US futures

Dow futures -0.03% at 31450

S&P futures -0.6% at 3851

Nasdaq futures -1.7% at 13000

In Europe

FTSE -0.1% at 6602

Dax -1.3% at 13792

Euro Stoxx -0.6% at 3674

Learn more about trading indices

Jerome Powell & rising inflation expectations

Federal Reserve Chair Jerome Powell begins a two day semi-annual testimony before Congress today. His appearance comes as concerns over future inflation expectations are on the rise.

The markets will be looking to Jerome Powell for indications as to whether the Fed is prepared to stick to the loose monetary policy in order to enable a quick recovery from the pandemic or whether fears of overheating will see the Fed start to consider a tighter stance.

Fed Powell is expected to provide assurance that this Fed will not respond to rising inflation expectations with an immediate rate hike. This could drag on demand for the US Dollar which is on the rise in the European session.

However, the Doves in the Fed could have an increasingly tough time talking down speculation of early tapering should the rising bond yield trend continue.

Learn more about the Federal Reserve

Stocks point lower tech rout continues

Tech stocks are by far the weakest link with the Nasdaq futures trading -1.5%, extending a 2.6% slide from the previous session. Rising yields and surging commodity prices are take the shine off these growth stocks which whose valuations are raising concerns in the current climate.

Home Depot

Home Depot trades -1.5% pre-market despite Q4 earnings beating expectations as the firm benefitted from a huge pandemic driven boom in home improvements. EPS $2.65 vs $2.62exp. on Revenue $32.26 billion vs $30.73 expected. However, failure to provide an outlook unnerved investors.

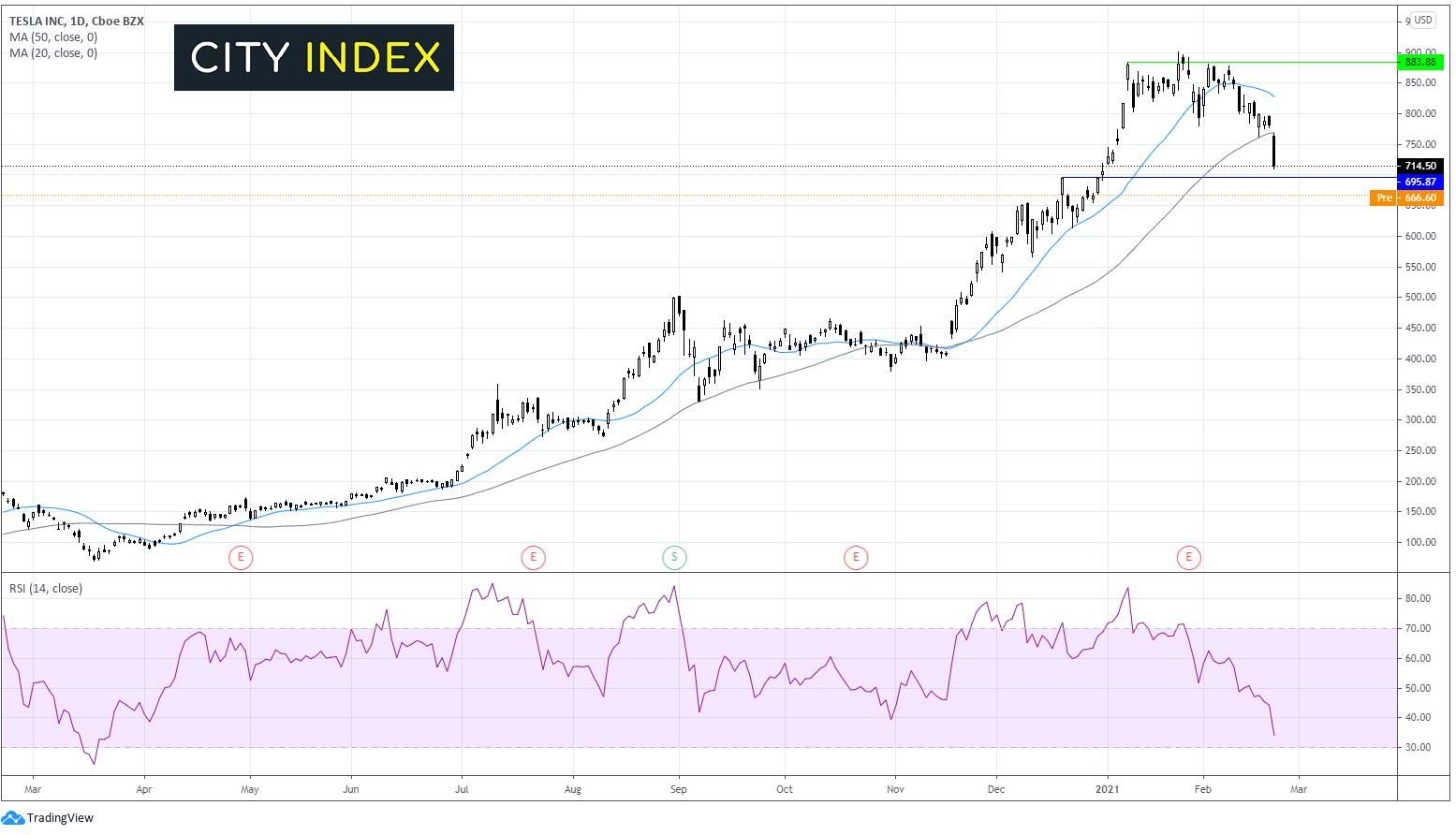

Tesla plunged -8% in the previous session and trades a further 5.5% lower pre-market hit by the sell off in tech stocks, the fall in bitcoin in which Tesla recently invested $1.5 billion. The stock trades -27% from its peak of $900 hit in January, putting it technically in a bear market.

Tesla rival Lucid goes public

Luxury electric vehicle maker Lucid Motors agreed to go public by merging with Churchill Capital IV Corp in a deal which valued the combined company at $24 billion.

Lucid is run by an ex-Tesla engineer. Investors are rushing into the EV sector, boosted by Tesla’s meteoric rise and with emission regulations toughening in Europe.

Lucid is expected to start production in North America in H2 with Lucid Air. It plans to deliver20,000 vehicles in 2022.

FX – USD holds 90.00

The US Dollar rebounded from an almost 6 week low in the Asian session and trades above the firm support of 90.00

GBP/USD holds above 1.4050 near its 35 month high after encouraging UK jobs data. Whilst the unemployment rate rose above 5% for the first time since the Brexit referendum in 2016, the claimant count fell by 20,000 and average wages rose by an above forecast 4.7%. PM Boris Johnson’s plan to reopen the UK economy in the coming months was also well received.

GBP/USD trades +0.05% at 1.4068

EUR/USD trades -0.1% at 1.2148

Oil rises on reopening optimism

Oil prices are on the rise supported by the easing of lockdowns, improving economic forecasts and a slow return to production in the US following the cold snap in Texas.

Goldman Sachs says they expect Brent to reach $70 in Q2 up from a previously predicted $60 and $75 in Q3, up from $65.

US crude trades +0.2% at $61.84

Brent trades +0.3% at $64.54

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

Fed Chair Powell’s testimony will be the main event.

Housing price index December.

15:00 UTC Consumer confidence Feb. is expected to move higher to 90.00, up from 89.3 in January.

API weekly crude oil stock inventories