economic calendar, headlined by the Bank of Canada meeting on Wednesday and dueling jobs reports from both the US and Canada on Friday.