Stocks on Wall Street hit fresh all time highs on Wednesday. The Dow closed at record levels whilst the S&P & Nasdaq hit record intraday highs. Further gains are expected on the open after Federal Reserve Chair Jerome Powell reaffirmed a supportive stance.

US futures

Dow futures trade +0.2% at 31450

S&P futures +0.2% at 3918

Nasdaq futures +0.3% at 13715

In Europe

FTSE flat at 6525

Dax +0.6% at 14024

Euro Stoxx +0.5% at 3666

Learn more about trading indices

Biden and Xi speak

On the eve of the Lunar New Year, President Biden and China’s Xi Jinping spoke for the first time. Biden spoke of his concern over China’s “coercive and unfair economic practices” in addition to human rights abuses in the Xinjiang region.

Taiwan was also specifically mentioned as one of Biden’s top three concerns, although China pushed back considering such affairs to be internal.

Relations and particularly economic relations between the two powers are expected to remain a key factor for market performance. Whilst it is still early days markets will be watching carefully going forwards to see whether Biden makes any substantial changes to US – Sino policy or whether he just adopts a more friendly tone.

Dovish Powell talks down the US Dollar

Federal Reserve Chair Jerome Powell reiterated that the Fed’s monetary policy will remain supportive. Speaking to the Economic Club of New York yesterday, Jerome Powell said that the US jobs market was still a long way fully recovered. He added that the Fed isn’t considering lifting interest rates from their current near zero level.

Powell’s comments kept pressure on the US Dollar with DXY continuing to hover around 2 week lows.

DXY trades flat at 90.37

GBP/USD trades +0.05% at 1.3835 after hitting a fresh multi year high of 1.3860.

EUR/USD trades +0.2% at 1.2140

Analyst Fiona Cincotta looks at the price movement of GBP/USD here

…Boosts stocks

US equities are pointing to a stronger start on the open, boosted by the prospect of an accommodative Federal Reserve for longer. Any expectations that the Fed would be tapering support early were quashed following the weaker than forecast CPI data yesterday.

Earnings continue to come through with PepsiCi and Heinz Kraft reporting ahead of the open and Disney reporting after the close.

My colleague Matt Weller looks at what to expect from Disney’s Q4 results here.

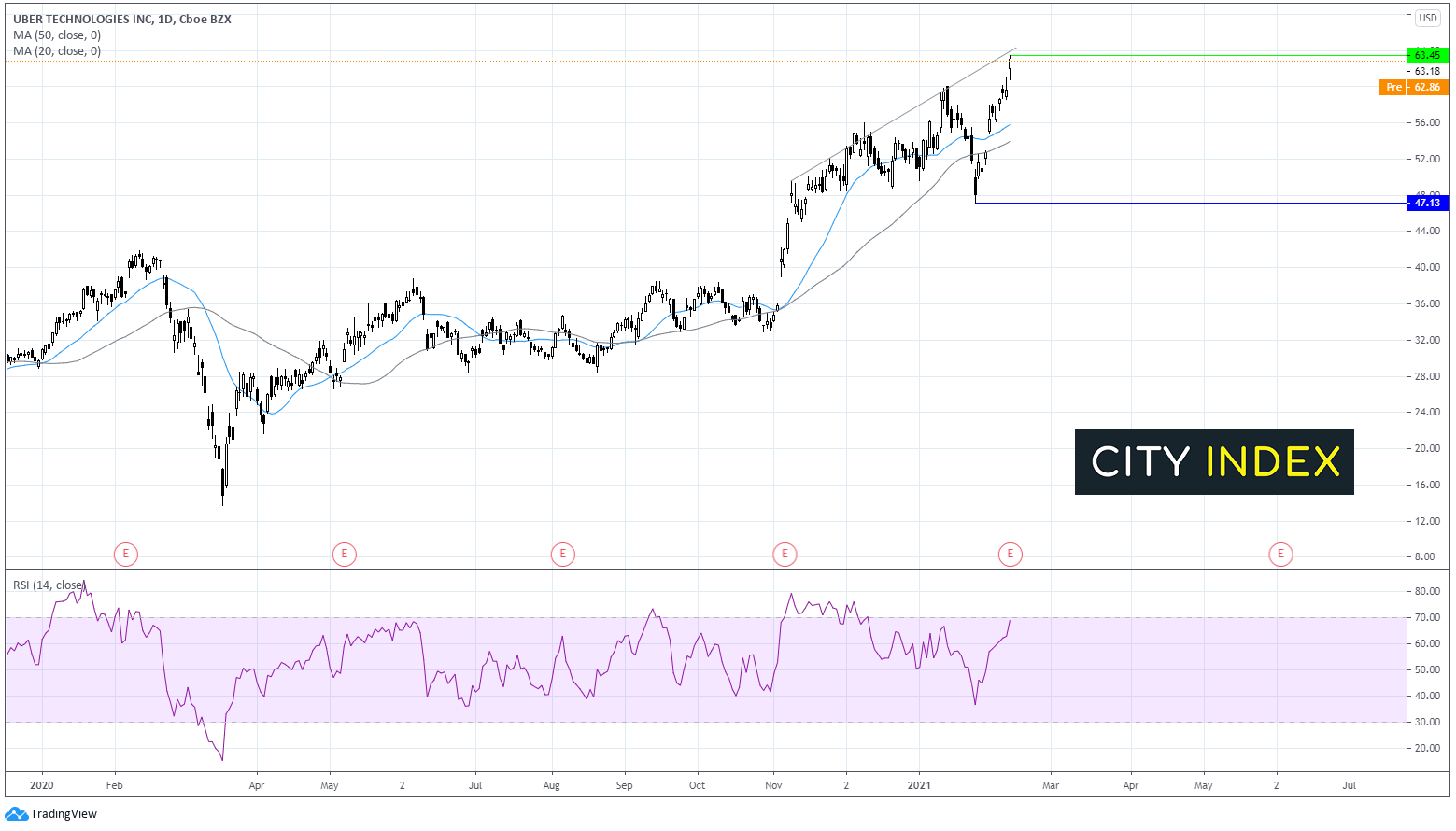

UBER misses on revenue

UBER trades -5% pre-market after disappointing Q4 results after food delivery growth failed to offset the decline in ridesharing & the pandemic continued to drag on revenues. Whilst revenues from the food delivery surged 224% Revenue from rideshare plunged 52% yoy, which was more than forecast. The overall effect was a 20% drop in revenue compared to a year earlier to $3.17 billion, well short of the $3.58 billion forecast.

Oil snaps 8 day winning streak

Oil prices are slipping lower amid profit taking after an impressive 8-day rally and despite a larger than expected decline in US crude supplies.

US EIA data recorded a draw 6.643 million barrels for the week 5th Feb, plunging crude stocks to their lowest level since March.

US crude trades -0.8% at $58.20

Brent trades -0.8% at $60.95

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

US initial jobless claims expected to show 757k vs 779k last week.