US futures

Dow futures +0.46% at 34000

S&P futures +0.25% at 4320

Nasdaq futures +0.2% at 14720

In Europe

FTSE -0.73% at 7047

Dax -0.5% at 15226

Euro Stoxx +0.01% at 4047

Learn more about trading indicesBargain hunters out in force

US stocks pointing higher as a slew of upbeat corporate updates help to calm investors nerves over rising inflation, slowing growth and the Fed tapering.

Bargain hunters are back on the scene for a second time this week after a combination of factors such as stagflation, the reining in of stimulus and setbacks for Biden’s spending plans sent stocks sharply lower on Thursday.

Its’ a bit of a relief to have September in the rear-view mirror. September is traditionally a poor month for equities and this September certainly didn’t disappoint there. US indices dropped sharply with the tech heavy Nasdaq taking the hardest hit as expectation rose that the Fed could move sooner to raise rates.

However, with many of the macro themes which have dragged on stocks set to rollover into October the outlook remains troubling.

Attention will now turn to US ISM manufacturing numbers along with Michigan consumer confidence.

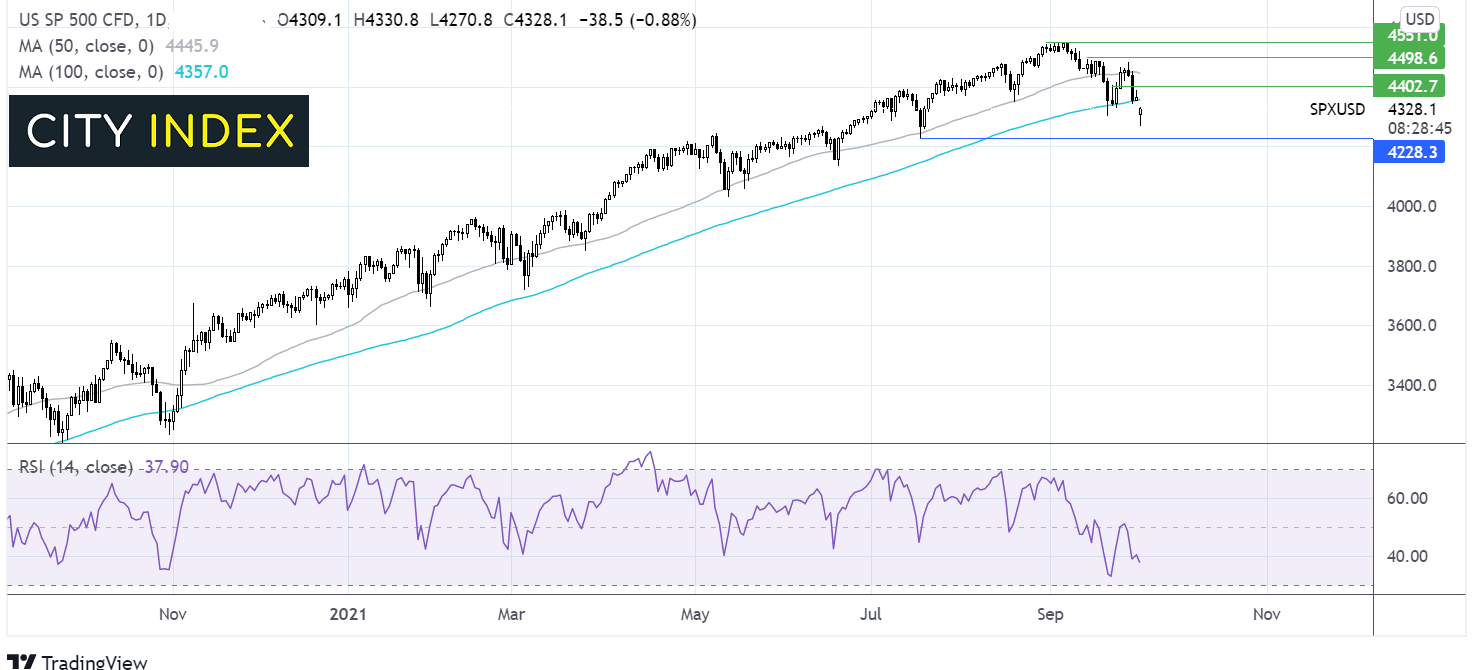

Where next for the S&P500?

The S&P 500 closed below its 100 sma for the first time since November. Whilst the RSI points to further losses, the hammer candlestick formation is keeping the buyers optimistic. Any meaningful recovery needs to retake 4350 in order to target 4400. On the downside the next key level can be seen at 4230 the July low ahead of 4200 round number.

FX – USD eases, UK Mfg PMI beats forecasts

The US Dollar is falling lower but is still set to book its strongest week of gains since June. The Greenback traced treasury yields higher amid expectations that the Fed could start tightening monetary policy sooner than its peers as inflation remains stubbornly high. Fed Chair Powell acknowledged that inflation could remain elevated for longer than the Fed anticipated.

GBP/USD The Pound is capitalizing on the weaker USD, extending its recovery from the recent 9-month lows, finding support from better than forecast manufacturing PMI data, which slowed by less than expected in September to 57.1, down from 60.3, but ahead of the 56.3 forecast.

GBP/USD +0.4% at 1.3540 EUR/USD +0.25% at 1.1606Oil falls on potential OPEC output increase

Oil lower on the day amid reports that OPCE+ producers could ramp up the planned increase in production in order to ease supply concerns. The OPEC+ group are to meet on Monday and could be considering a 400,000 barrels per day additional increase to supply each month.

Both benchmarks edged lower on the report. However, still continue to trade around recent highs and are set to book gains across the week, the sixth straight week of gains.

Demand is expected to outstrip supply by 1.5 million barrels per day for the next 6 months according to Citigroup, keeping prices buoyant. However, the stronger US Dollar has acted as a drag.

WTI crude trades -0.34% at $74.63

Brent trades -0.27% at $78.06

Learn more about trading oil here.

Looking ahead

14:45 Markit Manufacturing PMI

15:00 ISM Manufacturing

15:00 Michigan consumer confidence

18:00 ECB Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.