US futures

Dow futures -0.1% at 33842

S&P futures +0.02% at 4117

Nasdaq futures +0.3% at 13275

In Europe

FTSE +0.7% at 6985

Dax +0.8% at 15257

Euro Stoxx +0.9% at 3974

Learn more about trading indices

Tech stocks lead the risers after jobless claims drop

Jobless claims continued to fall, hitting a new pandemic low. 444k initial claims were made last week, down from 478,000 the previous week. This was mildly ahead of the 450,000 forecast.

The data adds to evidence that the US labour market is seeing a steady recovery as the US economy reopens. The data should help ease concerns over labour shortages adding upwards pressure to wages, a dynamic which raises inflation fears. The reaction in the market appears to be one of easing inflation fears with tech stocks picking up and the US Dollar weakening.

The data comes after the minutes to the April FOMC revealed that policy members are ready to start talking about tapering asset purchases in the coming months. This caught the markets a little by surprise after the Fed had re-iterated on numerous occasions its dovish stance. Immediate following the release as treasury yields rose. But that move has faded, treasury yields are lower and tech is leading the gains.

Earnings

Earnings from consumer facing companies will ensure that inflation risks continue to linger. Strong consumer spending helped the likes of Target, Home Depot and Walmart report bumper earnings earlier in the week. Whilst pent up demand has been strong what is less clear is well demand will be maintained across the year.

Today earnings from Kohls, Ralph Lauren.

Other stocks likely to be in focus include Cisco after highlighting concerns over disruptions from the global chip shortage.

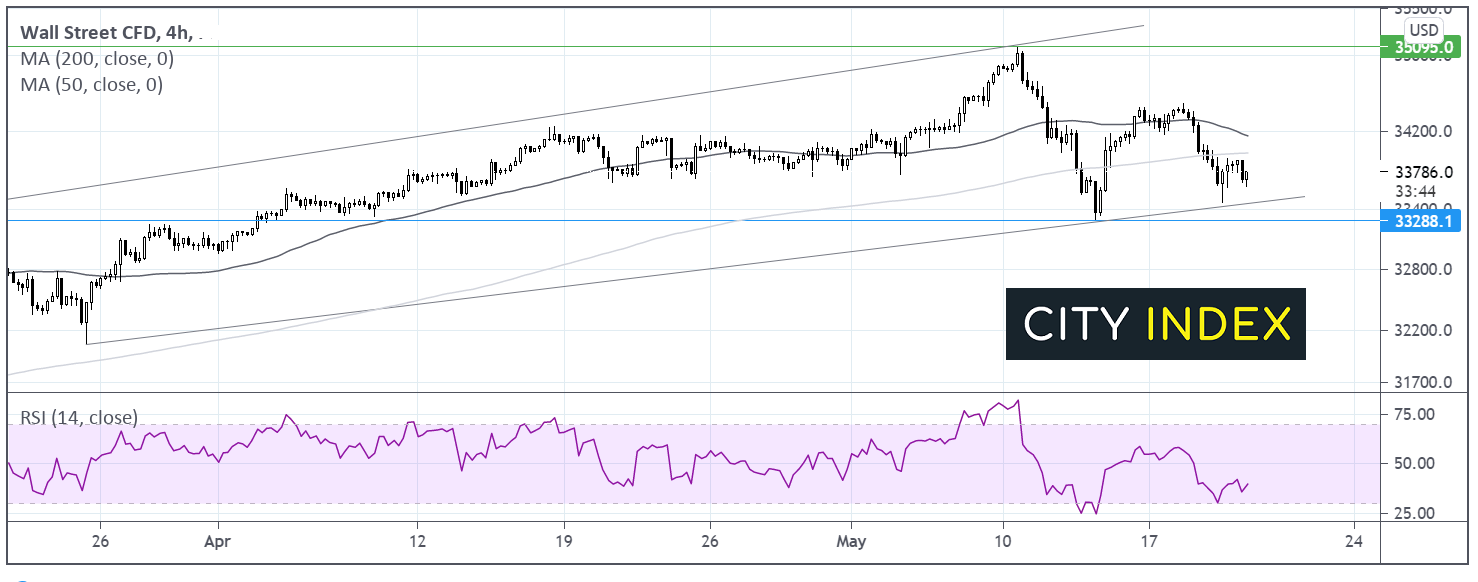

Where next for the Dow Jones?

The Dow Jones sold off in the previous session but found support on its ascending trendline dating back to late March. Whilst this trend line support holds and the price remains above horizontal support at 33290, buyers can remain hopeful. Any recovery would need to retake 34000 the key psychological level and 200 sma on the 4 hour chart in order to book further gains. A move below 33290 could see the sellers gain traction.

FX – USD bounces fades, AUD rises post jobs report

The US Dollar is trading lower, paring gains from the previous session. The cue from the Fed that they are ready to discuss tapering asset purchases hasn’t been enough to alter the down trend in the greenback that has been in place since the start of the year but it could help put a floor in place.

AUD/USD trades higher, outperforming G10 peers after an encouraging jobs report. Australian unemployment fell for the 6th straight month to 5.5%, the lowest level in a year. The data was well received as it comes as the fall in unemployment came despite the end of job-keeper wage subsidies programme.

AUD/USD +0.4% at 0.7758

GBP/USD +0.1% at 1.4126

EUR/USD+0.2% at 1.2200

Oil falls on reported progress in Iran US nuclear talks

Oil is trading sharply lower, extending losses for a third straight session. The latest sell off in oil comes after the Iranian President Hasan Rouhani said that a break-through had been achieved in restoring the 2015 Iran nuclear deal limiting its nuclear programme. He announced that all major sanctions had been lifted, this would include sanctions on oil exports, meaning more oil would come flooding back into the market.

US crude trades -1.13% at $62.59

Brent trades -2% at $67.29

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

00:00 Australia Markit Mfg & Services PMI

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.