US futures consolidating, watch BA, HAL, JNPR

Later today, the Federal Reserve Bank of Chicago will post March National Activity Index (-4 expected).

European indices are searching for a trend. The European Commission has posted February trade balance at 23 billion euros surplus (vs 20.0 billion euros surplus expected). The German Federal Statistical Office has reported March PPI at -0.8% on year, as expected.

Asian indices closed in the red. This morning, official data showed that Japan's exports declined 11.7% on year in March (-9.4% estimated).

WTI Crude Oil Futures are facing a drop amid growing concerns that the latest OPEC+ deal is unable to cope with slumping global oil demand. Meanwhile, the number of U.S. oil rigs counts dropped further to 438 as of April 17 from 504 a week ago.

On the currencies side, the US dollar remains firms on global growth fears. EUR/USD fell 12 pips to 1.0863 and GBP/USD declined 38 pips to 1.2461. USD/CAD jumped 92 pips to 1.4082 as the Canadian currency has been hit following sharp decline in oil prices.

US Equity Snapshot

Boeing (BA), an aircraft manufacturer, and China Development Bank Financial Leasing, an equipment leasing company, have agreed to terminate the purchase and delivery of 29 Boeing 737 MAX aircraft, leaving a total of 70 undelivered. The company said: "Boeing will offer certain economic concessions that are intended to mitigate the effect of the amendments to the Purchase Agreements."

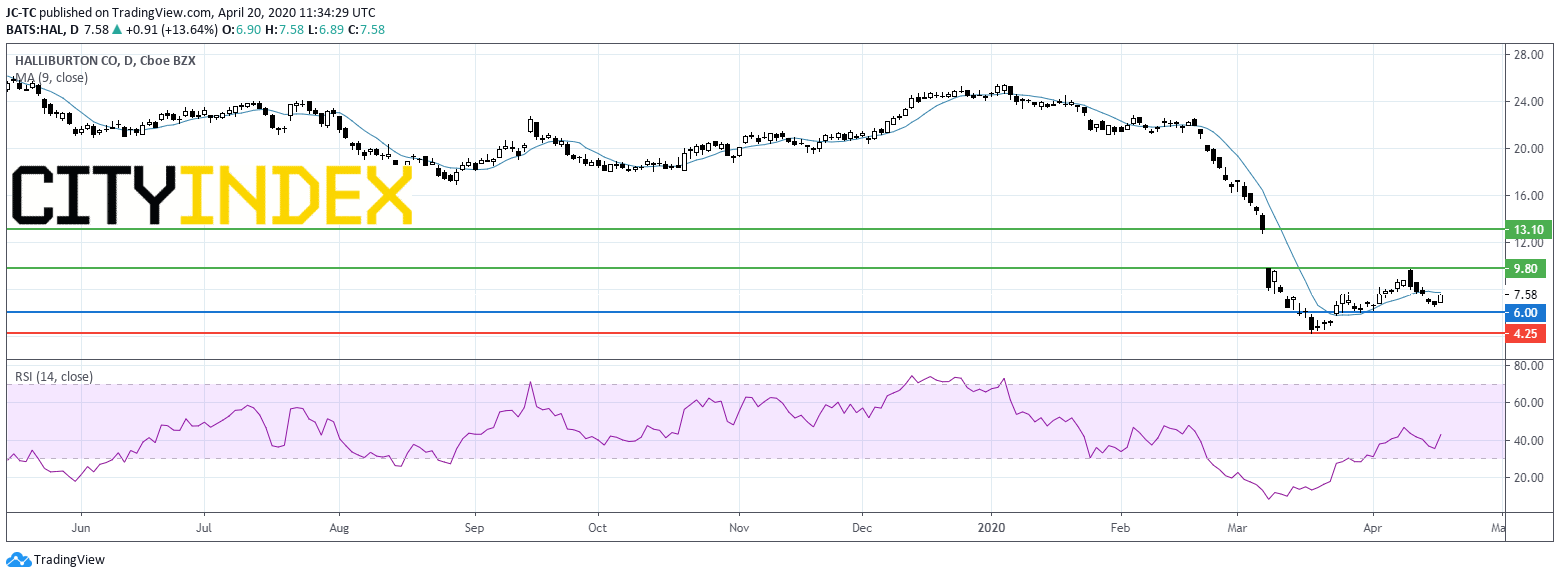

Halliburton (HAL), the oil and gas services company, posted first quarter adjusted EPS from continuing operations up to 0.31 dollar from 0.23 dollar a year earlier, on sales down to 5.04 billion dollars from 5.74 billion dollars a year ago. Both figures beat estimates. The company expects "further decline in revenue and profitability" in 2020.

Juniper Networks (JNPR), a networking products developer, was upgraded to "overweight" from "neutral" at JPMorgan.

Source, TradingView, GAIN Capital