US futures

Dow futures -1.8% at 33950

S&P futures -1.6% at 4359

Nasdaq futures -1.64% at 15092

In Europe

FTSE -1.5% at 6837

Dax -2.6% at 15051

Euro Stoxx -2.7% at 4017

Learn more about trading indices

Stock start a big week sharply lower

US stock are set for a steep drop lower on the open. Sentiment is taking a hit amid the unfolding crisis surrounding Evergrande in China and on concerns that the Fed could announce a possible reining in of support later this week.

The Fed rate announcement in due on Wednesday and expectations are growing the US central bank will start laying out the groundwork for a tapering of bond purchases, potentially tee-ing up for a November kick off. However, the preparation to withdraw support and taper bond purchases comes as concerns grow over the health of the global economic recovery.

Fears of contagion from the unfolding Evergrande crisis in China is hitting risk sentiment. Investors are taking risk off the table ahead of a likely default by China’s second largest real estate developers later in the week and what the wider implications for the financial market could be. Fears are being played out in the commodities market where iron ore futures extended losses as steel demand is expected to weaken.

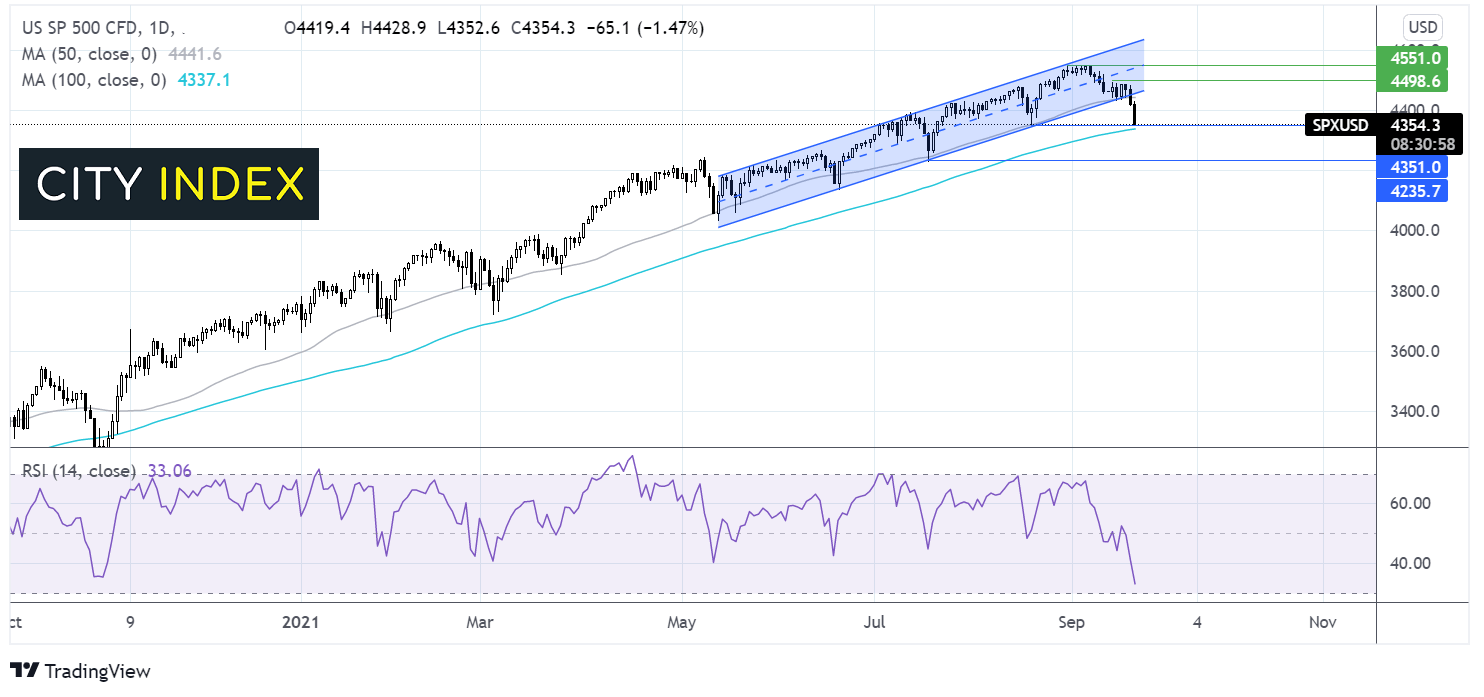

Where next for the S&P 500?

The S&P 500 has broken out below the ascending channel within which it has traded in since early May. In falling out the channel, it has also broken through the 50 sma. The 100 sma is offering support for a now at 4350, which also marks the August low. A break below this level would see the bias change to the downside. Meanwhile the RSI is supportive of further weakness in the price whilst it remains out of oversold territory. A move below 4350 brings 4235 the July low into play.

FX – USD rallies, Chinese proxy AUD drops

The US Dollar is rising amid safe haven inflows amid concerns over health of the Chinese real estate sector and the Federal Reserve tapering.

AUD/USD trades heavily lower, the Australian Dollar is often referred to as a Chinese proxy, the selling of the Aussies highlights concerns surrounding the broader impact of the Evergrande crisis on the Chinese economy.

AUD/USD -0.56% at 0.7227

GBP/USD -0.43% at 1.3672

EUR/USD -0.14% at 1.1772

Oil tumbles on growth concerns, rising output

After a strong rally across the previous week, oil prices are falling on Monday. Risk aversion, concerns over the global economic outlook, combined with a stronger US Dollar and rising output in the Gulf.

Oil production in the Gulf of Mexico after two hurricanes has been slow to come back online. However this has finally picked up and just 23% of production remained off line compared to 75% a week ago.

A rise in US rig count is also adding pressure to the price of oil. The number of rigs in the US in operation rose to its highest level since April 2020. The rig count often serves as an early indicators of future output.

WTI crude trades -1.95% at $70.50

Brent trades -1.7% at $73.62

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.