US futures

Dow futures -0.1% at 34430

S&P futures +0.03% at 4246

Nasdaq futures +0.3% at 14036

In Europe

FTSE +0.18% at 7146

Dax +0.06% at 15699

Euro Stoxx +0.07% at 4130

Learn more about trading indices

Rotation into value already over?

Stocks are pointing to a mildly mixed start, with the S&P hovering around an all time high as investors look ahead to Wednesday’s Fed decision. Expectations are for the Fed to maintain its ultra-lose monetary policy.

Market participants have taken on board the Fed’s persistent reassurance that the recent spike in inflation is temporary. The market appears to be positioning for a dovish Fed as reflected by falling bond yields, the weaker US Dollar and rising demand for high growth tech stock. Nasdaq futures are outperforming its peers.

High growth tech stocks are particularly sensitive to interest rate expectations. The rotation out of growth and into value which dominated earlier in the year appears to be unwinding already. Some cyclicals such as industrials and home builders have fallen considerably from their May highs, Caterpillar trades down 8% from its 52 week high. Even banks came under pressure last week Bank of American fell 4%. Meanwhile speculative tech stocks have risen firmly, Zoom & Spotify are up 15%and 11% respectively since mid-May.

Equities

Novavax trades +9% pre-market after reporting that late stage data from its clinical trial shows that its covid vaccine is 90%effective against a variety of variants.

Tesla could also be under the spotlight as CEO Elon Musk tweeted that Bitcoin will be accepted again as payment for cars once there is clean energy use by miners.

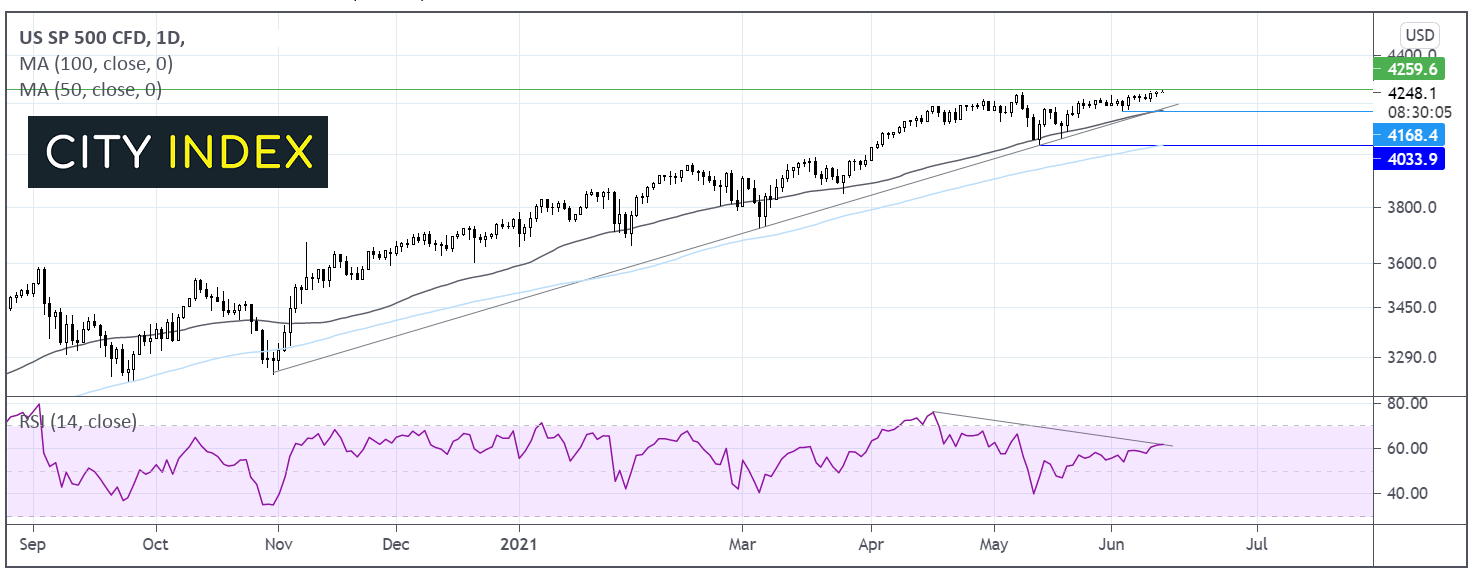

Where next for the S&P 500?

The S&P 500 trades around its all-time high of 4257. The S&P 500 trades above its ascending trendline dating back to November and above its 50 sma in a bullish trend. The fact that it broke above its previous all time high at 2445 could mean that further gains could come more easily. However, RSI divergence suggests that momentum could be slowing. Buyers could target 4300 ahead of 4350. It would take a move below 4170 for the near-term uptrend to be negated.

FX – USD edges lower, GBP slips on Freedom Day delay

After hitting as weekly high, the US Dollar is edging mildly lower versus its major peers as attention switches to the Fed monetary policy announcement on Wednesday.

GBP/USD lower and is underperforming its major peers as Brutish Prime Minister Boris Johnson is expected to delay the final steps to re-opening the UK economy. Amid growing concerns over rising delta variant covid cases. In the announcement later today, should Boris Johnson push back on easing restrictions for 4 weeks. Hospitality businesses, which has suffered the hardest across the pandemic could struggle to stay afloat amid the continued uncertainty. BoE Governor Andrew Bailey is due to speak later

GBP/USD -0.1% at 1.4103

EUR/USD +0.1% at 1.2118

Oil hits fresh two year high

Oil prices are pushing higher, extending gains for a fourth straight week and hitting a two year high. Oil remains supported by an upbeat fuel demand outlook. Thanks to successful vaccine rollouts, pandemic travel restrictions have eased and travel is picking up. Traffic in the US and in Europe is returning to pre-covid levels. Furthermore, on Friday the US saw 2 million passengers travel by air for the first time since March 2020, indicating that air travel demand and the associated jet fuel demand is picking up.

US crude trades +0.4% at $71.04

Brent trades +0.47% at $72.83

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:00 BoE’s Governor Bailey speaks

22:00 Australia Westpac Consumer Survey

02:30 RBA Meeting Minutes

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.