US futures

Dow futures +0.2% at 35022

S&P futures +0.35% at 4412

Nasdaq futures +0.45% at 15036

In Europe

FTSE +0.6% at 7077

Dax +0.15% at 15584

Euro Stoxx +0.6% at 4117

Learn more about trading indices

Futures tick higher as Senate agrees infrastructure bill draft

US futures are set to start higher continuing the recent upbeat tone amid broadly strong corporate earnings and a dovish Fed. Risk appetite is also being boosted by a US infrastructure bill as Senators introduce a $1 billion spending plan, potentially adding yet more stimulus to the economy. There is a chance though that this will get held up in the House of Representatives as Speaker Nancy Pelosi has tied it to a separate $3.5 trillion spending package to fight poverty and climate change.

Attention will now turn to the US ISM PMI which is expected to tick higher to 60.9 in July, up from 60.6. The data comes after a cool down in factory growth in China. The Caixin manufacturing PMI fell to 50.3 its lowest level since April. At the same time virus concerns are also ticking higher in China, although data remains scarce.

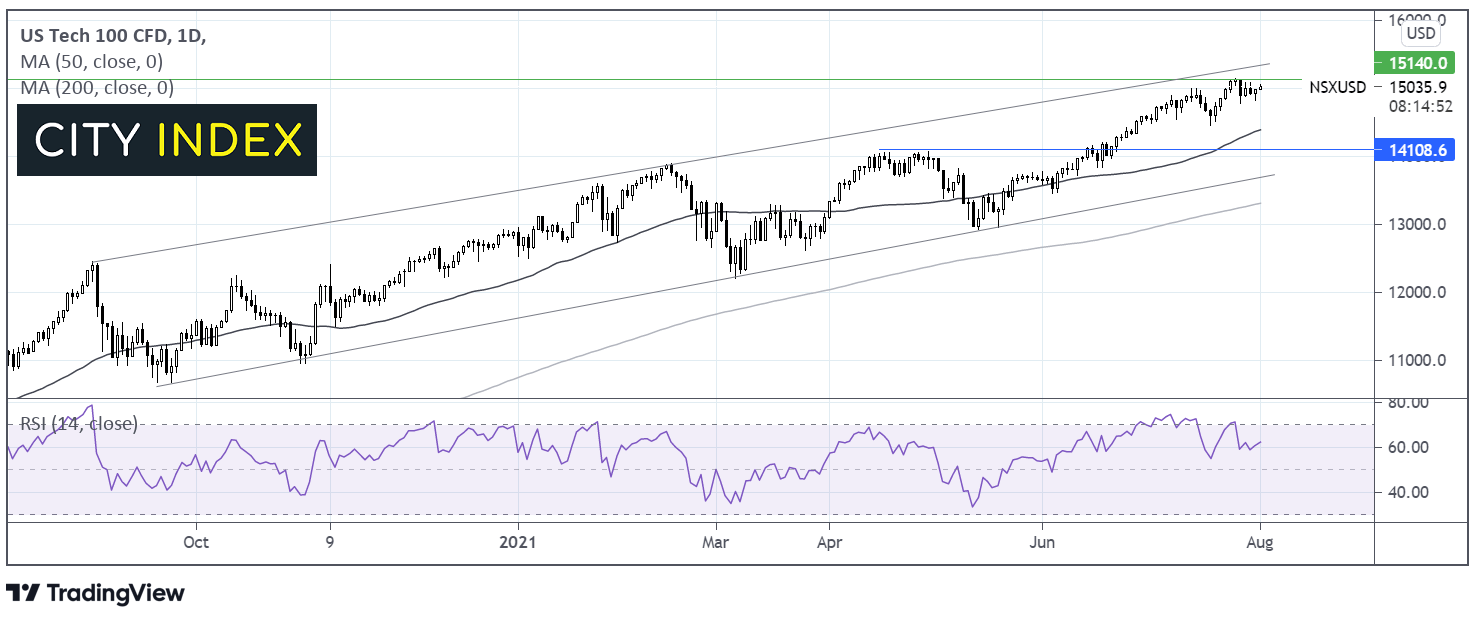

Where next for the Nasdaq?

The Nasdaq trades within an ascending channel dating back to September last year. The index trades just off records highs of 15140 reached last week. The RSI is supportive of further upside whilst it remains out of overbought territory. A move above 15140 could see the price aim for the upper band trendline projection at around 15350 and fresh all time highs. On the flip side there is plenty of support with 50 sma seen at 14385 and horizontal support at 14100.

FX – USD extends losses, EUR rises on upbeat data

The US Dollar is trending lower, extending losses from the previous week. The greenback experienced its worst weekly performance last week since May after the Fed reiterated that it Was in no hurry to tighten monetary policy. Attention will now turn to ISM manufacturing data ahead of the non farm payroll report on Friday.

EUR/USD trades just shy of 1.19, boosted by upbeat German retail sales data came in ahead of forecast at 4.2% MoM vs 2% estimated. Manufacturing PMIs for both Germany and the Eurozone was also upwardly revised to 65.9 and 62.8 respectively.

GBP/USD -0.11% at 1.3890

EUR/USD +0.12% at 1.1885

Oil pressurized on Chinese growth concerns

Oil is trading under pressure as concerns over the health of China’s economic recovery resurfaced. The latest PMI survey revealed that factory growth in the world’s second largest oil consumer slowed sharply. Oil market nerves were compounded further by higher output from OPEC producers.

OPEC output rose to the highest level in July since April 2020.

US crude trades -1.5% at $72.45

Brent trades +1.3% at $74.20

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:45 Markit Manufacturing PMI

15:00 ISM Manufacturing PMI

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.