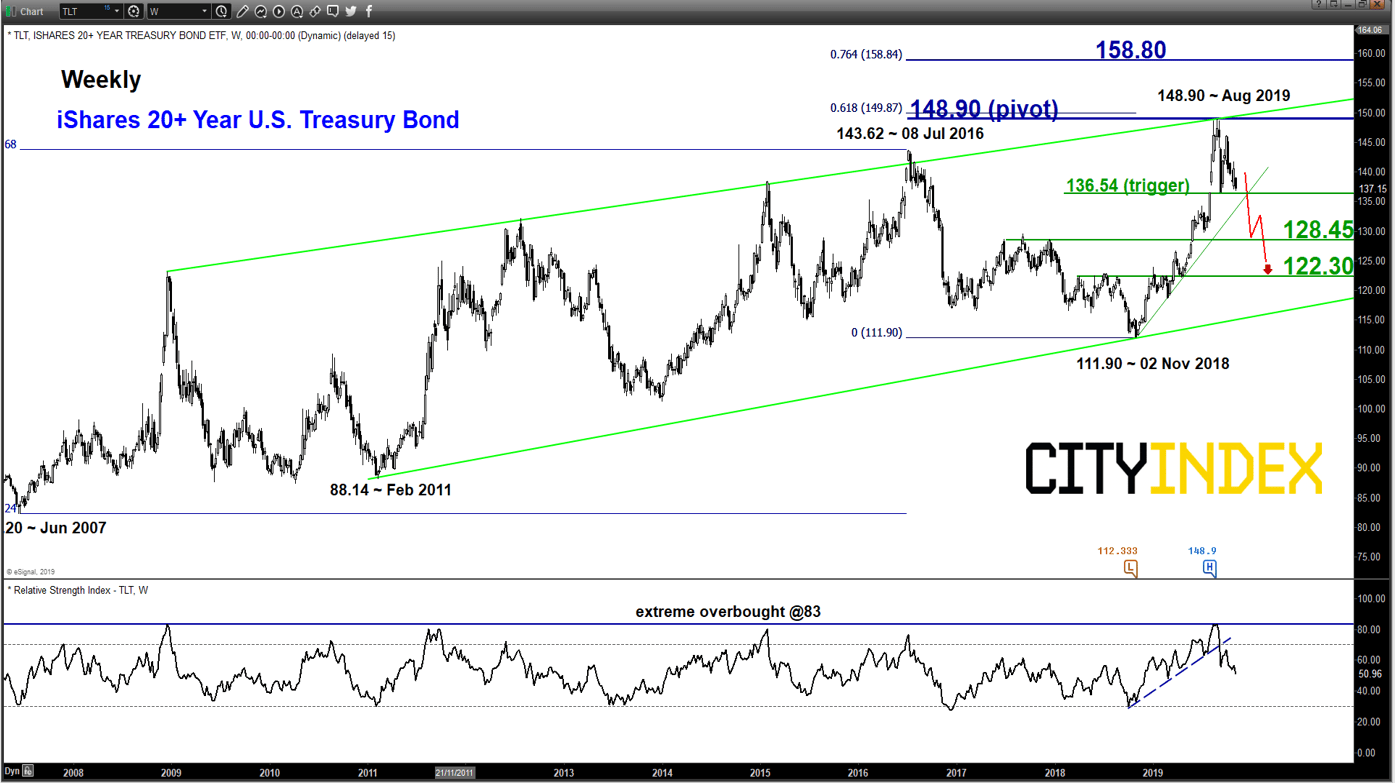

Medium-term technical outlook on U.S. Treasury Bonds ETF (TLT)

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key resistance): 148.90

Supports: 136.54, 128.45 & 122.30

Next resistance: 158.80

Directional Bias (1 to 3 weeks)

Bearish bias for TLT below 148.90 pivotal resistance and a break below 136.54 is likely to trigger a potential multi-week corrective down move to target the next supports at 128.45 and 122.60 (the lower boundary of a major ascending channel from Feb 2011 low).

On the other hand, a clearance with a daily close above 148.90 see an extension of the up move towards 158.90 next (Fibonacci expansion cluster).

