US futures

Dow futures trade +0.3% at 31370

S&P futures +0.3% at 3918

In Europe

FTSE +0.05% at 6535

Dax -0.05% at 14003

Euro Stoxx +0.05% at 3662

Learn more about trading indices

Stimulus package details

The Biden administration’s planned covid stimulus plan remains very much in focus as Democrat lawmakers released additional details of the package. These include a $400 a week unemployment benefit which would continue until the end of August. If these plans get approved, it would be another step forward to Biden’s $1.9 trillion stimulus package being passed.

Oil continues to rise

The oil bulls keep pushing the price of oil higher, extending gains for an eighth consecutive day to a fresh 13 month high. US stimulus optimism, rapid vaccine rollouts lifting the demand outlook and OPEC+ keeping market conditions tight are helping to drive prices higher. Adding to the upbeat mood API inventory data revealed an unexpected drop in inventories of 3.5 million barrels, expectations had been for a 1 million increase. Attention will now turn to the EIA data later today.

US Crude trades +0.6% at $58.67

Brent futures trade +0.5% at $61.51

The complete guide to trading oil markets.

CPI data and Powell

US CPI inflation data for January is due at 13:30 UTC, expectations are for MoM +0.3% vs +0.4% in December. YoY Jan +1.5% vs 1.4% Dec. Expectations for Core CPI +0.2% MoM & +1.5% YoY.

Central bankers are under the spotlight. A speech by Federal Reserve Chair Jerome could provide clues over any update to his outlook. In light of a projected $1.9 trillion fiscal stimulus package making its way through Congress, Powell could adopt a more upbeat tone. However, after recently calming taper talk he is unlikely to talk it up today.

BoE Governor Andrew Bailey is also due to speak later today at 17:00 UTC.

US Dollar softens further

Massive fiscal stimulus optimism, a lower for longer stance from the Fed and growing prospects of a strong global economic recovery amid is hampering demand for the safe haven US Dollar with DXY trading at 2 week lows.

EUR/USD holds gains above 1.21 - Analyst Fiona Cincotta looks at the price action of EUR/USD and levels to watch here

GBP/USD hit multi year highs of 1.3856

Learn more about trading forex.

Stocks point higher earning to watch

Stocks are heading for a positive start owing to stimulus optimism, whilst the energy sector can expect another boost from stronger oil prices.

US corporate earnings calendar sees another busy session with figures expected from General Motors, Coca-Cola, CME Group and Under Armour. After the close UBER is due to report.

Read what to expect from UBER’s earning in Joshua Warner’s preview.

Twitter

Twitter impressed with quarterly sales and profits whilst also forecasting a strong start to 2021 as ad spending rebounded. The stock trades +4% pre-market even though it warned that user growth could slow to low double digits this year.

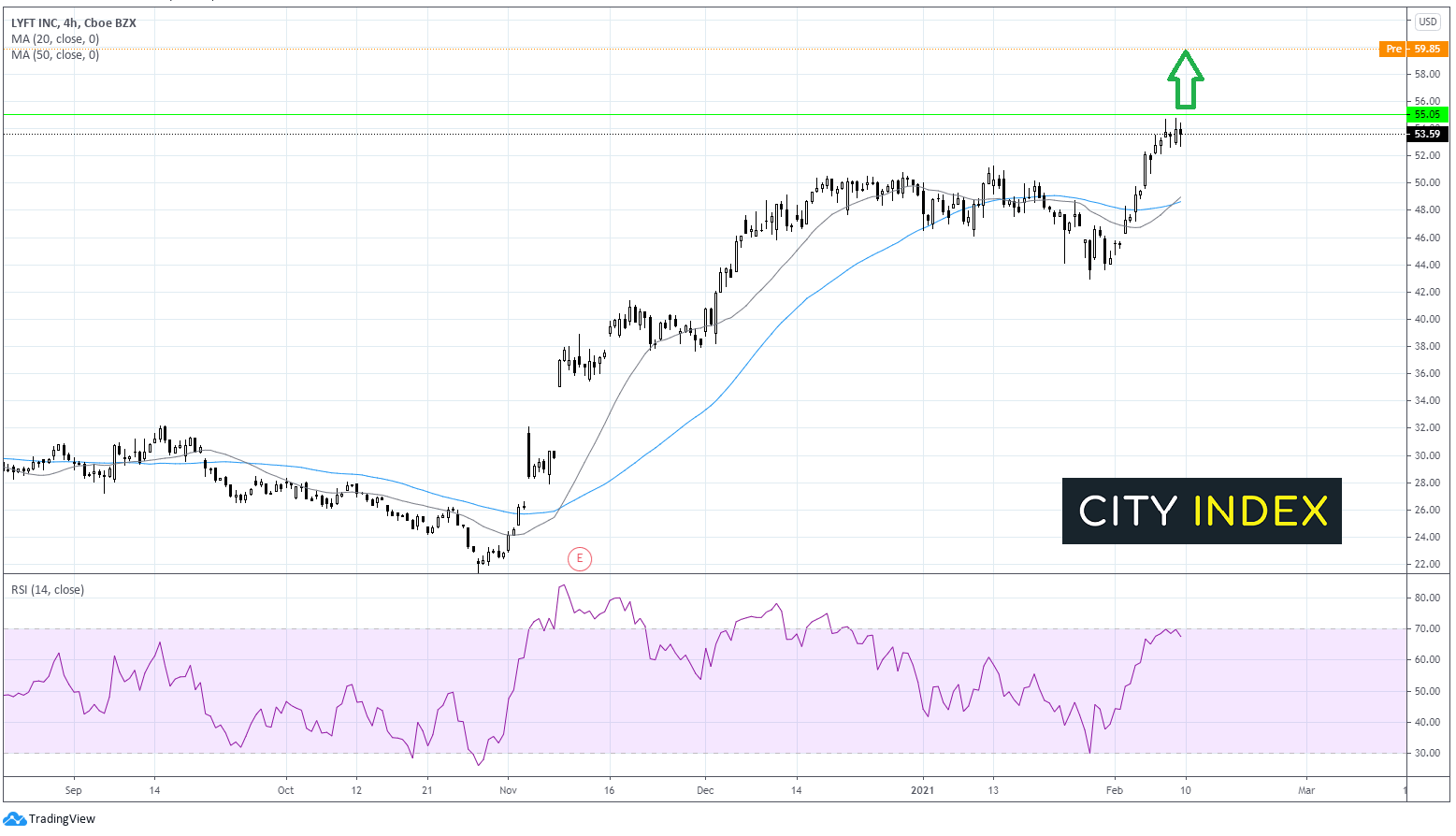

Lyft

Reported loss per share 58c vs 72c exp. on revenues $570 million vs $563 million.

Lyft rises 13% pre-market after beating expectations on Q4 revenue and loss per share suggesting it continues its recovery from the pandemic, although active rider numbers missed. According to the CEO Brian Roberts Lyft is still on track to become profitable by Q4 if not sooner.

Learn more about trading stocks