US futures

Dow futures +0.25% at 34830

S&P futures +0.07% at 4232

Nasdaq futures -0.02% at 13765

In Europe

FTSE +0.37% at 7095

Dax +0.1% at 15713

Euro Stoxx +0.2% at 4099

Learn more about trading indices

Stocks mixed, as tech slips, CPI in focus

US futures are pointing to a mixed start, trading within a familiar range around record highs as investors continue to digest Friday’s non-farm payrolls and look ahead to key inflation data later in the week.

Major indices on Wall Street closed higher on Friday after non-farm payroll data came in weaker than expected at 559k new jobs versus 650k forecast. The market saw this report as easing pressure on the Fed to taper support.

Today the economic calendar is light. Attention is firmly on US CPI data due to be released later in the week particularly after the 4.2% shock in April. CPI will be one of the last major macro releases before the Fed rate decision in the middle of the month.

The Nasdaq is trailing its peers and tech giants will be in focus after the G7 agreed on a corporation tax deal of a minimum of 15% in an attempt to raise more cash from the likes of Amazon and Alphabet.

Separately Tesla trades lower pre-market after Elon Musk tweeted that the EV maker has ended the planned production of Model S Plaid Plus, the most expensive version of its flagship sedan.

Meme stocks such as GameStop, AMC Entertainment and BlackBerry continue to see last week’s upbeat tone albeit in a less volatile manner.

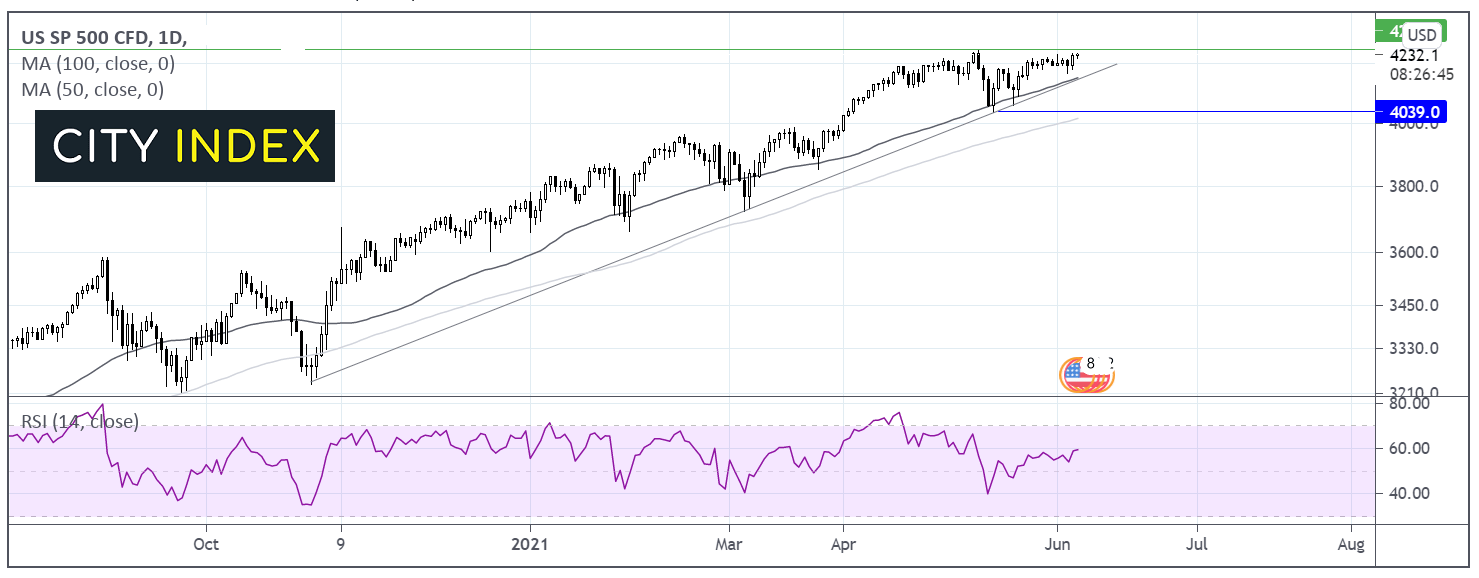

Where next for the S&P 500?

The S&P has been sluggish recently but shows no real signs of weakness. Whilst the ascending trendline holds, buyers remain optimistic of a move back towards the all-time high of 4240. The RSI is also supportive of further upside. On the flip side a move below 4150 the ascending trendline and 50 day ma could negate the near term uptrend, but sellers would need to seer a move below 4050 horizontal support to see the sellers gain traction.

FX – USD struggles for direction, EUR rises as sentiment improves

The US Dollar is trading marginally higher, licking its wounds after Friday’s steep losses. The weaker than expected non-farm payroll on Friday eased pressure on the Fed to taper support. However, comments by Janet Yellen have reignited tightening expectations, aiding the greenback.

The Euro is pushing higher following upbeat Eurozone investor sentiment data. Investor morale in the Eurozone in June hit its highest level since February 2018, boosted by re-opening optimism. As covid numbers decline, restrictions are easing, restaurants and tourism are reopening lifting sentiment.

GBP/USD +0.05% at 1.4165

EUR/USD +0.05% at 1.2166

Oil hovers around 2 year high

Oil prices are easing lower after strong gains across the previous week pushed the prices on both benchmarks to almost 2-year highs. Optimism surrounding the demand outlook as Western economies ease lockdown restrictions are underpinning the price. Global oil demand is expected to outstrip supply in H2 despite OPEC+ easing oil production cuts.

Data from China showed a 14.6% year on year decline in China’s crude oil imports in May, which Is dragging on oil prices slightly today. However, the bullish trend remains intact.

Talks between Iran and the US over the revival of the 2015 Iran nuclear deal will enter the 5th round in Vienna this week. A deal could see sanctions on Iran’s oil exports removed although any changes are likely to be gradual.

US crude trades -0.22% at $69.30

Brent trades -0.34% at $71.55

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

There are no major releases due.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.