USD JPY continues meteoric rise

USD/JPY (daily chart shown below) has continued its meteoric rise on Monday after last week’s stimulus action by the Bank of Japan. Friday’s aggressive surge […]

USD/JPY (daily chart shown below) has continued its meteoric rise on Monday after last week’s stimulus action by the Bank of Japan. Friday’s aggressive surge […]

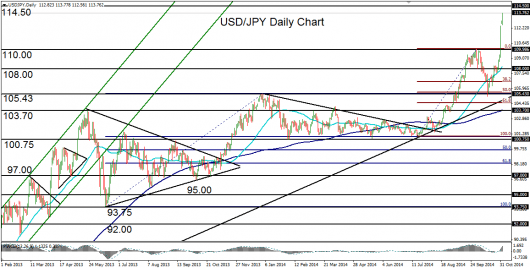

USD/JPY (daily chart shown below) has continued its meteoric rise on Monday after last week’s stimulus action by the Bank of Japan.

Friday’s aggressive surge pushed the currency pair well above its previous six-year high of 110.08, which was established a month ago at the beginning of October.

Prior to this latest surge, USD/JPY had been recovering from a pullback to the 105.00-area after having dropped by about 50% of its prior bullish run from the noted 110.08 high.

The recovery continued to gain steady ground during the past two weeks before Friday’s price leap.

Early trading on Monday saw the currency pair continue its strong advance to approach close to a seven-year high.

The next major resistance objective immediately to the upside resides around the 114.50 level, which was last hit towards the end of 2007.

While the trend bias for USD/JPY continues to be strongly bullish, a pullback should soon be due after the recent over-extension. Downside support areas in the event of this pullback reside around the 111.50 and 110.00 levels.