US futures

Dow futures +0.24% at 32340

S&P futures +0.6% at 4000

Nasdaq futures +0.90% at 11976

In Europe

FTSE +0.05% at 7576

Dax +0.5% at 14327

Euro Stoxx +0.76% at 3767

Learn more about trading indices

Has peak inflation passed?

US futures are trading higher following the release of PCE and personal income and spending data.

The data showed that PCE rose by less than expected in April at 6.3%, down from 6.6% in March and below forecasts of 6.6%.

Core PCE was in line with forecasts showing a slight cooling in inflation from 5.2% in March. However personal spending remained strong at 0.9%, down from 1.4% but above forecast of 0.7%.

The fact that consumers are still spending will bring comfort to the Federal Reserve. The data did nothing to change the outlook, instead confirmed that inflation is slowly, slowly falling but spending remains solid. There was nothing here to change the Fed from its course of two 50 basis point rate hikes, one in June and one in July.

Stocks have risen and the USD fallen across the week as the market pares back aggressive Fed bets thereafter. This data release suggests that the market was right. This could add to signs that peak inflation has passed, which would then give the markets reason to rally. Once peak inflation has been priced in that’s when we can expect a more sustained turnaround in the markets, rather than the flipflopping of later. The fact that the Nasdaq is leading the charge means pared back Fed bets are driving the market higher.

Attention will now turn to US consumer confidence data which is expected to hold stay in May at 59.1.

In corporate news:

Gap falls -19% pre-market after the clothing retailer slashed its full-year forecast, blaming decade-high inflation and weak demand. Morgan Stanley also downgraded the stock to underweight.

Dell Technologies is trading 9% high pre-market after revenue beat forecasts for a ninth straight quarter as companies invest heavily for hybrid working.

More insight on the stocks to watch pre-market

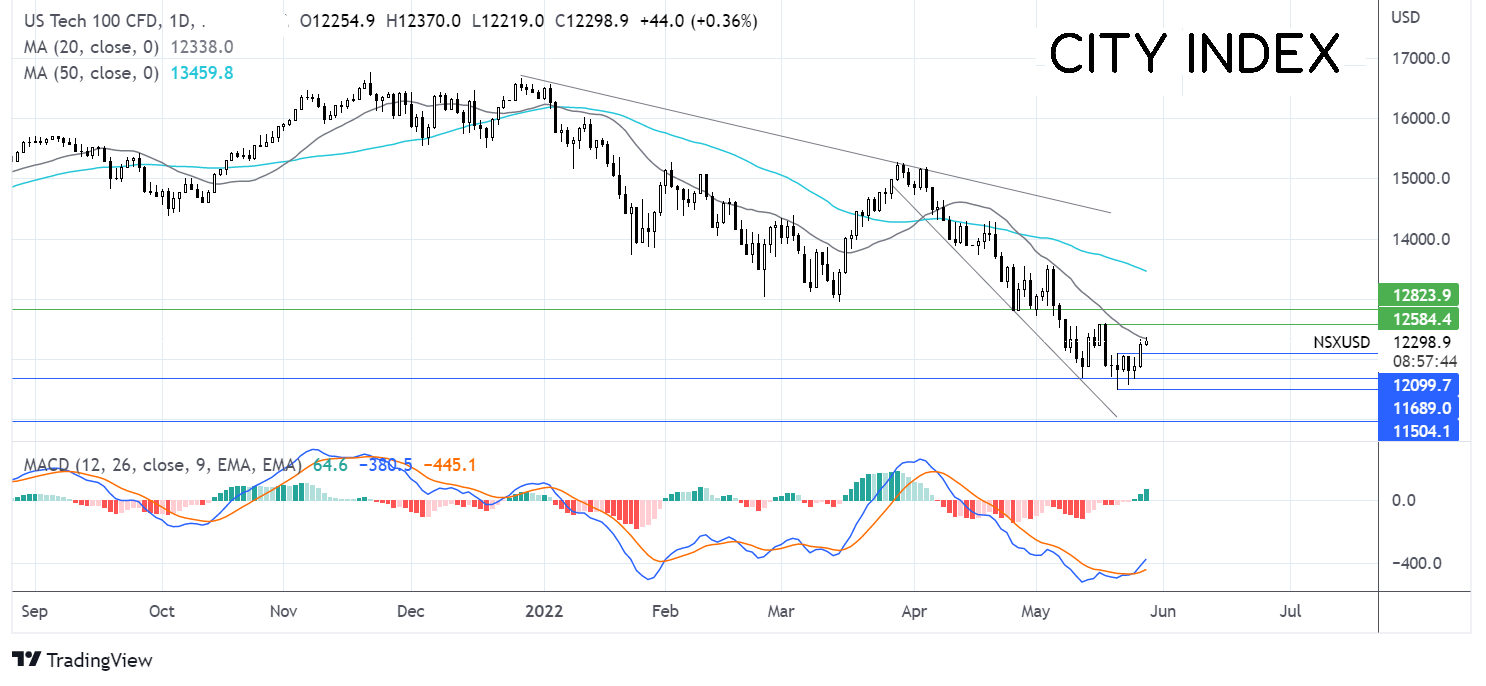

Where next for the Nasdaq?

The Nasdaq has been trading in a falling channel, capped on the upside by the 20 sma. The price fell to a 2022 low of 11490 and is rebounding. The recovery from the 11490 low is attempting to retake the 20 sma, which combined with a bullish MACD is keeping buyers hopeful of further upside. A rise above the 20 sma at 12337 could keep the bull trend intact towards 12575 the May 17 high towards 12800. Failure to retake the 20 sma could see the price slip towards 12100 the May 20 high, opening the door to 11700 the May 12 low.

FX markets – USD falls, GBP rises

USD is holding steady after the PCE inflation data, which

GBP/USD is edging higher as investors continue digesting the support package announced by finance minister Rishi Sunak yesterday. The £15 billion plus windfall tax from oil and gas companies is to help households pay energy bills which are expected to keep rising.

EUR/USD is edging lower but is set to rise 1.5% across the week, marking the second straight week of gains. EURUSD is on the rise after the ECB have adopted a more hawkish tone this week with the central bank expected to hike rates several times across the summer.

GBP/USD +0.14% at 1.2620

EUR/USD -0.12% at 1.0710

Oil edges higher

Oil prices are edging lower but are still set to gain across the week, after reaching a two-month high yesterday.

Tight supply has boosted the price across the week with the EU still expected to get the ban on Russian oil approved, with some saying early next week. Hungary has held up the approval process. Lifting the oil price yesterday were reports that OPEC+ increase output at the previously agreed rate of 432k, barrels, defying calls from the West to up production.

On the demand side, Shanghai is expected to reopen next week after two months in lockdown, which will improve the demand outlook. US driving season ramping up is another positive for demand.

WTI crude trades -0.6% at $110.50

Brent trades -0.47% at $112.04

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence

18:00 Baker Hughes rig count

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade