US futures

Dow futures -0.1% at 33786

S&P futures -0.3% at 4172

Nasdaq futures -0.2% at 13757

In Europe

FTSE +0.2% at 6872

Dax -0.01% at 15120

Euro Stoxx +0.3% at 3940

Learn more about trading indices

Wall Street remain cautious on covid concerns & Netflix disappoints

US futures are pointing to a flat start although steep losses in Netflix are set to pull the Nasdaq lower following its dramatic slowdown in subscriber growth.

With US earning picking up, broadly speaking results have been strong. However Netflix reported just 4 million new subscribers against 6 million forecast. The disappointment didn’t stop there after the streaming giant forecast just 1 million new subscribers for the current quarter. The reopening of economies is casting doubt over the growth narrative for the stay at home pandemic stocks.

A cautious tone to trading comes following yesterday’s steep selloff on rising covid concerns. With covid numbers rising 12% globally across the week it has become clear that the covid risk is still very much alive and kicking.

India saw a record 295,000 new cases whilst South America is also seeing numbers shoot higher. Japan, the world’s third largest economy is also considering lockdown. Travel restrictions and lockdowns will put the brakes on global growth.

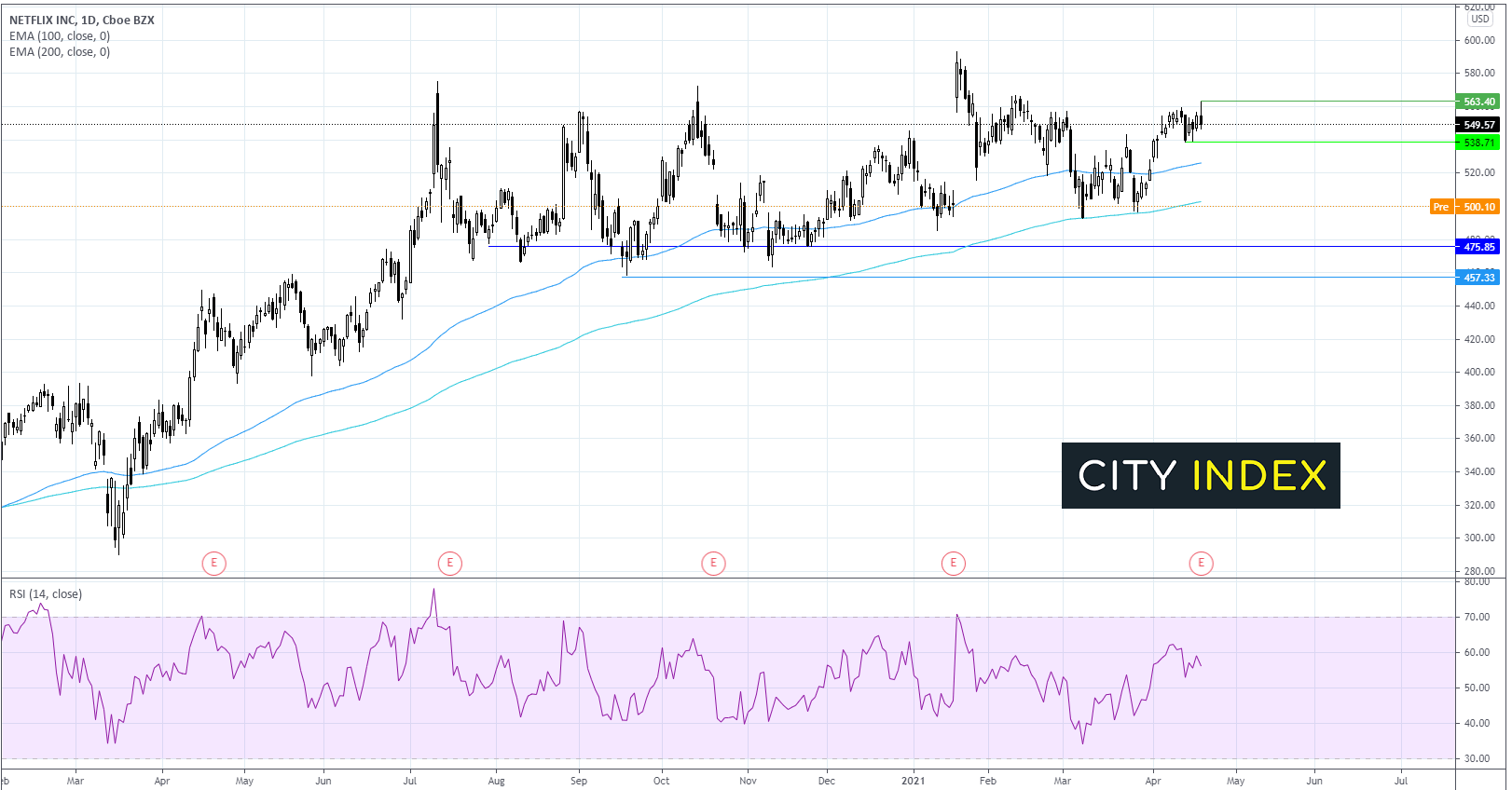

Where next for Netflix share price?

Netflix is set to open -8.4%, at around 503 just above the 500 round number, whilst find support at the 200 day EMA. This support level has held across March but that is not to say that it will continue holding.

A break through the 200 EMA could see the price slip to horizontal support at 475, a level which has offered support on several occasions across he past 9 months. Beyond here the September low of 457 could come into play.

Should the 200 EMA hold buyers could look to target the 100 EMA at 525 ahead of support turned resistance at 538.

FX – US Dollar traces treasury yields higher

US Dollar is rebounding as treasury yields tick higher, however in the grand scheme of things both remain depressed. The 10 year benchmark treasury yields continues below the key 1.60% level. The US Dollar continues to hover around 6 week lows.

With no high impacting US data due for release today, sentiment and yields are likely to direct the greenback in the US session.

GBPUSD trades under pressure after weaker than expected CPI data. Whilst inflation rebounded to 0.7% YoY in March, up from 0.4% in February. This was still short of the 0.8% forecast.

GBP/USD -0.13% at 1.3920

EUR/USD -0.25% at 1.2005

Oil extends losses

Oil prices are extending their sell off for a second straight session as several factors combine to hit demand.

Reports that the US House Judiciary Committee passed a bill that could leave OPEC vulnerable to antitrust lawsuits over production cuts sent prices tumbling yesterday. Price setting and limiting output would essentially become illegal. Whilst the news unnerved investors the reality is this is not the first time that a similar bill has been passed and it is unlikely to make it into law.

Covid cases in India continue to surge with lockdown restriction now stretching across many states. India is the third largest importer of oil so tightening restrictions there naturally raises question over the demand outlook.

API numbers revealed a unexpected build in inventories of 0.436 million barrels of oil. This was significantly up from a draw of 3.608 million the week before. The API stats don’t bode well for the official EIA inventory data due later today.

US crude trades -1.4% at $61.80

Brent trades -1.3% at $65.29

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 BoC interest rate decision

15:30 EIA crude oil inventories