As the World Economic Forum in Davos, Switzerland stretched into its second day of meetings and speeches on Wednesday, the US dollar’s persistent weakness was extended, pushing the US dollar index to new lows well below the 90.00 handle and EUR/USD up to new highs above 1.2400. As for USD/JPY, the currency pair dropped sharply, extending its breakdown below the key 110.00 previous support level, to hit a new 4-month low slightly below 109.00.

In Davos, US President Trump is expected to promote a protectionist trade agenda within the remaining two days of the Forum. Earlier this week, Trump approved tariffs on imported goods, including solar cells and washing machines. These moves have been seen as the harbinger of a protectionist US trade stance going forward, and have subsequently weighed further on the dollar. On Wednesday, US Treasury Secretary Steven Mnuchin prepped WEF attendees in Davos by stating that a weaker US dollar was positive for US trade. These statements helped to pressure the already-depressed dollar even further.

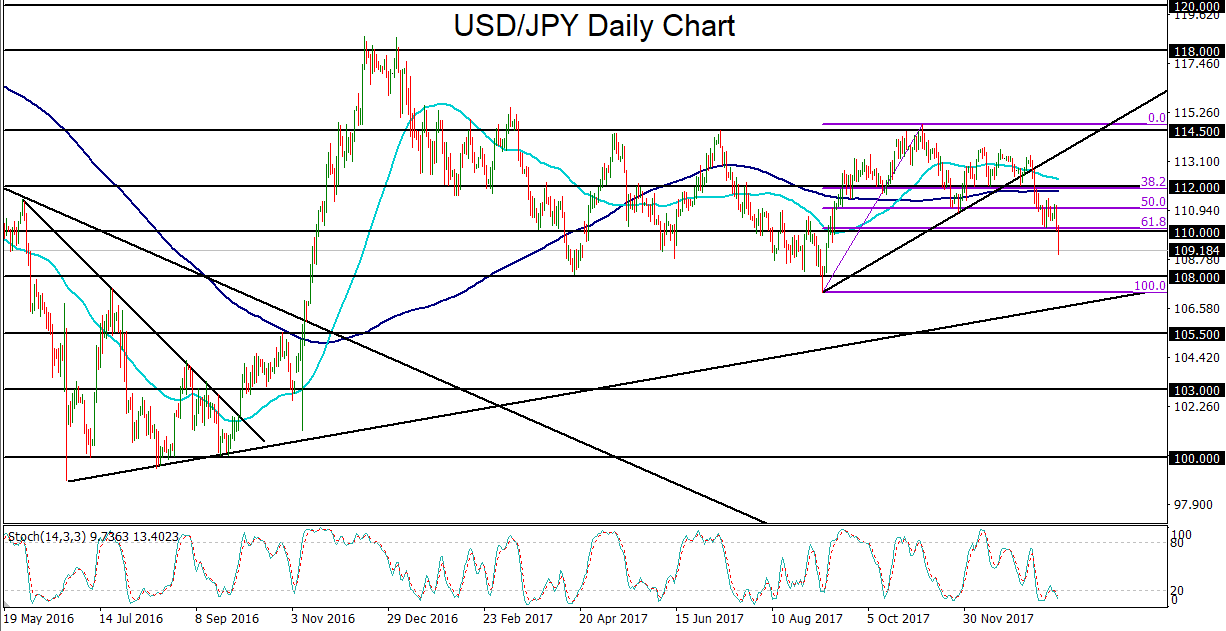

From a technical perspective, USD/JPY has been trading within a wide trading range – between approximately 108.00 to the downside and roughly 115.00 to the upside – since early last year. Most recently, the currency pair has dropped precipitously since the second week of January, prompting technical breakdowns below key levels, including an uptrend support line extending back to early September, the key 112.00 previous support level, the 200-day moving average, and most recently, the noted 110.00 previous support level. With Wednesday’s major breakdown below 110.00, the next clear downside target resides at the noted 108.00 support level, which is the approximate lower border of the longstanding trading range. Any subsequent breakdown below 108.00 would constitute a major technical event for USD/JPY bears, potentially targeting further downside around 105.50-area support.