After the Bank of Japan’s inaction overnight, the Nikkei fell a good 3% and the USD/JPY, which was already downbeat because of a dovish Fed the night before, tumbled below 105 to reach a low so far of 103.55. The USD/JPY and the dollar in general, has since bounced back a tad as traders took profit ahead of key US economic data at 13:30 BST (08:30 ET), including the latest inflation figures. If these numbers show further weakness then the US dollar will likely extend its falls as investors push out expectations about a potential rate rise further out. Already, a July rate hike is looking increasingly unlikely with the CME Group’s FedWatch tool pointing to a 7% probability – significantly lower than just a few weeks ago. And despite the Fed suggesting that there could be two rate rises in 2016, the probability of just one increase in the December meeting is currently just 38%. However if the data, especially the inflation figures, turn out to be better than expected then the odds for a rate increase could improve, leading to a more profound bounce in the USD.

Today’s US data releases include the Consumer Price Index (CPI) measure of inflation, the Philly Fed Manufacturing Index and weekly Unemployment Claims, all due for publication at 13:30 BST (08:30 ET). Headline CPI is expected to have edged up 0.3% month-over-month in May after climbing 0.4% the month before, while core CPI, which excludes the volatile food and energy prices, is seen rising 0.2% on the month. On a year-over-year basis, an unchanged headline CPI reading of 1.1% is expected to be seen. However core CPI is expected to have risen to +2.2% from +2.1% year-over-year in April. Meanwhile the Philly Fed Manufacturing Index is expected to have improved to +1.1 from -1.8 in May, while applications for unemployment claims are seen edging up to 267,000 from 264,000 the week before.

USD/JPY path of least resistance to the downside

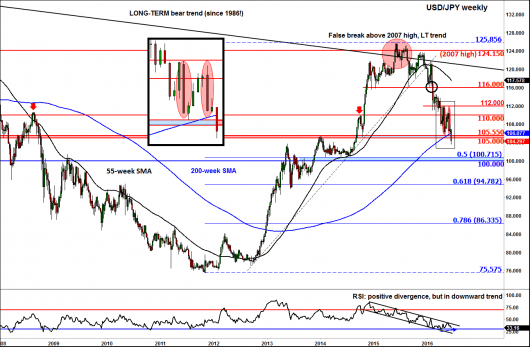

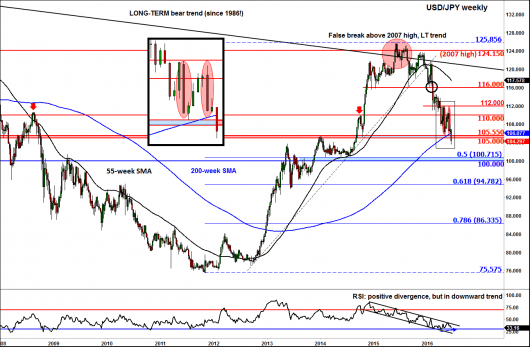

The USD/JPY will therefore be in focus once again around the time of the above data releases. However, the damage has already been done first by the Fed and now the BOJ, with the pair breaking below a significant long-term support around the 105.00-105.5 area, which led to further momentum selling. To be honest, the writing was already on the wall with price forming two large bearish engulfing candles in recent weeks above this area. Now that another big level is broken and with price moving below the 200-week moving average, there is little-further prior long-term reference points to watch until the 100.00-101.00 area now. As can be seen on the weekly chart, this psychologically-important area had been strong support in the past and it is where the 50% retracement level of the long-term upswing converges with price.

At this stage, there’s nothing bullish about price action other than the fact it is severely oversold on short-term charts, including on the daily. On the weekly time frame, the RSI is in a state of positive divergence but it remains inside a bearish channel. Only when the RSI breaks above the resistance trend of this channel would it signal a reversal in momentum. Obviously for the RSI to move higher, the underlying USD/JPY price will need to rally, preferably above the now broken 105.00-105.55 support area. But for as long as we are below this new resistance area, the path of least resistance would remain to the downside.