US futures

Dow futures -0.3% at 32285

S&P futures -0.4% at 3873

Nasdaq futures -0.6% at 12735

In Europe

FTSE -1.1% at 6638

Dax -1% at 14475

Euro Stoxx -1% at 3790

Learn more about trading indices

Suez remains blocked

Traffic along the Suez Canal has been suspended amid efforts to dislodge the container vessel which became wedged three days ago. Reports that it could take even weeks to remove the vessel which run aground are unnerving investors. This is a key trade route, seeing 12% of the global traded goods travel along it each day.

Oil prices jumped 6% yesterday on the back of the blockage news today oil prices have plunged 3%. The Canal is an important passage for crude oil from the Persian Gulf to Europe and the US east coast as well as oil being transported from Russia to Asia.

Stocks point lower in risk off trade

US stocks are pointing to a lower open in risk off trade as investors digest the latest developments surrounding the Suez Canal. Energy stocks are under pressure in Europe and are expected to come under pressure in the US session.

Stocks in focus

AstraZeneca ADR – trades -0.2% after stating that its covid vaccine was 76% effective, rather than the 79%. The update came after the firm was criticized earlier in the week for using outdated data.

Nike – trades -4.6% pre-market as the company, along with other Western companies came under pressure in China after historical comments expressing concern over labour conditions in Xinjiang were brought to light again by Chinese media.

