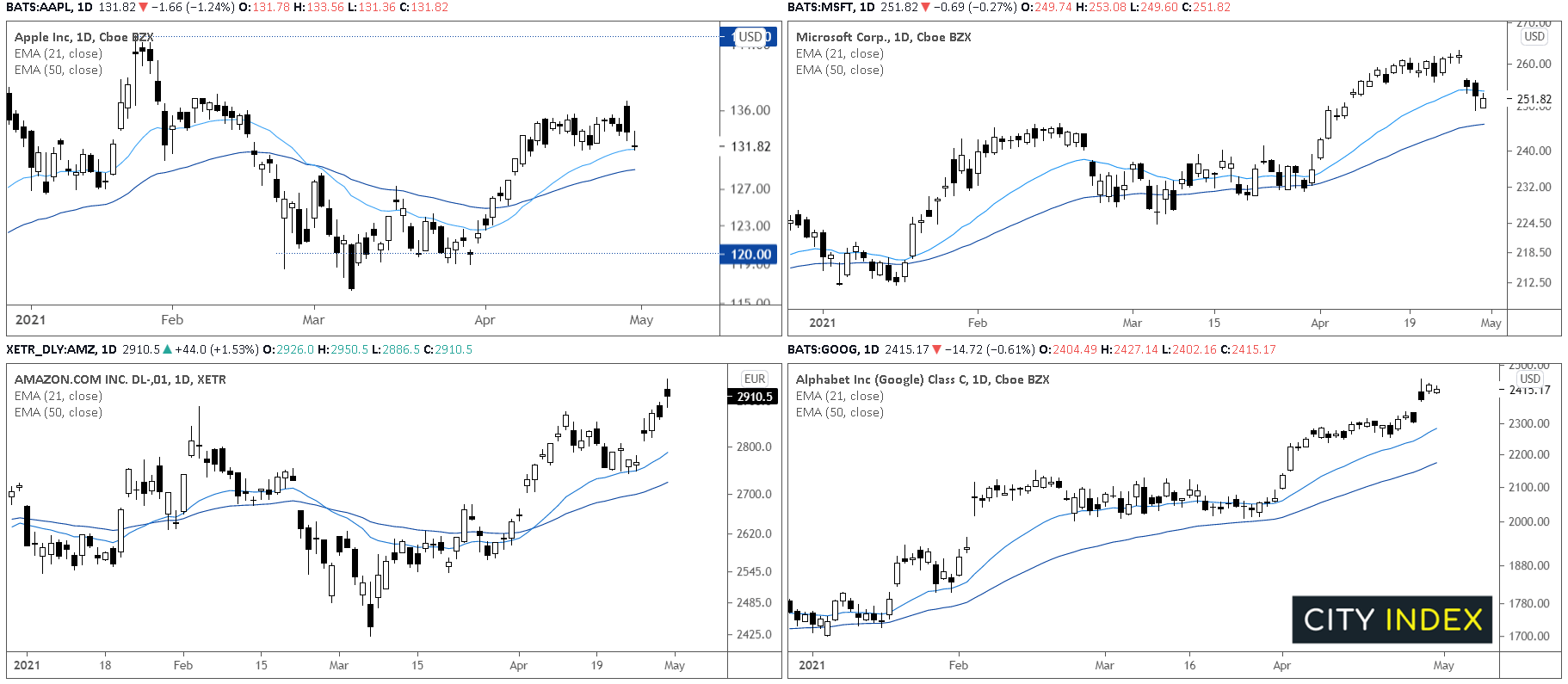

US Tech Earnings Season Recap: What’s up with AAPL, MSFT, AMZN, and GOOG?

The four biggest publicly-traded US stocks (Apple, Microsoft, Amazon, and Alphabet/Google) all reported earnings in the past week, and they absolutely obliterated analysts’ estimates:

- AAPL: $1.40 in EPS (vs. $0.99 eyed) on $89.6B in revenues (vs. $77.3B eyed)

- MSFT: $1.95 in EPS (vs. $1.78 eyed) on $41.7B in revenues (vs. 41.1B eyed)

- AMZN: $15.79 in EPS (vs. $9.56 eyed) on $108.5B in revenues (vs. $104.5B eyed)

- GOOG: $26.29 in EPS (vs. $15.82 eyed) on $55.3B in revenues (vs. $51.7B eyed)

Despite this unanimously strong fundamental data, traders have been rather stingy in awarding earnings beats with bullish price action. As Bespoke Research noted, so-called “triple plays” (stocks that raised guidance and beat both revenue and earnings estimates) have risen only 2.6% this earnings season, well below the 10-year average of 5.3%. In other words, the stocks that have crushed their earnings estimates so far this quarter are only rising by half as much as usual.

We’ve seen this dynamic at play with these previously unstoppable tech behemoths as well. Here is the week-to-date performance as of Friday afternoon for each stock:

- AAPL: -1.4%

- MSFT: -3.6%

- AMZN: +4.8%

- GOOG: +4.2%

To be sure, any time a $1T+ company can meaningfully increase its market cap, that’s a notable development, but surely investors in AAPL and MSFT (and arguably even GOOG and AMZN) would have expected a substantially better reaction to blowout earnings numbers.

So what’s happening here?

One factor we highlighted in our tech earnings preview report was the risk that these firms, which had been among the biggest winners of the pandemic, could become laggards as the developed world emerges from pandemic-era lockdowns and restrictions. The disappointing price performance for most of these names this week suggests that investors recognize this risk and are hesitant to push these stocks meaningfully higher when other sectors may be poised for a more powerful comeback.

That said, the balance sheets, cash flow generation, and general business prospects for each of these firms is impeccable, so an immediate crash is unlikely. Instead, traders may simply continue to rotate out of these massive stocks and into areas of the market where outperforming last year’s pandemic-depressed comparable figures is a cinch.

After their stocks dramatically outperformed their underlying business prospects in 2020, 2021 may be the year where these stocks tread water despite gradually improving business prospects.

Source: TradingView, StoneX

Learn more about equity trading opportunities.