US futures

Dow futures -1.2% at 34940

S&P futures -1.2% at 4560

Nasdaq futures -1.4% at 15216

In Europe

FTSE -1% at 7194

Dax -2% at 15228

Euro Stoxx -1.3% at 4103

Learn more about trading indices

Risk off and low volumes send stocks sharply lower

US stocks are pointing a steeply lower open as Omicron concerns and questions over the Biden administration’s $1.75 trillion spending bill hit risk sentiment.

US stocks are set to following European bourses into the red as the rapid spread of Omicron and resultant COVID restrictions are likely to hurt global growth, at least in the first quarter of 2022. Cases are so high in Europe it is more a question of when lockdown restrictions will be imposed rather than if.

Separately, US Senator Joe Manchin, who is considered a key vote for the Biden investment bill pulled his support over the weekend, citing inflation concerns. Without his vote, there are doubts as to whether the Build Back Better spending bill can be passed.

Oil prices are trading over 3% lower which will see energy stocks trade under pressure.

Also, its worth keeping in mind that we are seeing thin pre-Christmas trading. Low liquidity can mean big swings in the market.

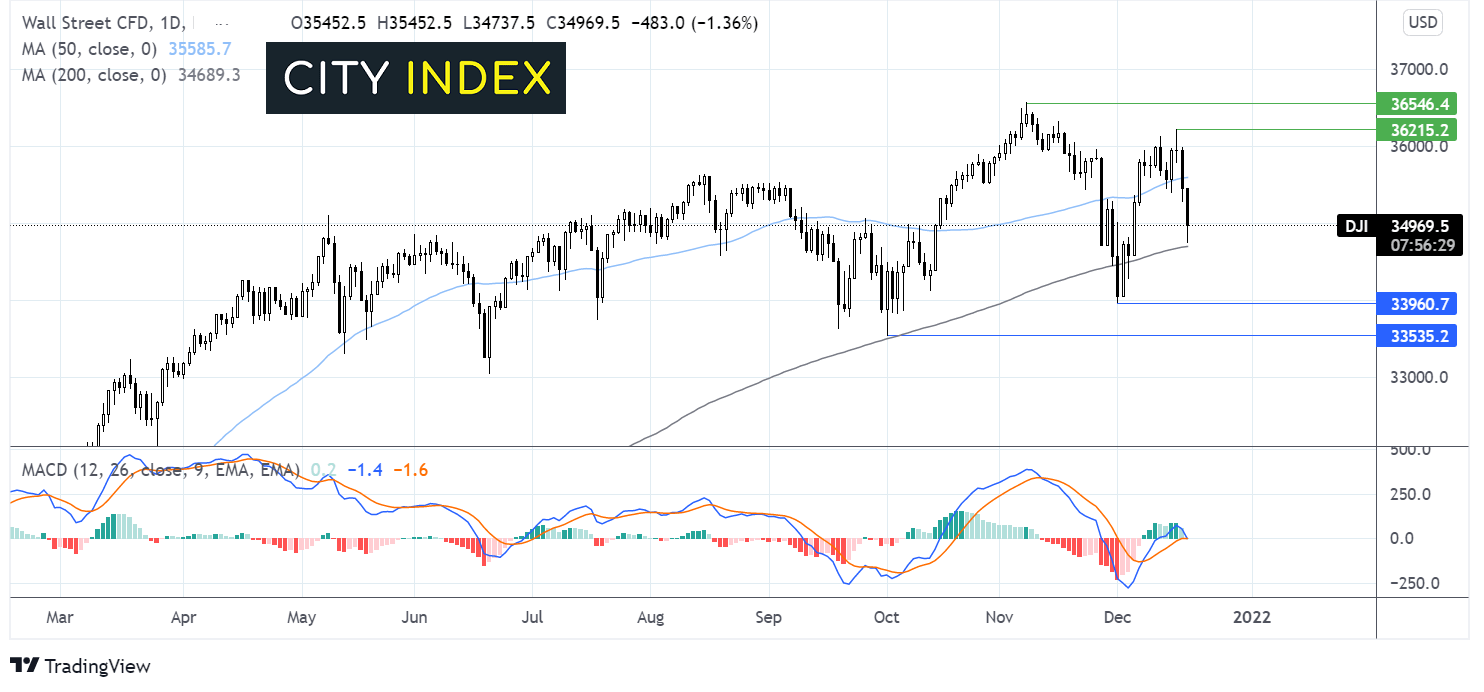

Where next for the Dow Jones?

The Dow Jones fell below 35000 before finding support at the 200 sna at 34700. It has picked up off session lows, although remains deeply depressed. The bearish crossover on the MACD suggests that here could be more downside to come. Sellers could look for a move below the 200 sma at 34700 for further losses towards 33960 the December low. Meanwhile buyers could look for a move over the 50 sma at 35500 and last week’s high at 36200 to target 36500 and fresh all time highs.

FX – USD falls, EUR takes advantage

The USD is falling lower on Monday after strong gains last week. Doubts over the BBB spending bill plus fears over Omicron holding back the Fed are hurting demand for the greenback.

EUR/USD is rising higher taking advantage of the weaker USD and showing resilience even COVID cases rise in Europe and restrictions tighten. Questions over the Fed’s ability to hike rates so quickly means less of a divergence with ECB monetary policy.

GBP/USD -0.01% at 1.3237

EUR/USD +0.44% at 1.1285

Oil tanks on Omicron fears

Oil prices are trading sharply lower, extending losses from the previous week. Surging Omicron cases and tighter COVID restrictions are clouding the oil demand outlook.

The Netherlands went into lockdown over the weekend and parts off Europe are seeing restrictions tighten. Fears of more mobility restrictions and international travel bans are pulling oil prices lower.

Separately, energy companies added oil rigs for a second straight week, with the rig count increasing by 3 to 579.

WTI crude trades -4.3% at $67.69

Brent trades -3.6% at $70.80

Looking ahead

20:00 AUS Westpac Consumer Survey

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.