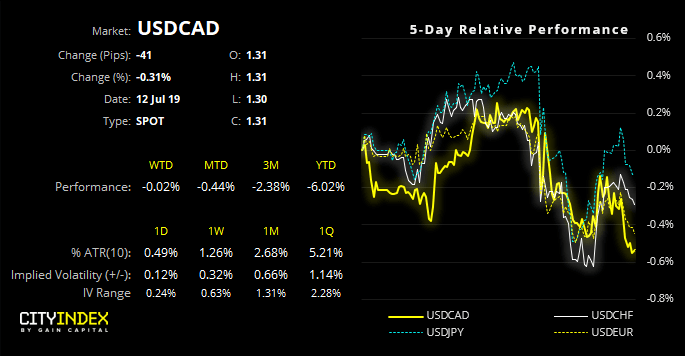

Key resistance held following Powell’s testimony and USD/CAD is now trying to extend its bearish trend, in line with our core view.

Going into Wednesday, it looked equally balanced between a near-term bullish reversal on the intraday charts, versus a sell-off from current levels. Even if it had popped higher, we saw the upper bounds of the bearish channel as worthy into fading it, given the underlying strength of the daily trend. Yet the clear rejection of 1.3145 puts it back into bearish hands who appear ready to break to new lows.

We’re light on USD/CAD specific news, other than US producer prices but it would have to be a fairly strong beat for USD/CAD to take notice at this stage.

- A clear break of 1.0330 brings the October low into focus

- We remain bearish whilst it trades beneath 1.3145.

Related analysis:

USD/CAD Braces Itself For Volatility Ahead Of Powell and BoC

EUR/CAD Stalls At Major Juncture Ahead Of NFP

AUD/CAD Probes Key Support Ahead of BOC

USD/CAD To Challenge 'Long' Held Views?