US equities slumped on the open, joining the global trend, which has seen markets in Asia and Europe tumble lower. With China threatening to take the trade war a step further and the bond market sounding recession alarm bells, traders are jumping out of riskier assets.

Trade frictions between the world’s two biggest powers show no signs of easing; quite the reverse, as China plans to use rare earth exports as leverage in the trade war.

Macro data has been showing signs of strain and the full impact of the most recent US tariff hikes is yet to kick in. Citi’s global surprise index, has been negative for over a year, which doesn’t bode well. Fears over the impact of the increasingly lengthy and messy trade dispute on the global economy are sending investors in search of safe havens.

Macro data has been showing signs of strain and the full impact of the most recent US tariff hikes is yet to kick in. Citi’s global surprise index, has been negative for over a year, which doesn’t bode well. Fears over the impact of the increasingly lengthy and messy trade dispute on the global economy are sending investors in search of safe havens.

Whilst riskier assets such as equities are rapidly being dumped, flows into the Japanese yen, gold and US bonds are all on the increase.

Fixed income market recession warning

As the US 10-year treasuries rally, the yield declines, so much so that it has inverted, falling below the yield curve of the 3-month treasury. This is the second time this year that the 10 year and 3-month yield curves have inverted. Historically, an inversion is considered a warning signal for a recession. The bond market last sounded this alarm back in 2007.

Investors will now look ahead to a raft of US data on Thursday and Friday to asses the health of the US economy.

As the US 10-year treasuries rally, the yield declines, so much so that it has inverted, falling below the yield curve of the 3-month treasury. This is the second time this year that the 10 year and 3-month yield curves have inverted. Historically, an inversion is considered a warning signal for a recession. The bond market last sounded this alarm back in 2007.

Investors will now look ahead to a raft of US data on Thursday and Friday to asses the health of the US economy.

Up Next:

US GDP Q1 revision is the key data point tomorrow

PCE inflation could drive trading on Friday.

US GDP Q1 revision is the key data point tomorrow

PCE inflation could drive trading on Friday.

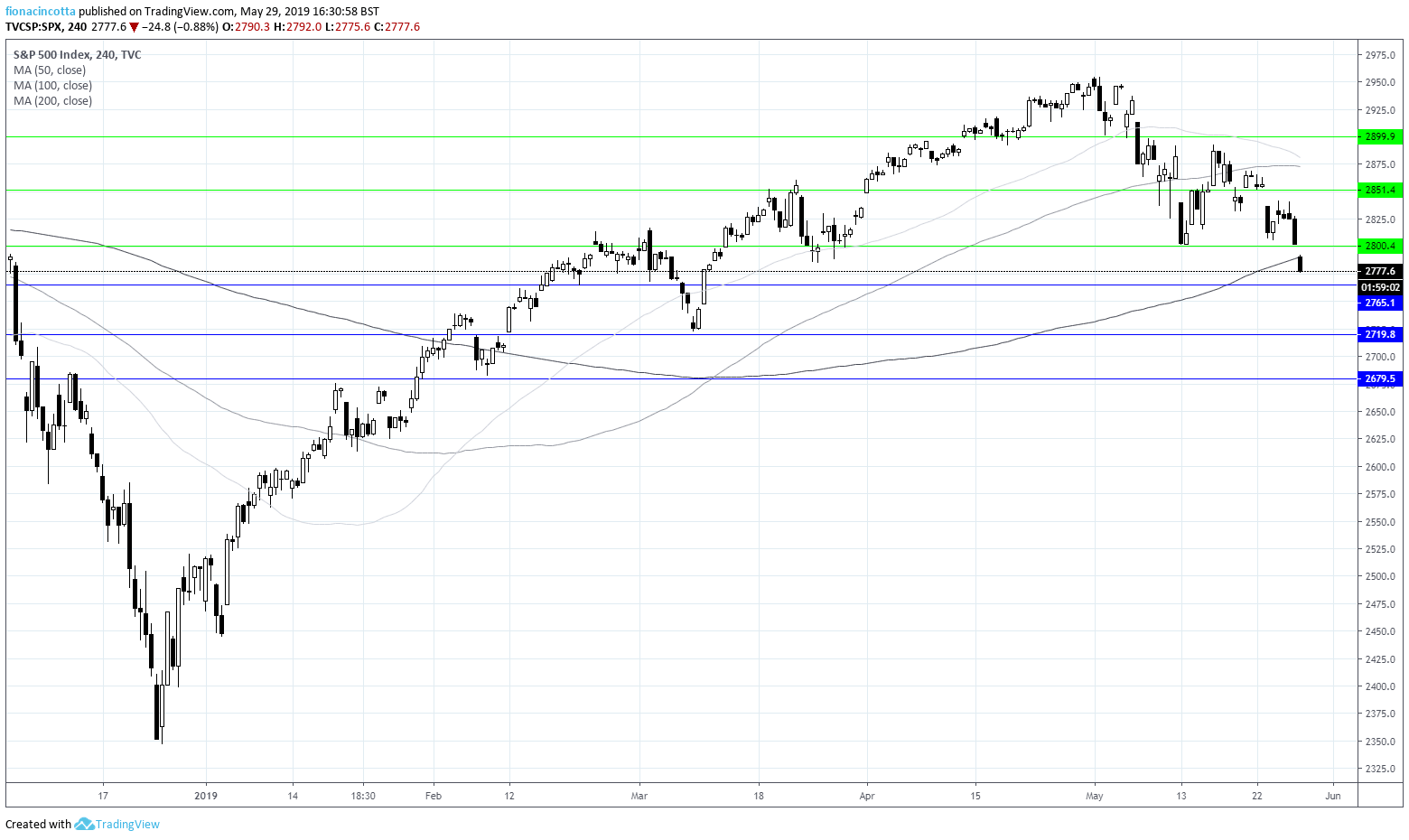

S&P levels of interest

On the 4-hour chart the S&P has dropped through its 200 sma. It now trades below its 50, 100 and 200 sma; a bearish bias. After crashing through support at 2800, the door has been opened to 2765. A meaningful move through here could see 2720 and 2680 tested. On the upside resistance can be seen a 2800 prior to 2850.