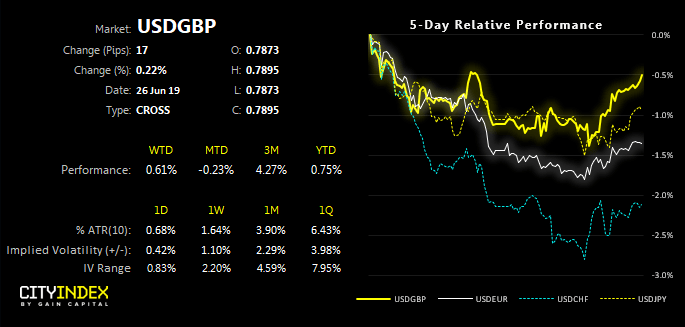

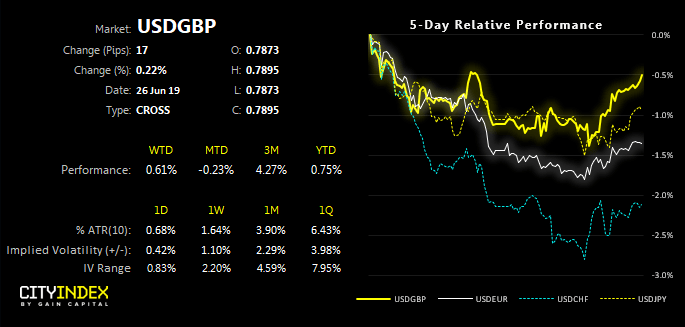

A bullish outside day on the US dollar index above the March lows suggests a corrective bounce could be due. Less dovish than expected comments from Fed members Powell and Bullard helped break the dollar’s bearish streak since last week’s FOMC meeting, proving reversal candles across FX majors. Whilst the G20 could still impact the greenback, the change of tone from the Fed has removed a headwind for the greenback.

- GBP/USD is of particular interest, given its bearish engulfing candle which has formed beneath a resistance cluster.

- EUR/USD remains above a pivotal level but, due to its rally looking overextended, the bias is for a break back within range (even if only temporary)

- USD/CHF has also produced a 2-ar reversal near the (prior) 2019 lows. Whilst this too could see a bounce, we prefer setups on GBP/USD and EUR/USD, due to the strength of the bearish move on the Swissy which led to thee lows.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM