US futures

Dow futures +0.55% at 34621

S&P futures +0.4% at 4214

Nasdaq futures +0.3% at 13698

In Europe

FTSE +0.5% at 7041

Dax +0.65% at 15515

Euro Stoxx +0.7% at 4067

Learn more about trading indices

Stocks rally on spending optimism

US stocks are pointing to a stronger open on hopes of a $6 trillion US budget spend, whilst shrugging off rising inflation.

Stocks are heading higher for a 7th straight session and 4th straight month as optimism surroundng the US economic recovery sends stocks roaring higher.

Core PCE

Core PCE the Fed’s preferred measure of inflation jumped to 3.1% YoY in April, up from 1.8% in March And ahead of the 2.9% forecast.

The futures were already trading higher ahead of the release and barely reacted to the high inflation numbers.

Fed officials have been consistently reassuring the market that they are willing to look through a period of high inflation, which they consider to be temporary. This was particularly the case after CPI hit a 13 year high of 4.2%.

This strong rise in PCE inflation could make it more difficult for the Fed to defend its dovish policy, but for now the market doesn’t appear concerned. High growth tech stocks which are usually dragged lower by fears of the Fed moving early have held onto gains. The US Dollar also remains elevated.

Biden’s Budget

Biden is due to unveil his first budget as President later today which is expected to increase Federal spending to $6 trillion in 2022. Whilst this would still need to be approved by a divided Congress, it would push Federal spending to the highest level since World War 2.

The prospect of additional spending on infrastructure is sending stocks higher. The market’s focus is very much on the reopening trade with almost no regard for surging debt levels, accompanied by higher interest rates.

Equities

Salesforce trades 4.5% pre-market after raising its full year forecast amid increased demand for its cloud-based software thanks to the working at home dynamic.

HP trades 5% lower pre-market despite reporting stronger than forecast Q2 results. However, it did warn that the ongoing computer chip shortage could reduce their ability to fulfill demand this year.

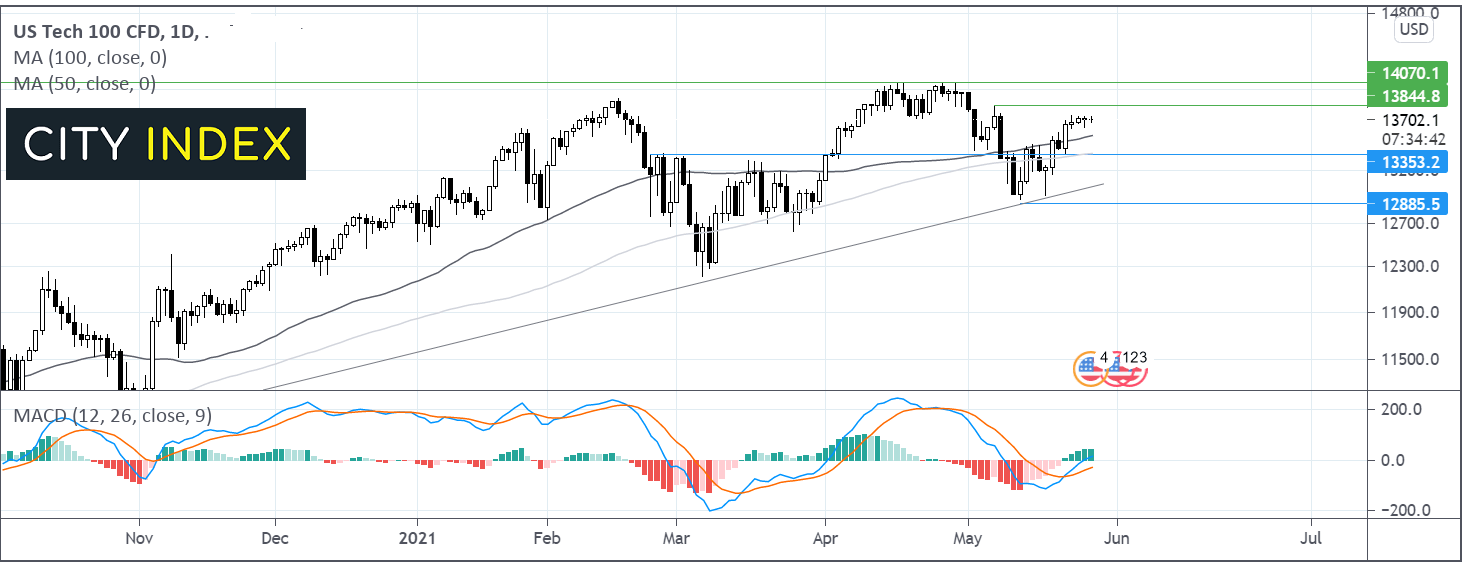

Where next for the Nasdaq?

The Nasdaq trades above its multi- month ascending trend line and above its 50 & 100 sma on the daily chart, showing an established bull trend. Given the bullish MACD buyers will be hopeful of a move back towards 13850 May 7 high, a level which needs to be cleared in order to take on 14000. A move below 13350 the 100 sma and horizontal support could negae the near term uptrend.

FX – USD jumps, EUR falls despite soaring economic sentiment

The US Dollar is trading higher on the back of expectations that Biden will ramp up spending in the coming year. The US Dollar index trades +0.4%

EUR/USD trades lower as US Dollar strength overshadows strong economic sentiment data for the region. Economic sentiment surged to the highest level since January 2018 suggesting that a strong economic recovery is already underway in the second quarter. Sentiment jumped to 114.5, up from 110.5.

GBP/USD -0.4% at 1.4140

EUR/USD -0.5% at 1.2134

Oil set for 5% weekly gains

Oil extends gains for a sixth straight session as reopening optimism and hopes of a strong US driving season are keeping prices buoyant. This is over shadowing concerns of Iranian oil supply re-entering the market.

US – Iran nuclear talks continue. Whilst no deal has been agreed, there is a growing acceptance that sanctions on Iran’s oil exports will only be reduced gradually; supply won’t suddenly shoot higher.

Attention now turns to the OPEC meeting on Tuesday.

US crude trades +0.6% at $67.22

Brent trades +0.47% at $69.50

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 Michigan Consumer Sentiment

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.