US Philly Fed and Initial Claims are Just the Beginning

The US Philadelphia Fed Manufacturing Index (Philly Fed) was released earlier today and the data was not encouraging. The headline number was -12.7 vs an expectation of +15. The February Philly Fed number was +36. Today's reading is the lowest since July 2012. In addition, the new orders component fell from +33.6 in February to -15.5 for March.

The number if initial claims for unemployment benefits for the week ending March 14th was also released earlier today and it increased to 281,000 vs 220,000 expected and 211,000 the prior week. This is the highest level since the week of September 2017.

Get ready for the bad data to continue and get even worse! The readings above are through the first half of March. With industries temporarily shutting down, such as airlines, cruise lines, bars and restaurants, stadium events, and casinos, demand for new products and equipment we be less. Employees in these industries will have to file for unemployment claims. The US government is already asking people not to travel unless, and they would prefer people not even leave their homes if not necessary. The ongoing economic effects of the coronavirus are likely to be felt for months to come.

Yesterday, JP Morgan revised their quarterly GDP outlook for the US for 2020. For the year, JP Morgan sees and a GDP contraction of -1.9%. The breakdown by quarter is as follows:

- 1Q: -4%

- 2Q: -14%

- 3Q: +8%

- 4Q: +4%

On Tuesday of next week, we will get flash PMI’s from around the global for March. This will be the first release of global data since the Coronavirus invaded countries outside of China. Economists expect the numbers to be bad. Prepare for them to be even worse.

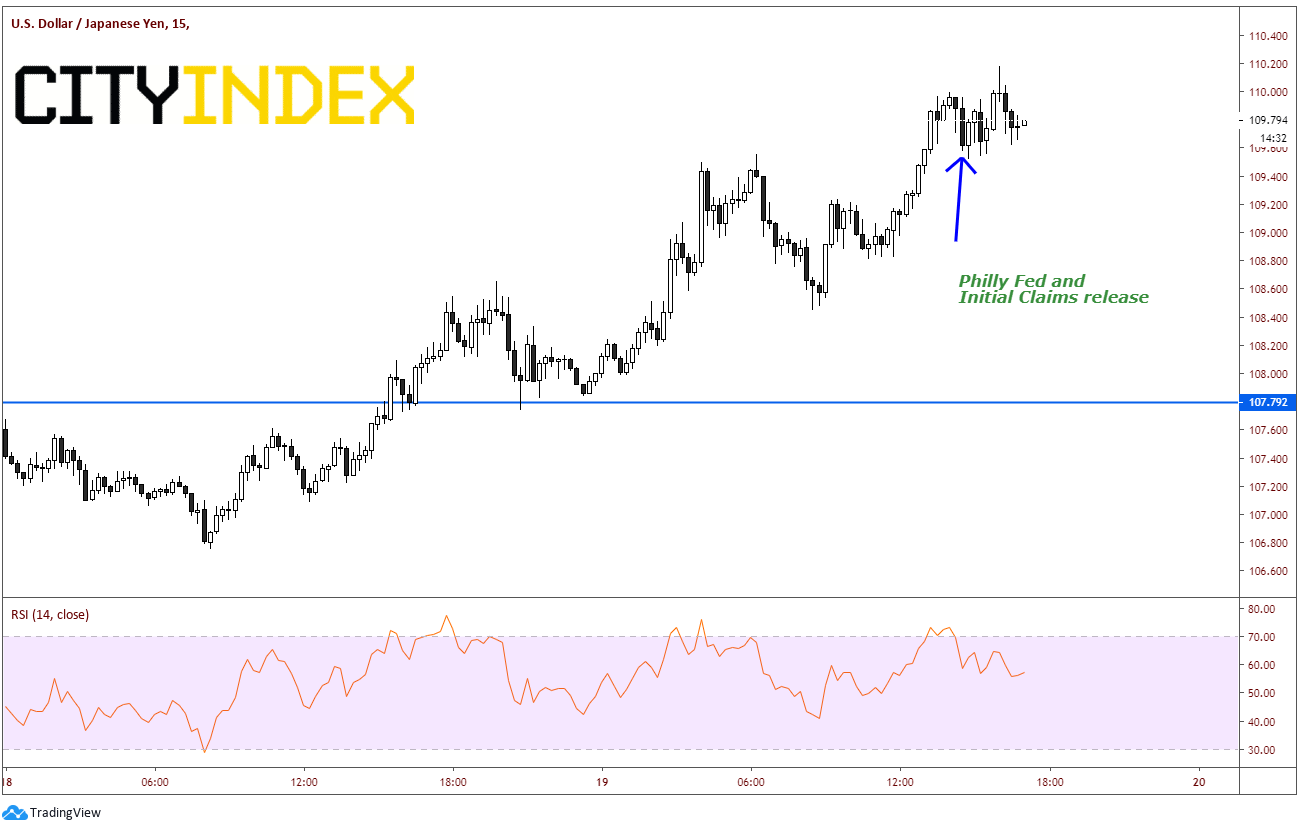

Be aware however, that much of this data is already priced into the markets. On the release of poor data earlier today, USD/JPY barely flinched. The pair moved lower 20 pips over a 15-minute period. Under “normal” circumstances, a Philly Fed miss as big as this would probably cause USD/JPY to drop nearly 100 pips immediately!

Source: Tradingview, City Index

As the data going forward continues to be dismal, just remember that markets have priced a lot of it in already. Stocks are currently in bear market territory. Surprises would be if the data were better than expected!!