According to Wikipedia, Hydrogen-7 is the radioactive isotope with the shortest half-life at about 21 yoctoseconds (10-24 seconds). Of course, nothing in financial markets moves quite that fast (despite the best efforts of some algorithms), but the half-life of Friday’s surprise BOJ interest rate cut has been shockingingly short, even by 2016’s fast-moving market’s standards.

While the decision to cross the “negative interest rate rubicon” represents a major shift from the BOJ, traders are starting to realize that the actual economic impact of the interest rate cut will be minimal. As we noted on Friday, “logistically, the impact of the change in policy will be relatively limited, as it will “only” apply to about ¥10-30T of reserves (the vast bulk of reserves will continue to earn 0.1%)…”

The BOJ may eventually opt to expand the holdings that the rate applies to (or cut rates further), but for today, the central bank’s decision is being completely overwhelmed by the massive wave of risk aversion enveloping global markets this week. In other words, despite (or in some ways because of) the now-negative interest rates in Japan, traders still view the yen as a major safe-haven currency. Therefore, the near-term direction of the yen will depend on market sentiment (read: price action in other major markets like equities and commodities) as much as traditional economic data out of the US and Japan.

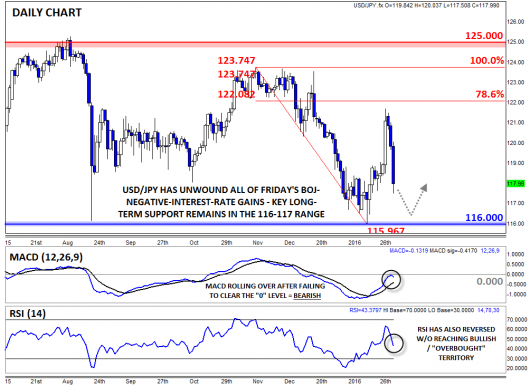

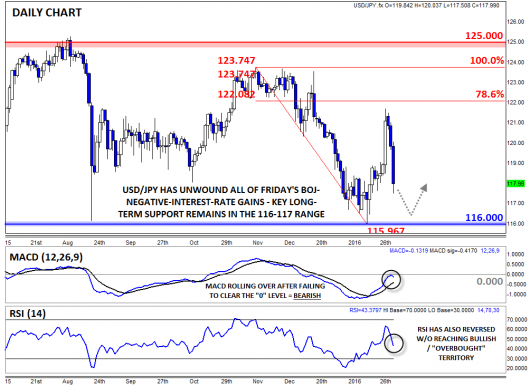

Technical view: USD/JPY

On a technical basis, the longer-term view for USD/JPY remains unchanged: the pair remains locked within the 900-pip range from 116.00 up to 125.00 that has contained rates since November 2014. From a fundamental perspective, we continue to believe that the BOJ will take actions to defend the bottom of this range, as the last thing the Japanese economy needs is a strengthening yen, but the near-term momentum remains strongly in favor of the bears for now.

With the MACD rolling over below the “0” level and the RSI indicator topping out before reaching “overbought” territory, more short-term weakness toward the 116-117 zone in USD/JPY is possible if global equities remain on the back foot.