US futures

Dow futures -0.08% at 36397

S&P futures +0.03% at 4703

Nasdaq futures +0.15% at 16367

In Europe

FTSE +0.03% at 7309

Dax +0.29% at 16091

Euro Stoxx +0.21% at 4367

Learn more about trading indices

A more dovish Fed coming?

US stocks are pointing to a mixed start after the S&P500 notched up yet another record close in the previous session, its eighth straight record close.

Today the Nasdaq is leading the charge whilst the Dow is trading mildly in the red as investors weigh up the possibility of a reshuffle at the Fed. News that Fed Governor Lael Brainard who is considered to be more dovish than Fed Chair Powell attended an interview at the White House. Brainard’s recent commentary has shown that she is in no rush to raise interest rates. A more dovish Fed Chair would be less supportive of cyclical stocks whilst boosting high growth companies. Powell’#’s current term ends in February.

Attention now will turn to US inflation with the release of PPI data today and CPI inflation data tomorrow. PPI is expected to continue ticking high to 8.7% YoY in October and rising 0.5% MoM.

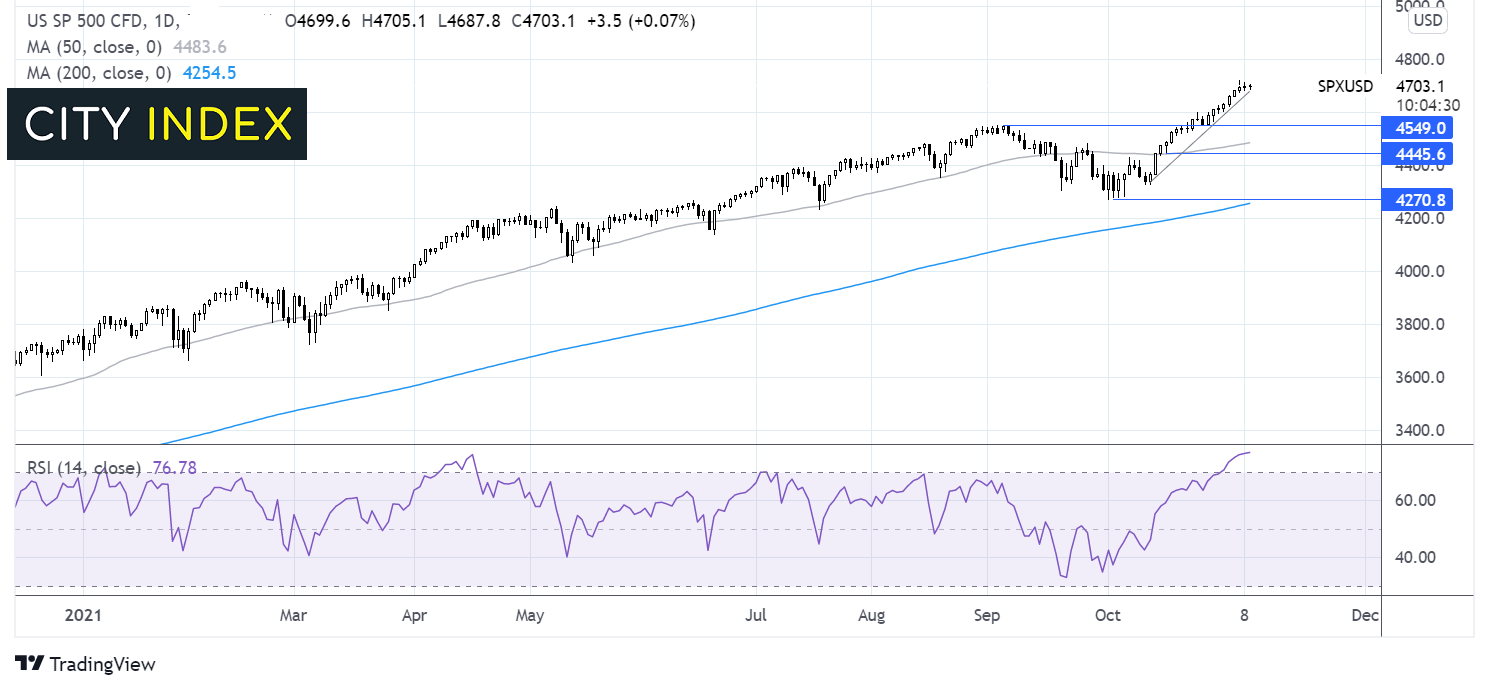

Where next for S&P 500?

The S&P 500 recorded its 8th straight record close on Monday and futures are edging higher still. The price trades above the rising trendline, although the RSI is firmly in overbought territory. Any move lower could be used as a buying opportunity. It would take a move below 4550 for sellers to gain traction and the 50 sma to be exposed.

FX – USD extends losses, EUR shrugs off rebounding German sentiment

US Dollar is easing lower amid uncertainty surrounding the next move by the Fed and the possibility of a reshuffle at the Fed.

EUR/USD has shrugged off impressive German data. The closely watched German ZEW sentiment data unexpected rose in November to 31.7, up from 22.3 in October and well ahead of the 19 forecast. This improvement in sentiment comes after supply chain bottlenecks had dragged the index lower over the past 5 months.

GBP/USD +0.12% at 1.3580

EUR/USD +0.01% at 1.1586

Oil rises for third straight session

Oil prices are on the rise for a third straight session supported by several bullish factors such as tight supply, the passage of the US infrastructure bill, and Saudi Armco raising its official selling price. However, price gains may be capped as the Biden administration considers what action it can take to bring down prices at the pumps. The release of key reserves is a possibility being floated as a way to bring down prices. That said bullish factors are still aplenty for now. Whether such as move by the Fed really brings down prices would depend largely on how much is released. For now, this is still at the ideas stage so the impact is minimal.

API inventory data is due later today.

WTI crude trades +0.35% at $81.42

Brent trades +0.3% at $83.30

Learn more about trading oil here.

Looking ahead

13:30 PPI

14:00 Fed Chair Powell

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.