USD JPY continues consolidation near key support

USD/JPY (daily chart shown below) has continued to fluctuate in a tight consolidation above the key support provided by its 200-day moving average and a […]

USD/JPY (daily chart shown below) has continued to fluctuate in a tight consolidation above the key support provided by its 200-day moving average and a […]

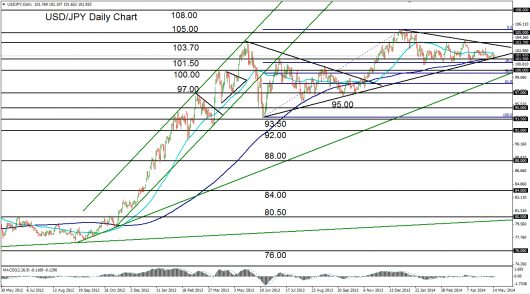

USD/JPY (daily chart shown below) has continued to fluctuate in a tight consolidation above the key support provided by its 200-day moving average and a critical trend line extending back to the mid-2013 low at 93.77.

The current prolonged consolidation has been in place since the five-year high of 105.43 was reached at the very beginning of the year.

Since that high, the currency pair has declined modestly, but has essentially traded sideways in a directionless trading range. This trading range has its borders approximately at 104.00 to the upside and 101.00 to the downside.

Price action is currently trading within an even tighter range, between its closely-situated 50-day and 200-day moving averages.

Despite this prolonged trading range, USD/JPY can still be considered to be trading within a general bullish trend that has been in place since the latter part of 2012.

With the noted support of the 200-day moving average and the mid-2013 trend line both still holding for the time being, the longer-term bias remains to the upside.

Resistance targets on any upside breakout currently reside around 103.75 and then the noted five-year high of 105.43.

A breakdown below current support could prompt a move back down towards the 100.00 psychological level.