US futures declining, watch IBM, KO, PM

Later today, official data on U.S. Existing Homes Sales for March will be released (an annualized rate of 5.30 million units expected).

European indices are on the downside. ZEW survey results of April were released for Germany at -91.5 for current situation (vs -75.0 expected) and at 28.2 for expectations, vs -42.0 expected. The U.K. Office for National Statistics has reported jobless rate for the three months to February at 4.0% (vs steady at 3.9% expected).

Asian indices all faced a drop. New Zealand Prime Minister Jacinda Ardern said the coronavirus alert level 4 lockdown in the country will end in a week, where key sectors will resume operations.

WTI Crude Oil Futures remain very volatile as the oil market saw an historic event yesterday. The May contract for West Texas Intermediate (WTI) futures collapsed to zero before ending the day at minus-$37.63 a barrel, meaning producers have to pay buyers to take oil away or store it. This is the first time in recorded history that crude has dropped into negative territory, far surpassing the 1986 low of $10.20 a barrel.

On the forex front, the U.S. dollar firmed against its major peers as market sentiment was impacted by US crude oil futures collapsing into negative territory. EUR/USD fell 24pips to 1.0838 and GBP/USD declined 137pips to 1.2305. USD/CAD gained 85pips to 1.4234.

US Equity Snapshot

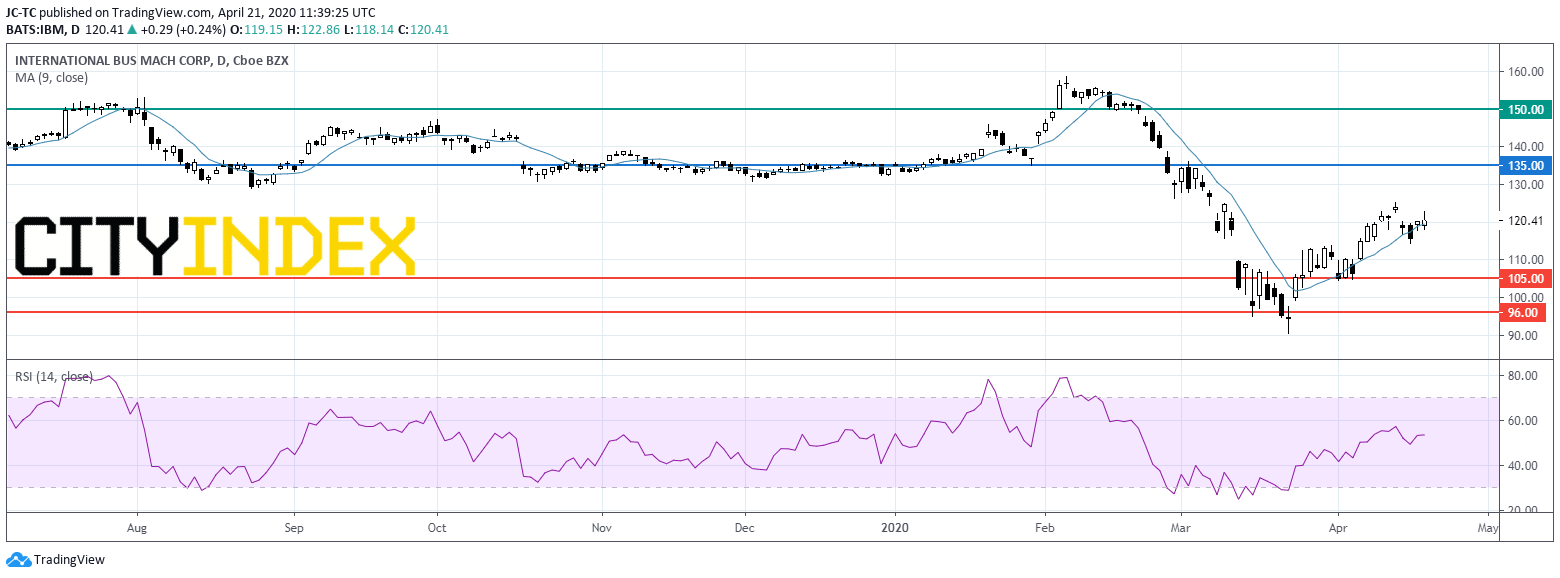

IBM (IBM), the IT company, reported first quarter adjusted EPS down to 1.84 dollar, just above estimates, from 2.25 dollars a year ago, on revenue of down to 17.6 billion dollars, below consensus, down from 18.2 billion dollars last year. The company withdrew its full-year 2020 guidance.

Coca-Cola (KO), the soft drinks giant, posted first quarter net income up to 2.78 billion dollars, or 0.64 dollar a share, from 1.68 billion dollar a year earlier. Adjusted BPA rose to 0.51 dollar, above estimates, from 0.48 dollar a year ago. Sales were down by 1% to 8.60 billion dollars but topped forecasts. Due to the COVID-19 pandemic, the company did not give full year guidance.

Philip Morris (PM), the tobacco company, unveiled first quarter adjusted EPS up 11% to 1.21 dollar, above estimates. Due to the COVID-19 crisis, the company withdraws its full-year EPS guidance. It expects second quarter EPS to be 1 dollar to 1.10 dollar.

Source : Trading View, GAIN Capital