US futures

Dow futures +1.5% at 35170

S&P futures +1.5% at 4639

Nasdaq futures +1.2% at 16210

In Europe

FTSE +1.3% at 7137

Dax +0.71% at 15356

Euro Stoxx +1.1% at 4135

Learn more about trading indices

Stocks point higher as market mood improves

US stocks are set to open firmly higher, rebounding from Friday’s selloff but by no means making up all of the losses. The WHO warned over the weekend that the new covid variant Omicron is a significant development. However, they added that it is too soon to say whether it is more deadly that Delta. So far, on the ground evidence from South Africa suggests that the strain is more contagious but less severe. The bottom line is it is too soon to tell.

There is still significant uncertainty over whether the current vaccines will be effective against Omicron. Pfizer has said that a vaccine could be ready in 100 days if Omicron is resistant to jabs.

The mood in the market is lifting even as Omicron spreads quickly across the globe and governments impose stricter travel conditions.

Retailers are likely to be in focus as Black Friday number come through. However, the broad trend suggests that sales are still considerably down from 2019’s.

Oil stocks are expected to more northwards tracing oil prices higher ahead of the OPEC + meeting.

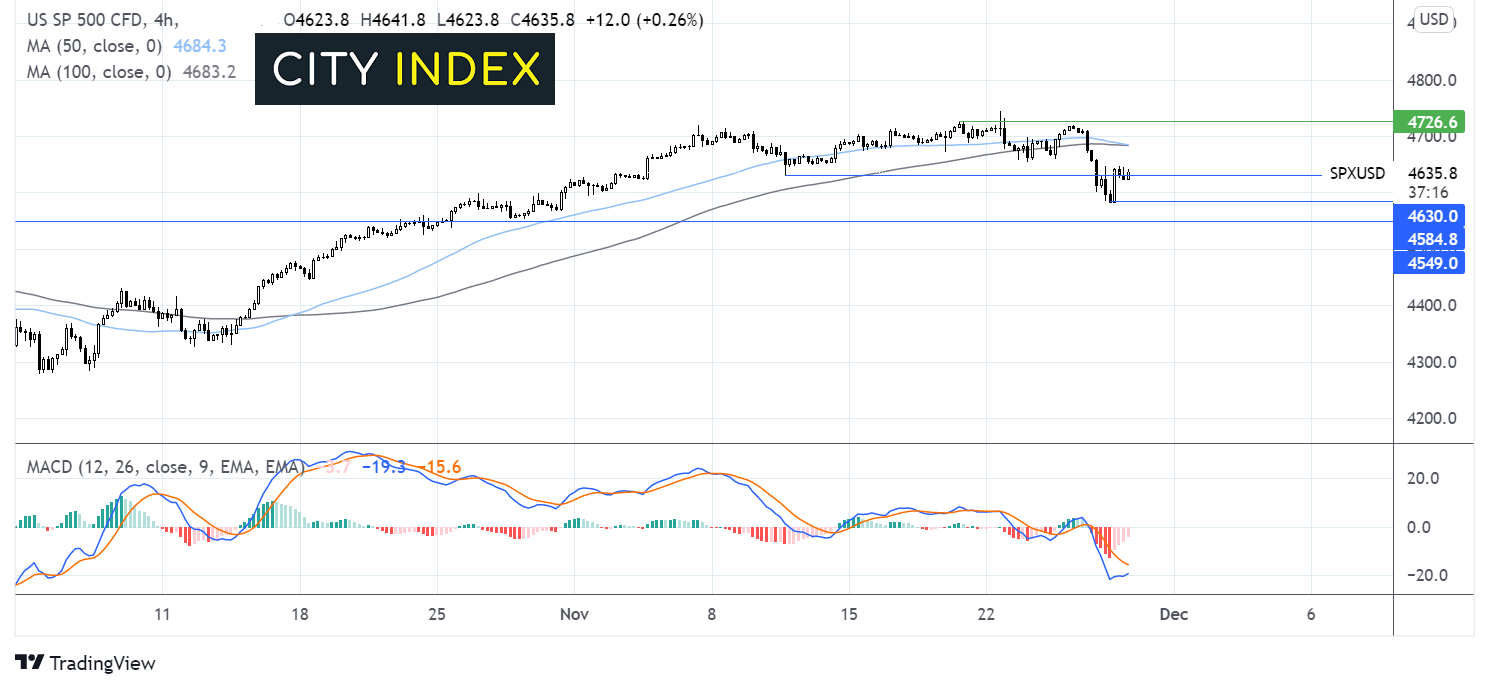

Where next for the S&P500?

The S&P 500 rebounded off 4581 Friday’s low and is stalling around 4630 the November 10 low. The receding bearish bias on the MACD is keeping buyers’ hopeful of further upside. A move above 4630 is need to expose the 50 & 100 sma at 4680. However, the 50 sma appears to be crossing below the 100 sma suggesting that there could be more downside to come. Rejection at 4630 could see the price test the November low at 4580.

FX – USD rebounds, tracing treasury yields higher

The USD is rebounding after weakness on Friday. Fears surrounding the Omicron covid strain made investors questions the Fed’s ability to lift interest rates soon. Today those fears are easing, and the greenback is tracing treasury yields higher. Fed Chair Powell is due to speak later.

EUR/USD fall back, paring gains from Friday when it jumped 1%. The move lower comes despite German inflation surging to its highest level in 3 decades at 5.2% in November, up from 4.6% in October.

GBP/USD -0.06% at 1.3328

EUR/USD -0.35% at 1.1276

Oil rebounds after Friday’s steep declines

Oil prices are rising, paring some of Friday’s 13% declines, which were looking a little overdone. Fears over the high mutated Omicron strain of covid sparked a deep selloff on Friday as governments re-imposed some travel restrictions and fears of lockdown restrictions hit the demand outlook.

Fears surrounding the new strain have eased over the weekend which is helping oil rebound. Attention is also turning towards the OPEC+ meeting later in the week where the oil cartel will consider whether to press ahead with oil production increases. The group is likely to adopt a cautious approach over the demand outlook.

WTI crude trades +5.25% at $71.73

Brent trades +4.85% at $75.06

Learn more about trading oil here.

Looking ahead

15:00 Pending Home Sales

19:00 BoC’s Governor Tiff Macklem speech

20:00 Fed Chair Powell’s speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.