US futures

Dow futures +0.43% at 35965

S&P futures +0.8% at 4704

Nasdaq futures +0.93% at 16297

In Europe

FTSE +0.02% at 7321

Dax -0.01% at 15634

Euro Stoxx -0.08% at 4203

CPI hits 6.8%

US stocks are rising higher even as inflation surged. CPI data revealed that consumer prices rose 6.8% YoY inline with forecasts. On a monthly basis CPI rose 0.8%, this was ahead of the 0.7% forecast but down slightly from the 0.9%.

The inline year on year reading plus the slight move lower in the monthly read appears to have eased bets of a sooner rate rise by the Fed. That or the market had built itself up for a much higher reading. The initial reaction has seen the US Dollar fall and stocks rise with high growth tech stocks leading the charge; moves consistent with easing hawkish Fed expectations. However, the initial knee jerk reaction isn’t always the one that stays.

Looking ahead attention will now turn to the preliminary reading of Michigan consumer sentiment, which is expected to weaken in December to 67.1, from 67.4.

In corporate news:

Lululemon Athletica is likely to be under the spotlight after reporting a rising in annual sales but warned on a potential hit to demand from the new COVID variant. LULU trades -1.7% pre-market.

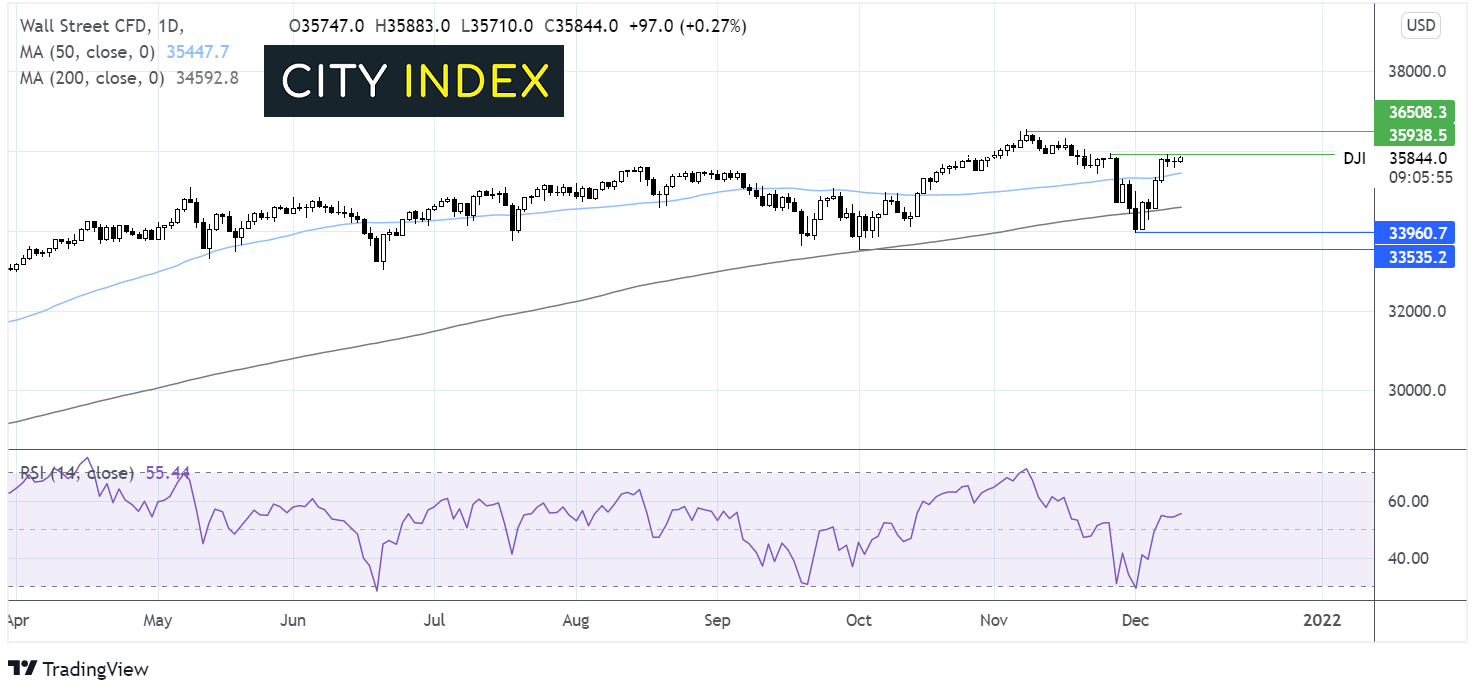

Where next for the Dow Jones?

The Dow is pushing higher trading above the 50sma but capped by 35950 the weekly high and the high November 25. Whilst the RSI is in bullish territory, buyers need to overcome this resistance level in order to look towards 36000. Meanwhile a break below support at 34600 the 50 sma could see the price head back towards the 200 sma at 34600.

FX – USD rises, GBP falls after GDP misses

The USD fell lower following the CPI release after a miss on the monthly print appeared to cool bets that the Fed would move faster to hike rates.

GBP/USD is falling after UK economic growth stumbled in October. The monthly GDP came in at -0.1%, down from 0.6% in September and below the 0.4% forecast. Given that’s the economy was slowing even before the latest COVID restrictions the outlook for the coming months is pretty bleak.

<aclass="add_entity_prefix" href="/forex-trading/gbp-usd/">GBP/USD -0.03% at 1.3218</aclass="add_entity_prefix">

EUR/USD -0.08% at 1.1283

Oil set for strong weekly gains

Oil prices are rising over 1% and is up 8% across the week putting it on track for its largest weekly gain since August, as concerns ease over Omicron and the impact that it could have on global growth.

Oil prices initially priced in a worse case scenario, taking 16%, before rebounding 8% after an encouraging report from Pfizer, that three shots of its COVIDA jab neutralizes Omicron. Even so, tighter travel restrictions and nerves surrounding the default of Evergrande in China are keeping gains capped.

WTI crude trades +1.2% at $71.59

Brent trades +1.05% at $75.08

Looking ahead

15:00 US Michigan confidence

19:00 US monthly budget statement

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.