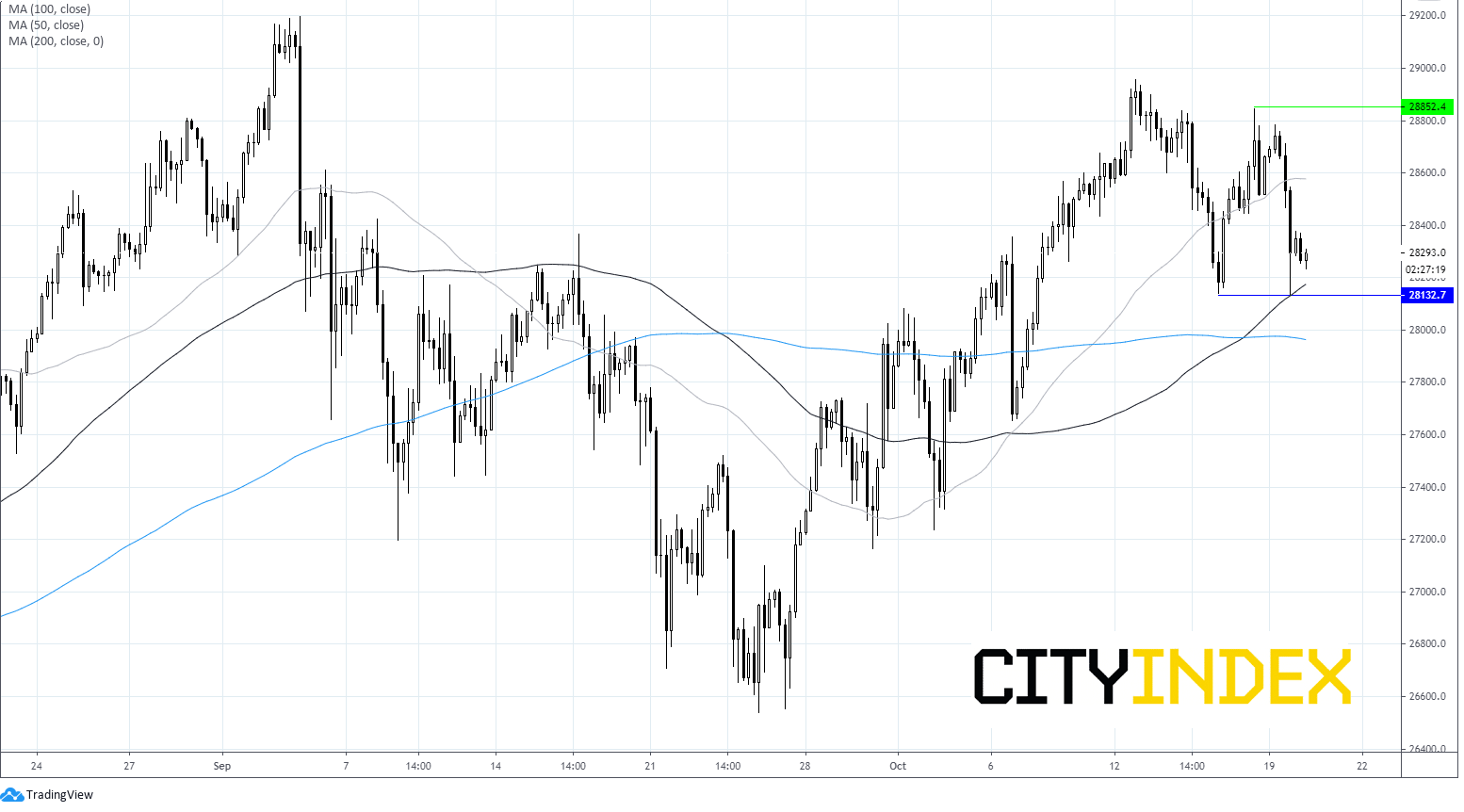

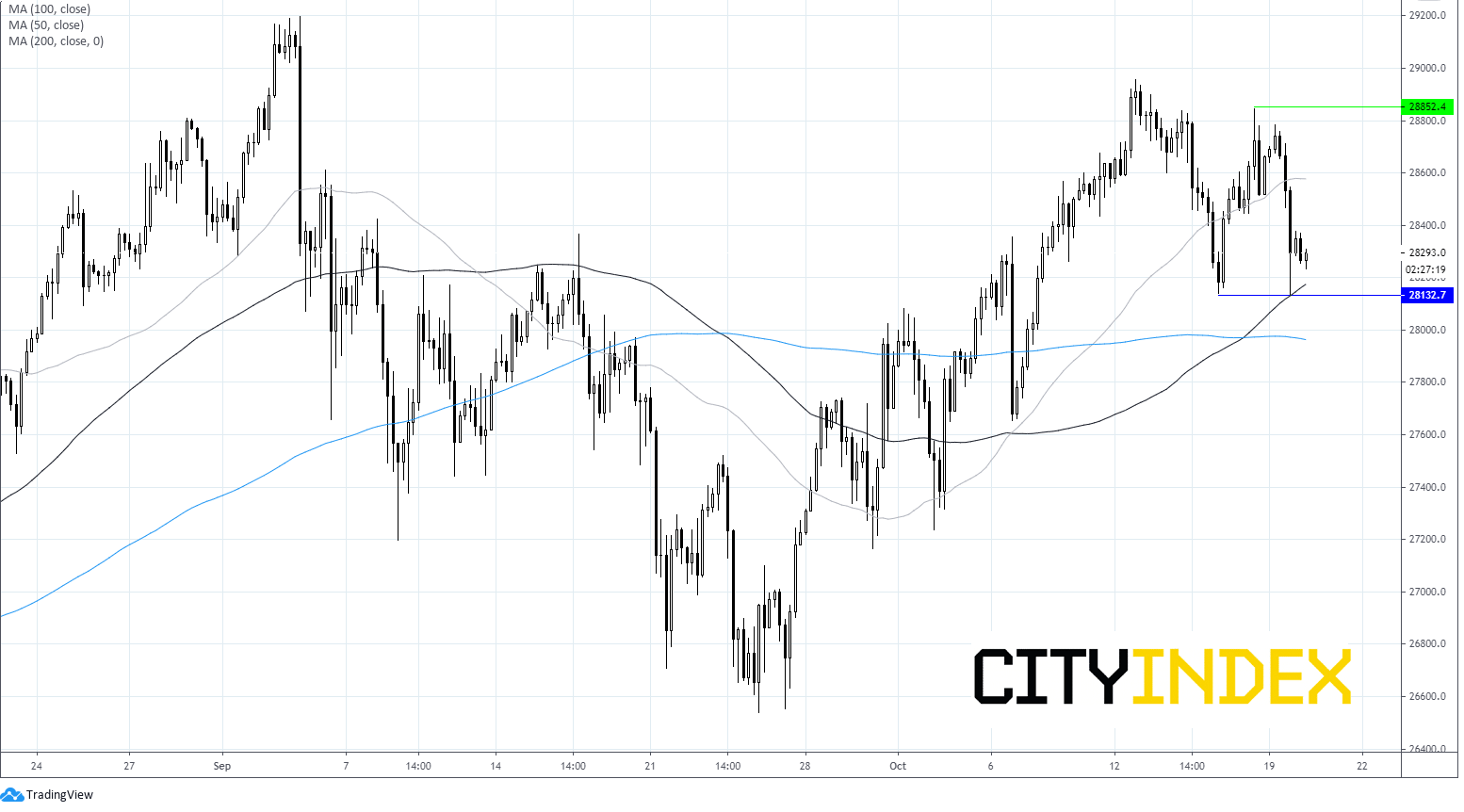

Wall Street ended lower as the stimulus clock ticked. News that there was still no agreement on fiscal stimulus unnerved investors. The negativity spilled over into Asia overnight and Europe is also set to start in the red.

The Tuesday deadline for a fiscal stimulus agreement between the Democrats and Republicans looks as if it could come and go without an agreement being reached. Whilst the two sides are narrowing their differences, differences still remain and the deadline is later today. The likelihood of a deal being achieved before the November 3rd election is slipping lower.

Not only are investors grappling with the idea that the world’s largest economy will have to wait for additional stimulus, rising coronavirus cases are also dragging on sentiment. Europe recorded a record number of new daily covid cases on Monday and lockdown restriction are being tightened across the region.

There could still be some hope for Airlines as Heathrow launches 20-minute covid test for passengers flying to destinations which require proof negative test to fly. This could be the start of an initiative which helps lift the struggling aviation sector off the ground.

Trump & Netflix in focus later

Looking ahead, the final election debate between Trump and Joe Biden will be live. Whilst Joe Biden holds the lead in the national polls there are signs that this could be narrowing as we move closer to the big day. Netflix is also due to report later today,

A word on oil

Oil prices are dropping for a fourth straight session on Tuesday amid growing concerns that the second wave of covid cases globally will choke the oil price recovery whilst increasing output from Libya is providing additional supply at a time when it is not needed.

Tighter lockdown restrictions are being applied globally as the number of covid cases crosses the 40 million mark, with Europe and the US seeing a strong resurgence.

An OPEC meeting on Monday did little to calm concerns over waning demand and plentiful supply as Russia and Saudi Arabia avoided giving any indication, they would reconsider the planned output increase in January.

Currently the OPEC+ group will stick to the planned output cut of 7.7 million barrels per day in December, reducing to5.8 million in January. WTI is currently just holding above $40.