Key elements

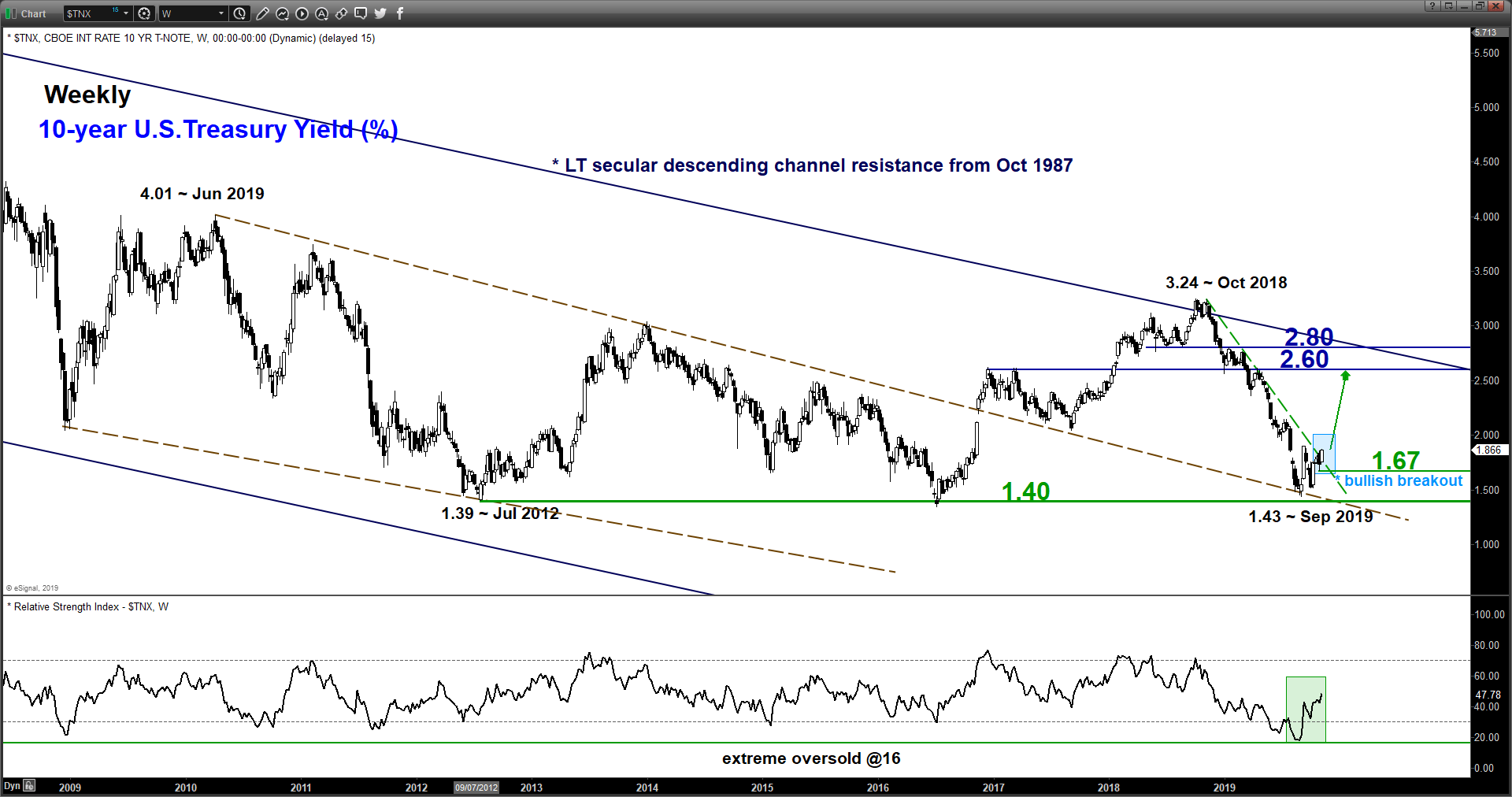

- The U.S. Treasury 10-year yield has started to show signs of resilient after its 11-month of downtrend from Oct 2018 high of 3.24% has managed to stall at a major support at the 1.40% level that has prevented further decline since Jul 2012.

- The recent rebound from Sep 2019 low of 1.43% has broken above a descending trendline from Oct 2018 swing high with the weekly RSI oscillator that has exited from its oversold region. These observations suggest a potential mean reversion rebound towards 2.60%-2.80% zone within a long-term secular descending channel in place since Oct 1987.

- The movement of the Treasury yield has an inverse relationship with the prices of Treasury bonds; if yield goes up it will cause the bond prices to fall and vice versa.

- The 136.54 downside trigger for the U.S. Treasury Bond ETF (TLT) is defined by the ascending support from 02 Nov 2018 low and the Sep 2019 swing low. Interestingly, the weekly RSI oscillator has shaped a bearish breakdown from its corresponding ascending support after it hit an extreme overbought level of 83. These observations suggest a bearish presignal on the price action of TLT which increases the odds of a breakdown below 136.54.

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM