US futures

Dow futures +0.4% at 33970

S&P futures +0.67% at 4213

Nasdaq futures +1.1% at 14060

In Europe

FTSE +0.45% at 6996

Dax -0.44% at 15235

Euro Stoxx +0.2% at 4017

Learn more about trading indices

US stock point higher as the good news keeps rolling in

US stocks are heading for a stronger start on Thursday with the tech heavy Nasdaq set to outperform following stellar earning from Apple & Facebook, after a dovish and impressive macros data. What more could the bulls want?

Earnings

Apple posted blowout earnings smashing expectations. Sales jumped 54% on strong demand for 5G enabled iPhones. Profits more than doubled to 110% to $23.6 bn. Apple also announced that it will increase its existing buyback programme by $90 billion.

Facebook also beat Wall Street’s forecasts for both revenue and profit thanks to a surge in digital ad spend as consumer shopped online.

Today is the busiest day of earnings season with 11% of the S&P due to release numbers. These include Caterpillar and McDonald among some of the big names, and Amazon after the close.

US GDP beats, jobless claims at new low

US GDP jumped 6.4% annualized in the first three months of the year. This was ahead of the 6.1% forecast and a solid jump higher from 4.3% recorded in the final quarter of last year. On a quarterly basis GDP jumped 4.1%, significantly beating the 2.5% expected and 1.3% growth recorded in Q4 2020.

Jobless claims came roughly in at 555k, down from 566k in the previous week, the lowest level post pandemic.

The data confirms the Fed’s more upbeat assessment on the US economy. The numbers are suggesting that the US economy is very much on the right path as the covid vaccine drive continues and the economy reopens.

Federal Reserve

Adding to the upbeat mood is a supportive Fed. The Fed, as expected, kept policy unchanged. The Fed reiterated its dovish stance, reassuring the market that any rise in inflation would be temporary. The Fed insisted that it was too early to talk about tapering even though it upgraded its outlook for the US economy. The US Dollar dropped as the likelihood that tapering is unlikely to materialize until 2022.

Biden

President Biden used his first joint address of Congress to set out his plans for a $1.8 trillion plan aimed towards education and childcare. The package, he proposed is to be part funded by tax hikes in wealthy Americans.

