US futures

Dow futures -0.01% at 36145

S&P futures +0.14% at 4660

Nasdaq futures +0.35% at 16192

In Europe

FTSE +0.53% at 7280

Dax +0.52% at 16031

Euro Stoxx +0.44% at 4328

This content will only appear on City Index websites!Learn more about trading indices

The Fed tapers without a tantrum

Continued accommodation from the Fed is like Christmas came early for the markets. The prospect of cheap money for longer as the Fed pushed back on interest rate hikes boosts stocks to fresh all-time highs.

As expected, the Fed announce the start of its tapering by $15 billion per month. However, the forward-looking market is already past that decision, instead focusing on what Powell had to say over inflation expectations and prospects of a rate hike.

Powell was clear that he won’t consider a rate hike until further recovery is seen in the US labour market, even though inflation could remain elevated for months. Employment is the Fed’s greater concern right now.

The meeting is being reflected in different ways in the stock market and the FX market. Whilst the USD dropped sharply post meeting it has rebounded firmly today. As the dust settles perhaps the Fed doesn’t seem that dovish compared to its peers, particularly in light of the BoE shock 7-2 vote. Meanwhile US stocks advanced yesterday and are set to extend those gains today thanks to the accommodative Fed.

Jobs will be back in focus ahead of tomorrows NFP. Jobless claims fell to a fresh post pandemic low of 269k, besting forecasts whilst labour unit costs surge.

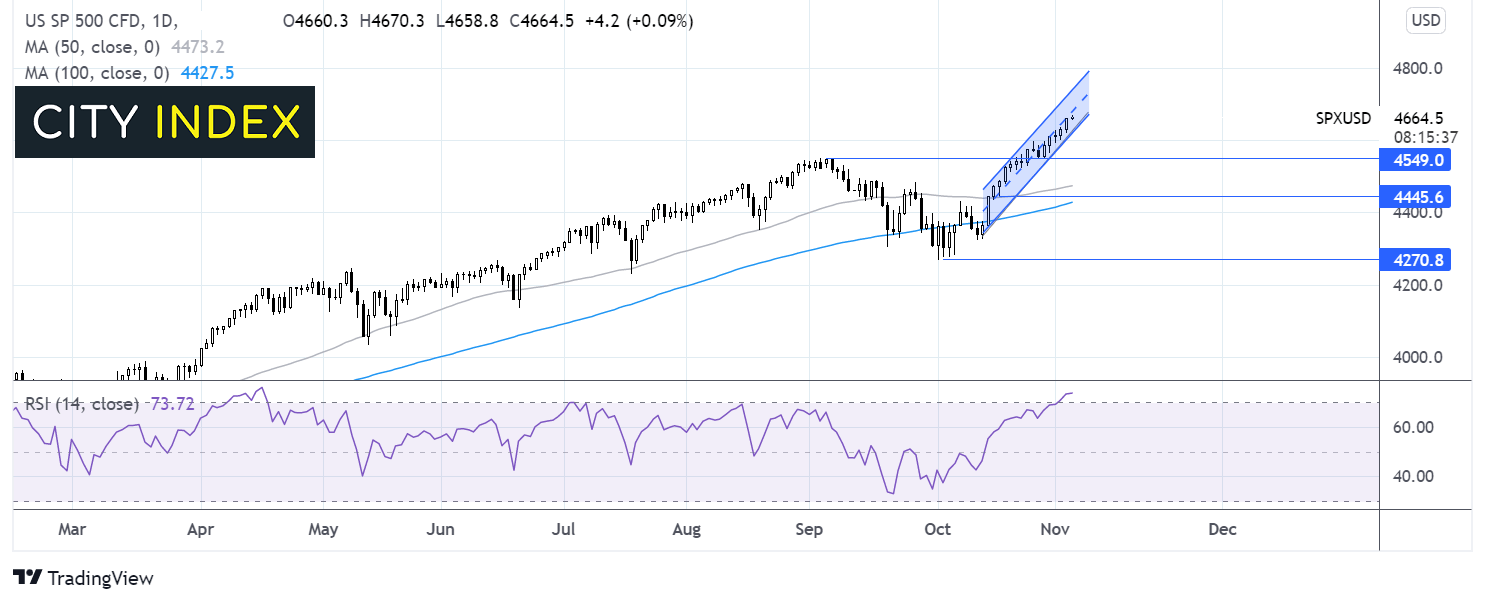

Where next for S&P 500?

The S&P continues to charge high with the futures reach a fresh all time high. It trades within a steep 3 week ascending channel. The RSI is in overbought territory so some consolidation or easing back in the share is expected. The price is also a good distance from the 50 sma. It would take a move below 4550 to negate the near term up trend.

This image will only appear on cityindex websites!

FX – USD rebounds GBP tanks as BoE stays pat

After an initial selloff following the Fed meeting US Dollar is rallying, recovering yesterday’s losses and more. The USD had concentrated on the Fed pushing back on a rate hike yesterday. However, today is a new day and the greenback is rising as the Fed doesn't look so dovish next to its major central bank peers.

GBP/USD is diving lower after the BoE voted 7-2 to keep interest unchanged. The market had expected the BoE to hike rates or at least for the vote to be significantly closer. Investors await the press conference shortly but it would appear that the market had gotten well ahead of itself.

This content will only appear on City Index websites!GBP/USD -0.85% at 1.3566

EUR/USD -0.48% at 1.1556

Oil rises ahead of OPEC+ meeting

Oil prices are rebounding more than 2% amid expectations that OPEC+ will stick to steady output increases despite call from leaders for further supply. OPEC+ appears to want to remain behind the demand curve for now and are hesitant about ramping up output.

So why aren’t OPEC going to increase output? There are growing concerns not just from OPEC but also IEA and EIA that supply will exceed demand next year if output is ramped up now. The organisations believe that the deepest oil draws are behind us a theory which is supported by recent stockpile data. There are real concerns that the current demand deficit turns into surplus next year.

WTI crude trades +1.85% at $81.63

Brent trades 2% at $83.36

This content will only appear on City Index websites!Learn more about trading oil here.

Looking ahead

N/A

This content will only appear on City Index websites!

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.