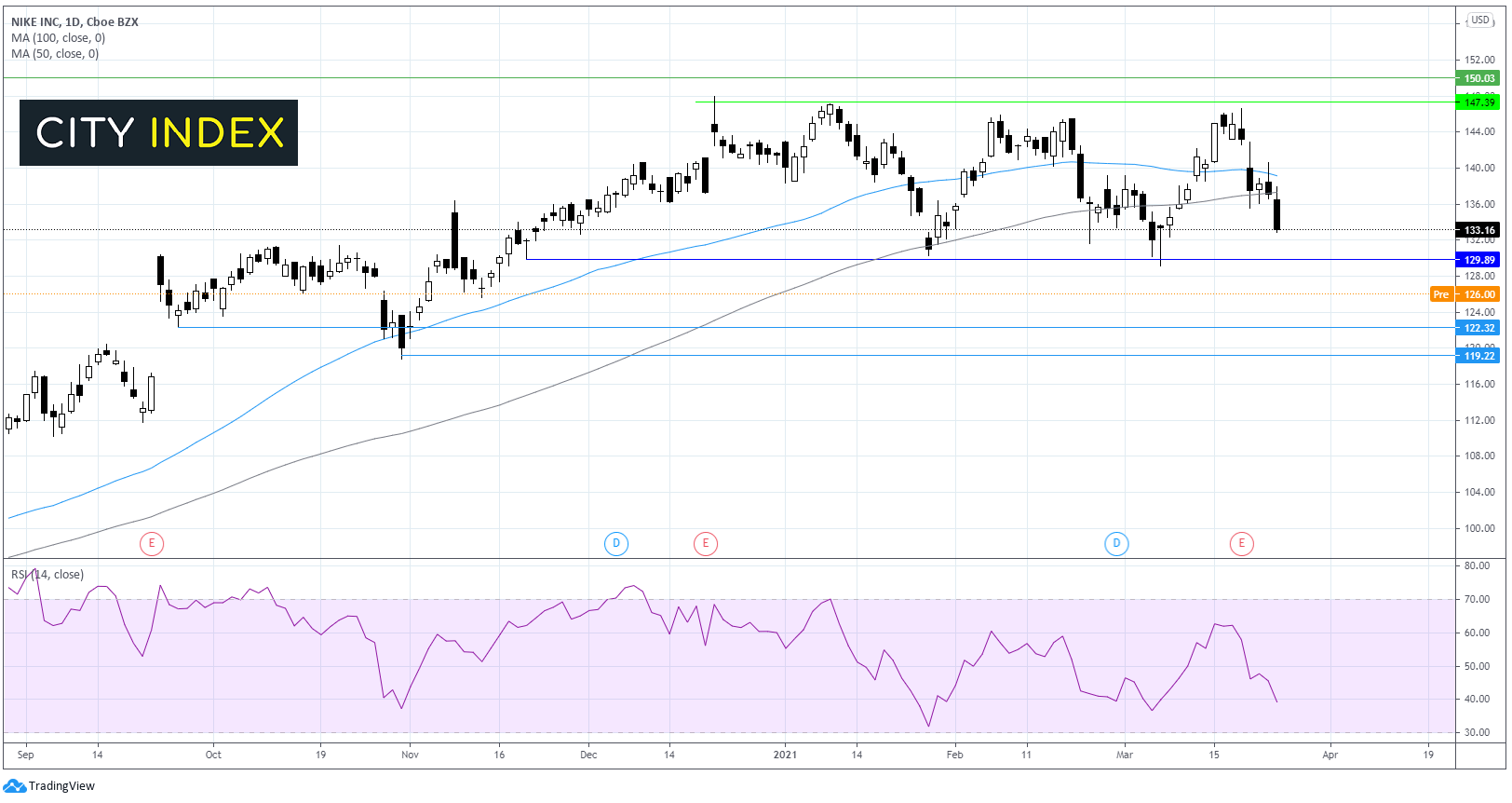

Where next for Nike share price?

After a strong run up from its mid -March lows Nike has been relatively range bound since the start of the year.

The share price has traded within a $20 range, capped on the upside by 147.00 and on the lower band by 130.00.

Stock is expected to drop some 4% on the open breaking it out of the lower band of the horizontal channel.

The RSI is supportive of further downside whilst it sits in bearish territory but not yet oversold.

Support can be seen 122.00 September 25 low, ahead of 120.00 October low. Any recovery would need to climb back over 130.00 in order to gain momentum back towards the 50 sma at 137.00.

US data mixed

US jobless claims rose by 684k down almost 100k from last week’s 770k, and well ahead of the 730k forecast. This is the lowest level that initial claims have been since the start of the pandemic, as the recovery gains momentum.

US Q4 GDP final print beat previous estimates at 4.3% annualised, up from 4.1%.

PCE the Fed’s preferred inflation gauge missed forecasts at 1.5% vs 1.6% expected.

The data comes following a positive assessment of the US economic outlook by Federal Reserve Chair Jerome Powell & US Treasury Secretary Janet Yellen in their second day of testifying before Congress.

Both Powell & Yellen expect strong growth this year thanks to supportive monetary policy and amply fiscal stimulus.

These comments come even before the US government looks to upgrade infrastructure with an eye watering $4 trillion.

FX – US Dollar trades at 4 month highs

The US Dollar is advancing following Fed Powell & Janet Yellen’s upbeat outlook for the US economic recovery and amid safe haven flows over growing concerns regarding the Suez Canal blockage.

EUR/USD – the pair remains depressed trading at multi-month lows as covid concerns and vaccine troubles hits demand for the common currency. Euro traders have shrugged off recent upbeat data. Yesterday PMI data showed business activity moved back into expansion. Today’s GFK German consumer confidence index rose to -6.2, up from -12.7 in March.

Investors will now look ahead to the release Fed speakers Clarida & Williams later today.

GBP/USD +0.2% at 1.3719

EUR/USD trades -0.1% at 1.1809

Oil drops on Suez block and covid fears

Oil trades on the back foot as concerns over a resurgence of covid overshadows combined with the blockage of the Suez Canal sent prices tumbling.

Rising covid cases in Europe resulted in Germany, France, Italy and the Netherlands tightening lockdown restrictions. However, key developing markets such as India and Brazil are also seeing covid cases surge and lockdown restrictions being imposed. Investors are growing increasingly jittery over the impact that such restrictions will have on demand.

US crude trades -2.8% at $59.37

Brent trades -2.6% at $62.58

Learn more about trading oil here.

The complete guide to trading oil markets

Market analyst Fiona Cincotta looks at the price action of oil here and levels to watch here

Looking ahead

14:10 Fed Clarida speaks

14:30 Fed Williams speaks