USD finds strength against its majors

USD finds strength against its majors

The US Dollar was bullish against most of its major pairs on Wednesday with the exception of the EUR.

On the economic data front, the Mortgage Bankers Association's Mortgage Applications increased 2.7% for the week ending May 22nd, from -2.6% in the prior week. The U.S. Federal Reserve released its Beige Book, which stated economic activity declined in every district, employment continues to decline and weak demand is weighing on selling prices. Although the Fed expressed high hopes for swift recovery, it remarked that the outlook is still highly uncertain.

On Thursday, GDP for the first quarter second reading is expected to remain at -4.8% on quarter, in line with the first quarter advanced reading. Durable Goods Orders for the April preliminary reading are expected to decline 19.3% on month, from -14.7% in the March final readings. Initial Jobless Claims for the week ending May 23rd are expected to fall to 2,100K, from 2,438K in the previous week. Finally, Continuing Claims for the week ending May 16th are expected to rise further to 25,500K, from 25,073K in the week before.

The Euro was bullish against all of its major pairs. In Europe, EU Commission has announced it will mobilize 750 billion euros for European recovery. France's INSEE has released May indicators on consumer confidence at 93 (vs 92 expected), business confidence at 70 (vs 69 expected) and manufacturing confidence at 70 (vs 85 expected).

The Australian dollar was bearish against all of its major pairs.

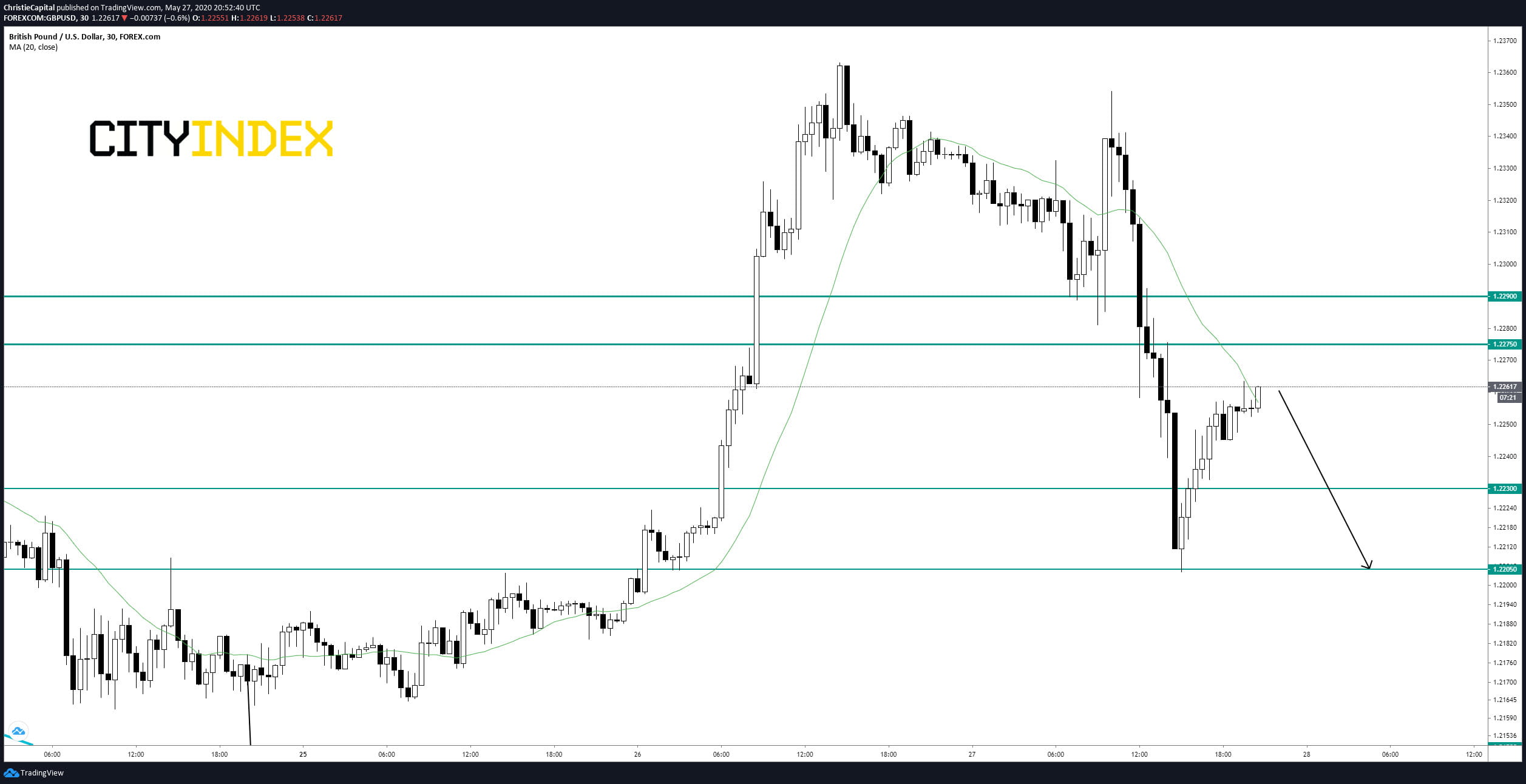

Wednesday's trading saw the largest pip move in the GBP/USD which dropped 77 pips to 1.2257. The pair made a late day recovery from the 1.2205 lows. The bias remains bearish with resistance at the 1.2275 level. Traders looking to short the pair may want to consider 1.223 and 1.2205 support levels as targets to the downside.

Source: GAIN Capital, TradingView

Happy trading.

