US futures

Dow futures +0.7% at 334190

S&P futures +0.6% at 4384

Nasdaq futures +0.64% at 15110

In Europe

FTSE +1.1% at 6983

Dax +1.4% at 15351

Euro Stoxx +1.2% at 4093

Learn more about trading indices

Stock rebound

The mood in the market has picked up considerably since yesterday’s blood bath. Taking a step back expectations have cooled that Evergrande could be China’s Lehman’s moment. Wall Street considers that China has this under control allowing investors to turn their attention to the Fed, which kicks off its two-day FOMC meeting today.

The Fed will update with its quarterly economic forecasts and the dot plot. There is a good chance that if the Fed don’t start tapering, they will at the very least pave the path for a move in November. It is quite widely acknowledged now that the US economy doesn’t need this currently level of support from the Fed.

The US economic calendar is quiet today. Housing starts and building permits revealed that the US housing market was on a solid footing.

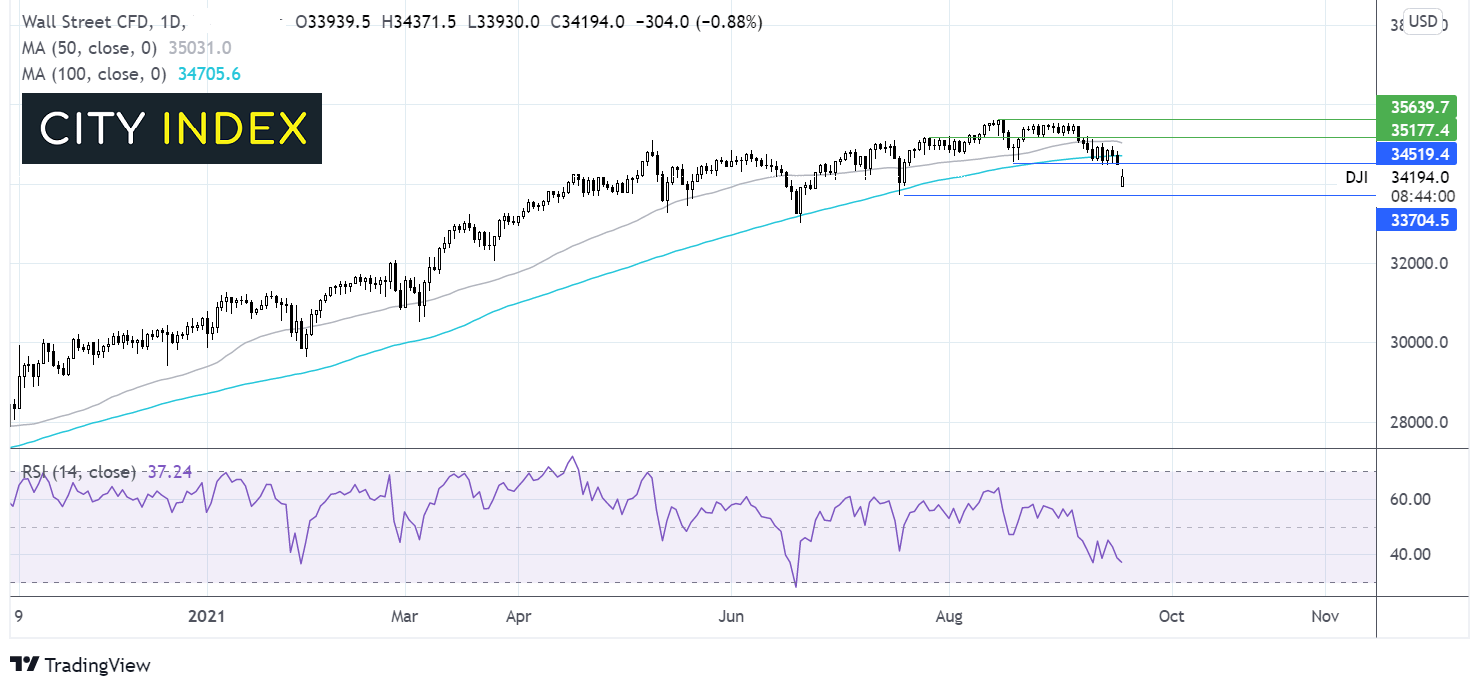

Where next for the Dow Jones?

The selloff in the previous session saw the Dow Jones break through some key levels. The index broke below its 100 sma at 34700 and horizontal support at 34500 hitting a low of 33930, a level last seen two months earlier. The index is rebounding today. Any meaningful recovery will need to reclaim 34500 and 34700. Buyers are only likely to gain traction above the 50 sma at 3500 which could pave the way to 35250. Sellers will be looking for a move below 33930 to 33730 the July low.

FX – USD eases, CAD pares losses

The US Dollar is edging lower off monthly highs as the Fed’s two day meeting kicks off later. It is expected to trade relatively range bound ahead of the Fed’s press conference tomorrow.

USD/CAD is giving back yesterday’s gains. The rebounding oil price and Canadian election results have under pinned the Loonie. Canada’s ruling Liberal Party led by Prime Minister Justin Trudeau returned to power though failed to gain an outright majority.

USD/CAD -0.5% at 1.2750

GBP/USD +0.18% at 1.3680

EUR/USD +0.14% at 1.1742

Oil rebounds on tight supply

Oil prices are heading higher paring at least some of yesterday’s losses. As market sentiment recovers the markets have shifted their focus back onto the tight supply situation in the US. The recovery in output has taken much longer than most anticipated and Shell even warned today that a full return to output is unlikely until 2022 given the damage caused by Hurricane Ida.

US tight supply is overshadowing other factors such as concerns surrounding Evergrande and any potential wider crisis which it may trigger and of course the Fed’s next steps.

18% of the Gulf’s oil production remains offline.

API crude oil stock pile data is in focus later.

WTI crude trades +0.95% at $70.90

Brent trades +0.97% at $74.00

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

21:30 API weekly crude oil stock pile data

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.