US futures

Dow futures +0.2% at 34730

S&P futures -0.4% at 4465

Nasdaq futures -0.4% at 15443

In Europe

FTSE -0.02% at 7028

Dax +0.31% at 15680

Euro Stoxx +0.7% at 4173

Learn more about trading indices

Cyclicals gains as retail sales rebound

US stocks have opened mixed following a surprise jump in US retail sales. Retail sales unexpectedly jumped 0.7% MoM in August, up from -1.1% in July and well ahead of the -0.8% decline forecast. The upbeat sales data shows that consumers are resilient despite concerns over the rise in Delta covid cases. Whilst travel and leisure sales stagnated, back to school sales overshadowed this.

For the markets the data all links back to what the Fed will do in the meeting next week. The resilience seen in consumers has boosted bets that the Fed could fire the tapering gun in September. The US Dollar is charging higher and cyclicals, which are closely tied to the health of the economy, are outperforming high growth stocks. Dow futures managed to quickly reverse losses

There were few surprises from jobless claims which rose from the previous week’s 310k to 332k, just slightly above forecasts.

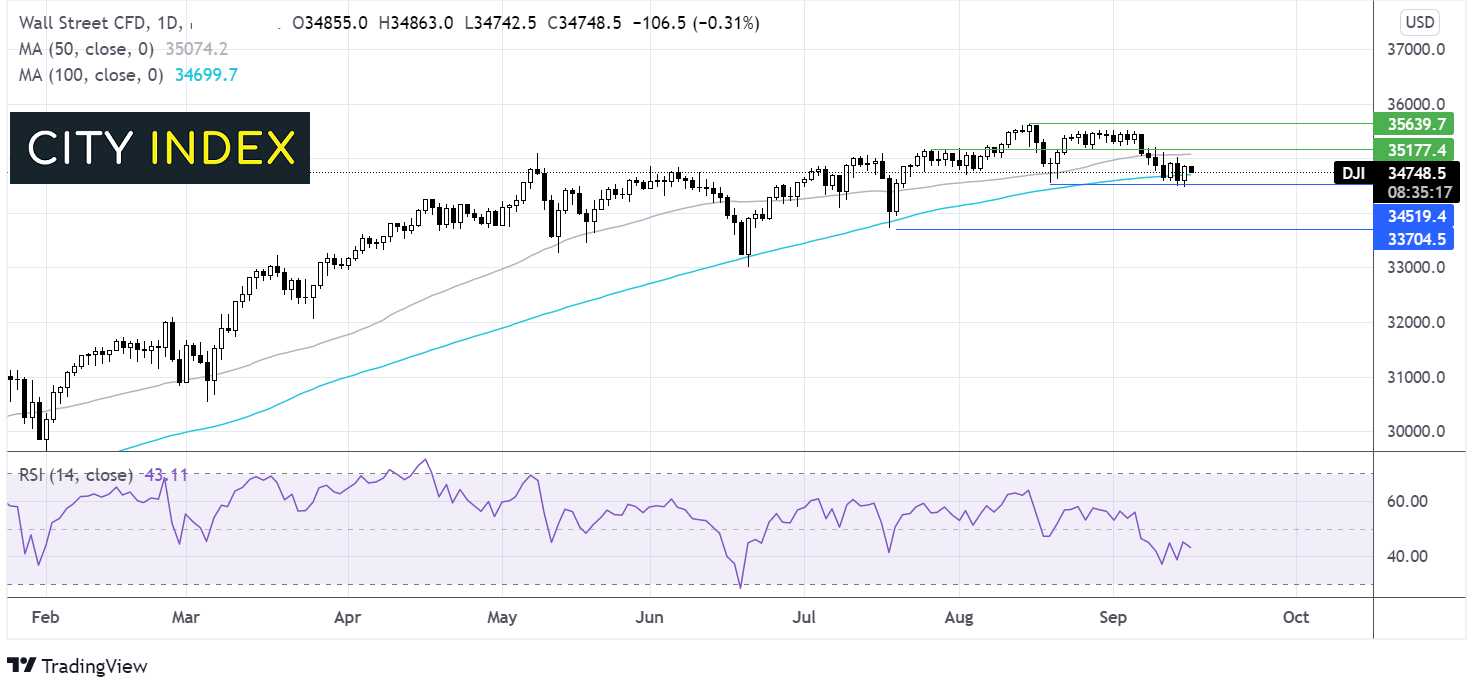

Where next for the Dow Jones?

The Dow Jones continues to trade below its 50 sma a key support across the year. It is now approaching the 100 sma at 34700. A break below here will bring 34500 into play, this is the weekly low and also the August low. It would take a move below this level for the bears to gain traction, possibly sparking a deeper sell off to 34750 the July 20 low. Any recovery would need to retake 35000 the round number, 50 sma. It would take a move over 25200 for the bulls to gain traction.

FX – USD rallies EUR trades sub 1.18

The US Dollar is on the rise as attention turns to the Fed meeting next week. Expectations are building that the Fed will taper which is lifting the US Dollar.

EUR/USD – the Euro is bearing the brunt of the stronger US Dollar. The common currency shrugged off upbeat Eurozone industrial production numbers yesterday and more hawkish commentary from the ECB. All eyes are on Christine Lagarrde who is due to speak shortly.

GBP/USD +0.07% at 1.3839

EUR/USD -0.36% at 1.1772

Oil rises on as stockpiles decline

Oil prices are holding steady around multi-week highs hit in the previous session. A huge draw on US inventories lifted the price. US crude stockpiles fell by 6.4 million barrels last week, well over the 3.5 million forecast as offshore facilities continue to recover from Hurricane Ida. The recovery to output has taken longer than expected.

Oil is also finding support from the surge in European power prices. The energy crisis in Europe is like to deteriorate before it gets better.

This week could be a key week for oil which is expected to see global oil demand rise to over 100 million barrels a day – last seen in 2019.

WTI crude trades -0.12% at $72.15

Brent trades -0.13% at $74.90

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 US Business Inventories

23:30 NZ Business PMI

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.