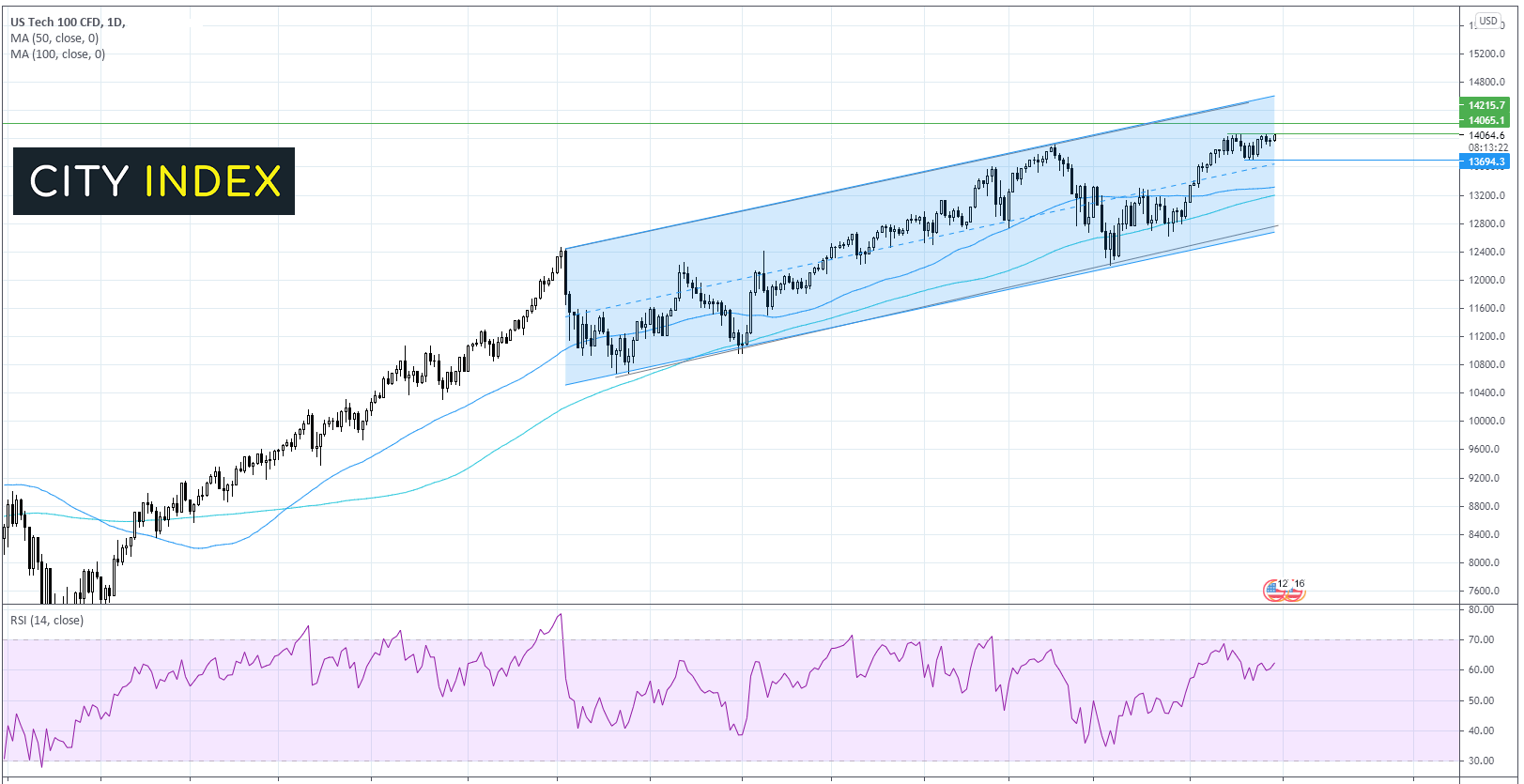

Where next for the Nasdaq?

The Nasdaq continues to struggle against tough resistance at 14070 the all time high. The RSI is keeping bulls hopeful. A move beyond this level could see the index power towards 14500 round number and the upper band of the 7 month ascending channel. Sellers would be looking for a move below 13300 the 50 DMA.

FX – US Dollar extends gains, EUR fall on weak German confidence data

The US Dollar is edging higher after a steep sell off in the previous session. The US Dollar index continues to struggle around its 9 week low after the dovish Fed.

EUR/USD trades in a muted fashion despite upbeat data. Eurozone economic sentiment shot higher in April to 110.3 points up from March’s 100.9. The data showed strength across the board, but particularly in the service sector which surprised with an 11.7 point jump. German inflation numbers also surprised to the upside +0.7% MoM and 2% YoY.

GBP/USD +0.1% at 1.3954

EUR/USD 0.05% at 1.2131

Oil surges high on improved demand prospects

Oil prices are rallying for a third straight day on fuel demand optimism, heading back towards March’s post pandemic highs. The oil market is looking past the ongoing covid crisis in India, the third largest importer of oil. Instead, the focus is on better than expected US crude inventory data and the ramping up of refining activity.

US crude inventories rose by 90,000 barrels last week, significantly better than the 659,000 barrel build forecast. Meanwhile distillate stockpiles, which include diesel fuel fell by 3.3 million barrels, whilst refining activity rose to 85.4% of capacity suggesting that fuel demand is rising.

US crude trades +1.4% at $64.73

Brent trades +1.4% at $67.77

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 Pending home sales

19:00 Fed Williams speech

02:00 China Non-Manufacturing PMI