The US Dollar was bullish against most of its major pairs on Wednesday with the exception of the EUR.

On the economic data front, the Mortgage Bankers Association's Mortgage Applications increased 2.7% for the week ending May 22nd, from -2.6% in the prior week. The U.S. Federal Reserve released its Beige Book, which stated economic activity declined in every district, employment continues to decline and weak demand is weighing on selling prices. Although the Fed expressed high hopes for swift recovery, it remarked that the outlook is still highly uncertain.

On Thursday, GDP for the first quarter second reading is expected to remain at -4.8% on quarter, in line with the first quarter advanced reading. Durable Goods Orders for the April preliminary reading are expected to decline 19.3% on month, from -14.7% in the March final readings. Initial Jobless Claims for the week ending May 23rd are expected to fall to 2,100K, from 2,438K in the previous week. Finally, Continuing Claims for the week ending May 16th are expected to rise further to 25,500K, from 25,073K in the week before.

The Euro was bullish against all of its major pairs. In Europe, EU Commission has announced it will mobilize 750 billion euros for European recovery. France's INSEE has released May indicators on consumer confidence at 93 (vs 92 expected), business confidence at 70 (vs 69 expected) and manufacturing confidence at 70 (vs 85 expected).

The Australian dollar was bearish against all of its major pairs.

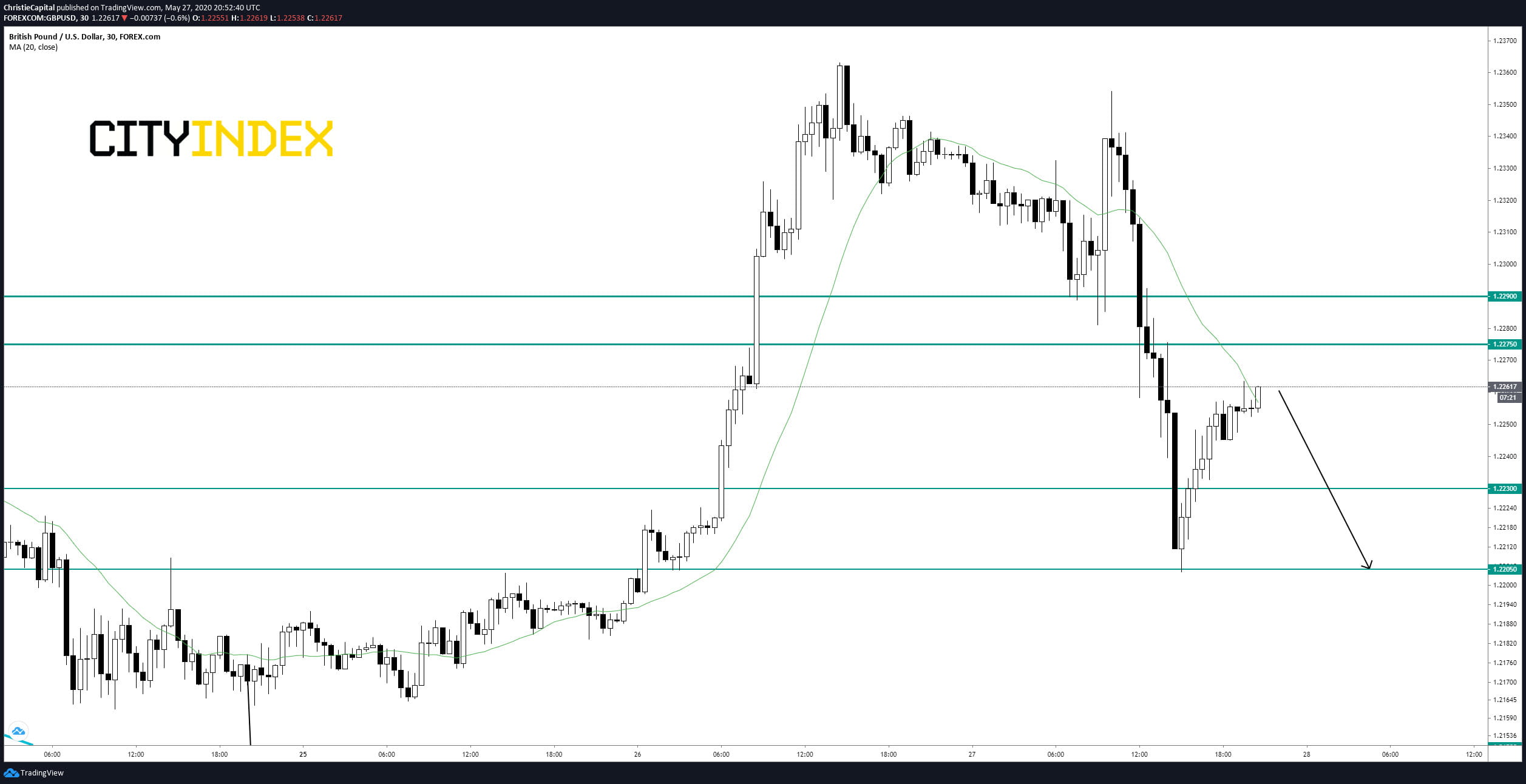

Wednesday's trading saw the largest pip move in the GBP/USD which dropped 77 pips to 1.2257. The pair made a late day recovery from the 1.2205 lows. The bias remains bearish with resistance at the 1.2275 level. Traders looking to short the pair may want to consider 1.223 and 1.2205 support levels as targets to the downside.

Source: GAIN Capital, TradingView

Happy trading.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM