US futures

Dow futures +0.07% at 34520

S&P futures +0.12% at 4365

Nasdaq futures +0.27% at 14750

In Europe

FTSE -0.35% at 7117

Dax -0.31% at 15143

Euro Stoxx -0.45% at 4050

Learn more about trading indices

Nasdaq leads gains

US stocks are pushing higher following yesterday’s selloff, with the tech heavy Nasdaq leading the gains, possibly after an encouraging update from Tesla.

Investors are managing to push inflation and stagflation fears aside for now, even as oil prices remain elevated around $80 per barrel. The market appears to be taking a breather as inflation fears fueled by the energy crisis and global supply chain disruptions will be back under the microscope later in the week with CPI and retail sales data.

With third quarter earnings just around the corner, cost pressures will be in focus across earning season and are likely to be the barometer of investor confidence.

Looking ahead US JOLTS job openings are due to be released. Given the surprisingly weak US NFP report, investors would be forgiven for assuming the JOLTS job openings will be low. However, recently JOLTS job opening data has been adding to the conundrum rather than resolving questions. Over 10 million job vacancies are expected to be reported.

Where next for the S&P500?

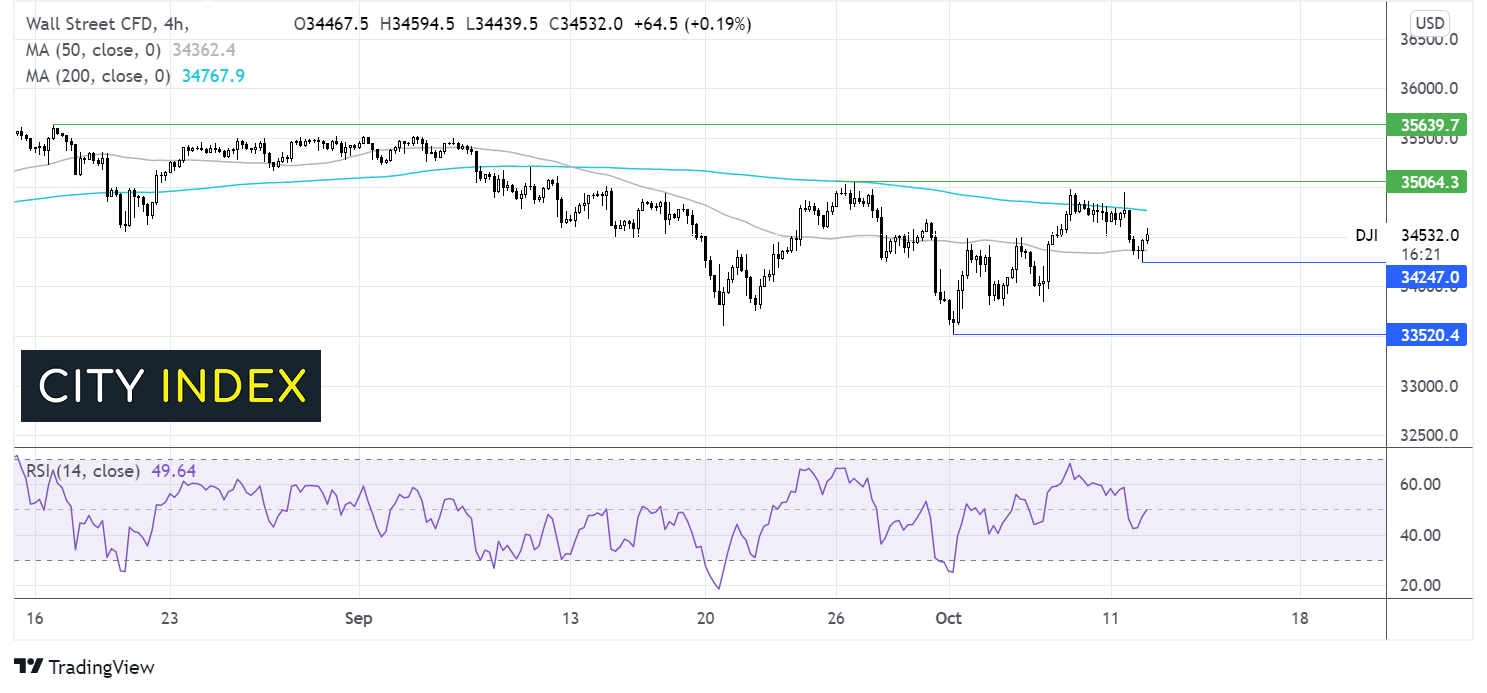

The Dow Jones is picking up off yesterday’s low of 34250. It trades caught between the 50 sma and the 200 sma on the 4 hour chart. The RSI is providing few clues at neutral point. Buyers might look for a move over the 200 sma at 34750 for further gains towards 35000 psychological level. Sellers might look for a move below the 50 sma at 34380 and yesterday’s low of 34250 for a deeper sell off.

FX – USD drifts, GBP rises after solid jobs data

The US Dollar is easing a few pips lower but remains around yearly highs as treasury yields hit at 5 month high of 1.63%

GBPUSD is on the rise after UK jobs data revealed that the labour market continues to recover. UK vacancies topped 1 million suggesting that the labour market can absorb the extra workers released from furlough as the scheme ended. The ONS reported a record 235k jobs added in July. More people are in work now than in February 2020. The data raised bets that the BoE could raise interest rates sooner.

GBP/USD +0.3% at 1.3628

EUR/USD -0.05% at 1.1570

Oil set for 5th straight day of gains

Oil prices are on the rise for a fifth straight session as the energy crunch continues. Coal prices rose to a record high in the previous session, gas prices have cooled slightly but is still four times more expensive than at the start of the year. Comparatively oil is more attractive lifting demand.

Technically oil is looking overbought on the daily chart so there could be a period of consolidation or a move lower on the cards. That said the outlook is still bullish whilst OPEC remain cautious over raising output.

WTI crude trades +0.4% at $80.43

Brent trades +0.26% at $83.56

Learn more about trading oil here.

Looking ahead

14:00 JOLTS job openings

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.