As the US dollar pulled back on Thursday after its recent rebound from multi-year lows, the Canadian dollar experienced heightened volatility after Canadian retail sales data for December came out on Thursday morning much worse than expected.

The headline retail sales number showed a surprising drop of -0.8% versus expectations of 0.0%, and after the previous month’s +0.3% growth. Even more unexpected was the core retail sales data (excluding automobiles), which showed a sharp drop of -1.8% against expectations of +0.1%, and after the previous month’s +1.7% growth.

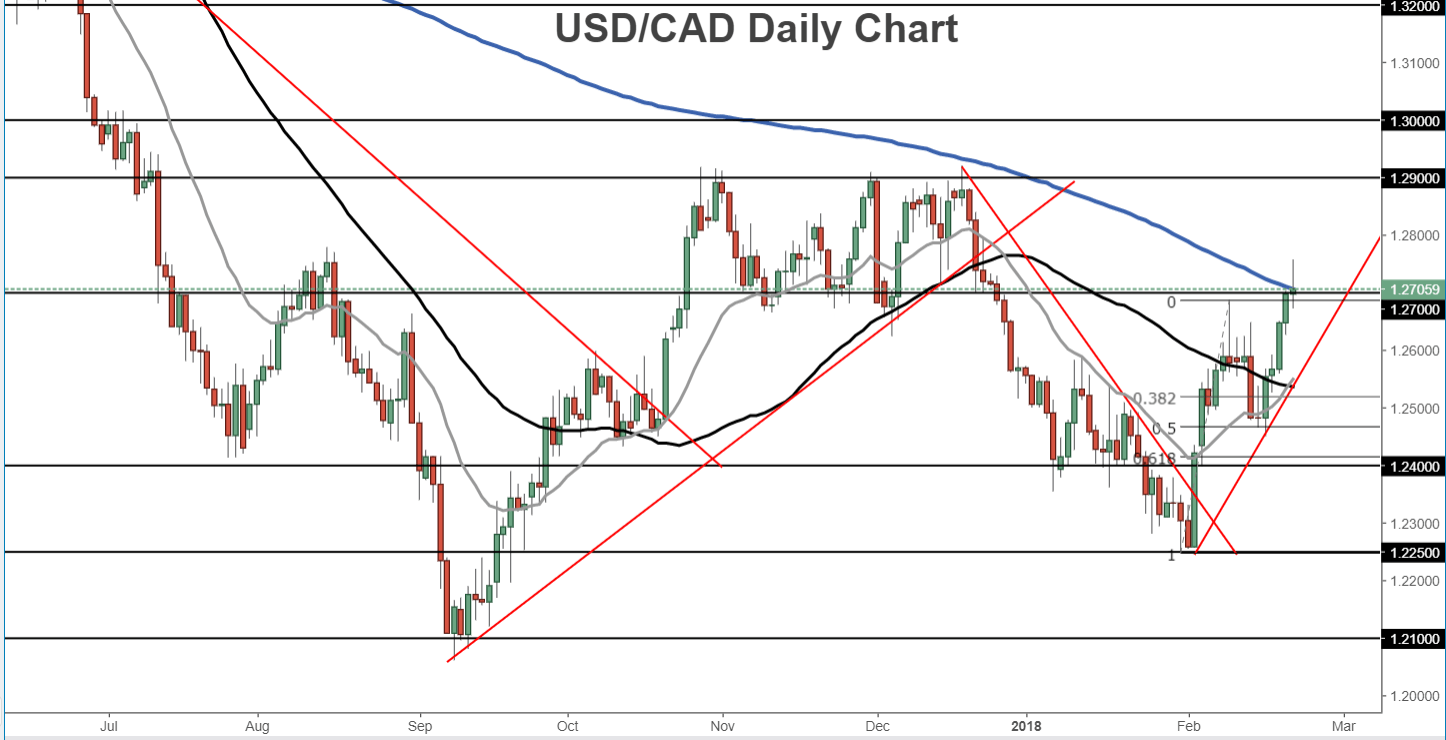

As a result of these disappointments, the Canadian dollar tumbled in a knee-jerk reaction, pushing USD/CAD up to new 2-month highs despite US dollar weakness. The Canadian dollar quickly reversed those losses, however, pressuring USD/CAD back down around the key 1.2700 level as the US dollar remained pressured.

Friday morning brings an even more important metric for the Canadian dollar – Canada’s Consumer Price Index (CPI) inflation data for January. Prices of consumer goods and services are expected to have risen by +0.4% in January after a lower-than-expected reading of -0.4% for December. Any higher-than-expected inflation reading on Friday should boost the Canadian dollar, as it would potentially support a more hawkish Bank of Canada. A lower-than-expected reading, in contrast, should have the opposite effect, as it would potentially be a more dovish signal for the central bank.

From a technical perspective, as noted, USD/CAD continues to trade around the key 1.2700 level, having just risen to establish a new 2-month high. This area is also around the important 200-day moving average. In the event that the US dollar regains some of its recent strength while Canadian CPI data comes in lower than expected, USD/CAD would likely break out above the current resistance, which could boost the currency pair towards its next major upside target around the 1.2900 resistance level, which represents the highs of late last year.