The USD/CAD is among the most interesting pairs we are watching this week after it started to break lower last week. More losses could be on the way this week, especially if US CPI disappoints on Thursday. Here is why the USD/CAD has been falling:

- CAD has been supported in part by a less dovish central bank than expected – the Bank of Canada last week decided to leave interest rates unchanged at 1.75%, reiterating that “the current degree of monetary policy stimulus remains appropriate.”

- CAD has also been underpinned by rebounding oil prices – WTI is up for the third week

- USD has been undermined by a soft US jobs report and speculation for further rate cuts this year – the Fed is widely expected to trim rates by another 25 basis points next week.

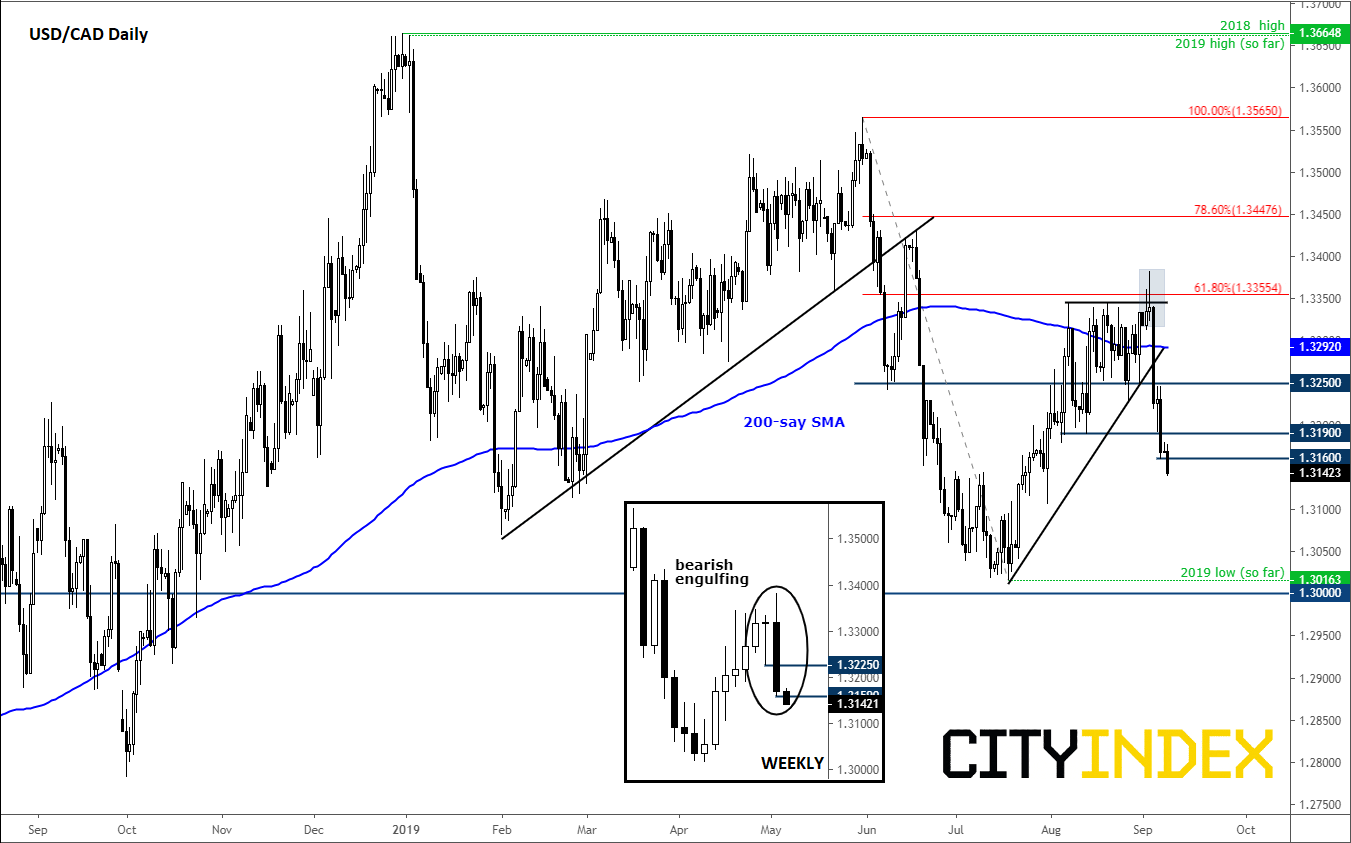

Source: Trading View and City Index

From a technical point of view, the USD/CAD’s price action point to a weaker exchange rate:

- There is large bearish engulfing candle on the week, suggesting the sellers took control last week after the bulls had earlier dominated the agenda.

- On the daily, the USD/CAD has broken its corrective trend line, which means the path of least resistance is to the downside

- The bears are possibly targeting the 1.30 handle, which comes in just below the prior lows

Latest market news

Yesterday 08:33 AM