US futures

Dow futures +0.07% at 35360

S&P futures -0.05% at 4526

Nasdaq futures +0.01% at 15600

In Europe

FTSE -0.83% at 7111

Dax -0.21% at 15855

Euro Stoxx -0.20% at 4192

Learn more about trading indices

Futures trade lower but set for strong monthly gains

US stocks are set to open lower on the final day of trading in August. However, across the month as a whole the three main indices on Wall Street have seen strong gains booked. The S&P has booked gains of 3% in its seventh straight month of gains. Meanwhile the Nasdaq has rallied 4% and the Dow Jones 1.3% amid the ongoing rotation out of cyclicals.

The Fed looks set to remain supportive and adopt a cautious approach to reining in stimulus, particularly as covid cases continue to rise in the US southern states. Fed Powell’s lack of a firm timetable to taper bond purchases on Friday at the Jackson Hole Symposium sent stocks higher.

Attention will now swing to US consumer confidence. The report comes hot on the heels of the Michigan consumer sentiment data last week which revealed that consumer sentiment fell to pandemic lows in August amid rising concerns over Delta.

Zoom falls despite billion-dollar quarter

Zoom is heading -13% pre-market following earnings. The vide communications firms which benefited hugely from the pandemic reported EPS of $1.04 in Q2, up from 0.63c but short of $1.16 forecast. Meanwhile revenue surged to $1.02 billion, ahead of the $991 million forecast marking the first billion dollar quarter. However, this also marked the slowest growth in revenue since its IPO in April 2018, rising 54%.

Guidance for the coming quarter was even more concerning with revenue growth expected at just 31% whilst EPS was guided for at $1.07, missing the $1.10 hoped for. As social contact rises, and people return to the office zoom demand is expected to ease.

Where next for Zoom share price?

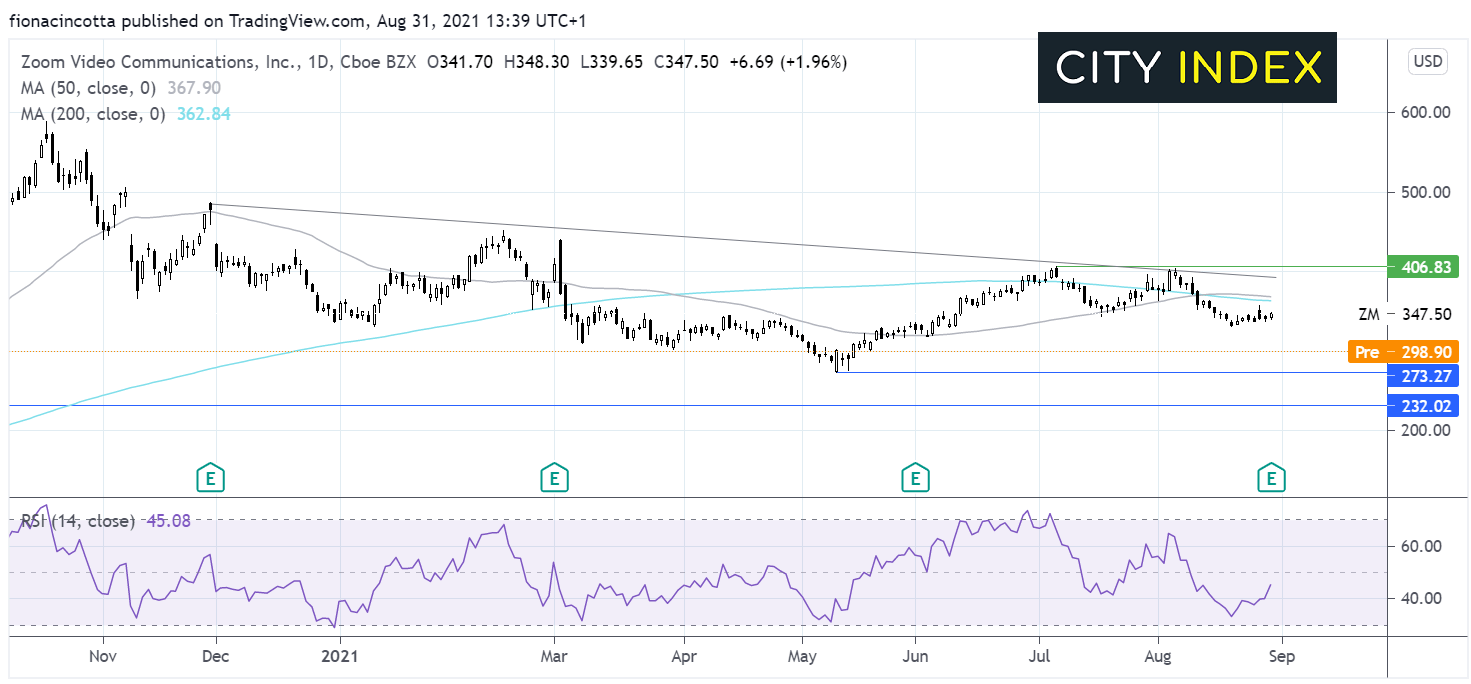

The Zoom share price has been trending lower since October last year when it reached its all time high of $588. The stock hit a year to date low of $273 in May before briefly pushing back over its 50 & 200 sma to a high of $406.

Today’s sell off sees the Zoom share price trade below the 50 & 200 sma and looks to target $273 the August low. A breakthrough this level could open the door to $232 a level the August 2020 low.

Any meaningful recovery in the share price would need to retake the 50 & 200 sma resistance at $365 in order to aim towards the July & August high of $406.

FX – USD hits 2 week low, EUR soars on strong CPI

The US Dollar is resuming its selloff and trades around a 3 week low as investors await further tapering clues. The greenback has been on the back foot following the Jackson Hole Symposium where Fed Chair Powell failed to provide a firm timetable on tapering bond purchases. Attention now turns to US non-farm payroll numbers for further clues on Friday. With the Fed’s employment criteria still not being met – the labour market holds the key for reining in support.

EURUSD trades at a three-week high following stronger than forecast Eurozone inflation data. EZ CPI jumped to 3% in August its highest level in a decade and above the 2.8% forecast. Core inflation also surged to 1.6% up from 0.7%.

GBP/USD +0.05% at 1.3711

EUR/USD +0.26% at 1.1860

Oil edges lower amid concerns over demand

Oil has seen some wild swings over the past two weeks. Oil prices tumbled almost 9% two weeks ago only to jump 11% last week.

This week the price is coming under slight pressure despite Hurricane Ida hitting output I the Gulf of Mexico. Instead, concerns over demand as the storm hit refineries are dragging on the price of oil.

Furthermore, rising Delta covid cases globally are impacting the future demand outlook. The EIA said that it expects oil demand to increase more slowly for the rest of 2021 owing to the Delta variant. Even so, OPEC is set to stick to its July agreement of boosting output by 400,000 barrels per day from August.

US crude trades -0.79% at $68.54

Brent trades -0.77% at $71.66

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:00 US House Price Index

14:45 Chicago PMI

15:00 US Consumer Confidence

21:30 API Weekly Crude Oil Stock

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.