US futures

Dow futures +0.5% at 34050

S&P futures +0.5% at 4263

Nasdaq futures +0.64% at 14363

In Europe

FTSE +0.4% at 7114

Dax +0.4% at 15560

Euro Stoxx +1% at 4115

Learn more about trading indices

Stocks pare yesterday's losses

Optimism over the economic recovery is once again driving stocks higher on Thursday, paring some weakness in the previous session. The markets are choosing to ignore the Fed’s mixed messages on inflation and policy outlook, instead focusing on data.

Jobless claims fell slightly to 411k

Initial jobless claim resumed the downtrend after the number of Americans filing for unemployment benefit increased last week for the first time since April. Initial jobless claim fell to 411k, down from 418k the previous week but still short of the 380k forecast.

The data shows that the labour market recovery still has a way to go. Given the Fed’s focus on the labour market, this data supports a slower move towards tightening policy, reflected by the falling US Dollar and cheering equities.

US durable goods came in below forecasts 2.3% MoM in May vs 2.7% forecast.

Fed speakers keep on coming

Two Fed speakers on Wednesday gave a more hawkish take on the inflation outlook, considering a rate hike in 2022. This comes after Fed Chair Powell earlier this week once again reassured that inflation was transitory and the Fed was in no rush to tighten policy. More Fed speakers are on tap later today to explain their thinking and possibly add more clarity or confusion to the picture.

Banks stress test results

Looking ahead the US banks’ stress test results will be released. The results could allow banks to restart stocks buybacks and dividends, which were halted across the pandemic. Keep an eye on the big banks such as Citigroup, JP Morgan, Goldman Sachs and Wells Fargo which could increase payouts to $130 billion over the coming year.

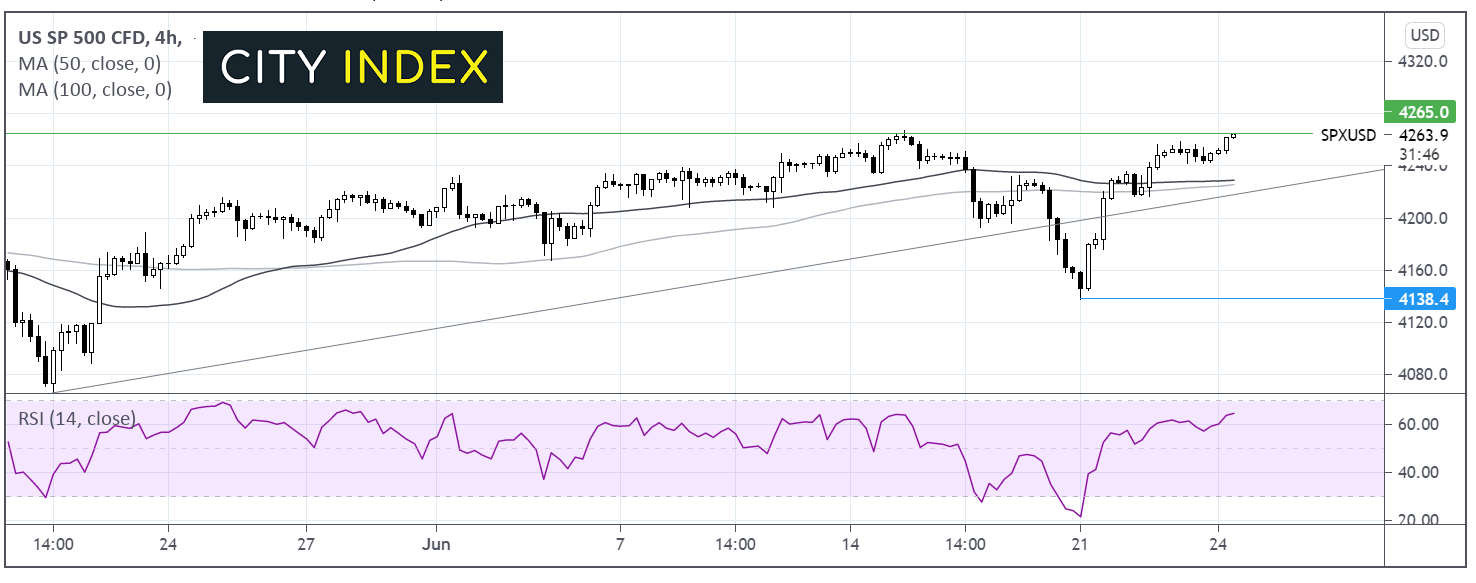

Where next for the S&P500?

The S&P 500 is powering higher attempting to break out to fresh all time highs. The S&P trades above its multi-month ascending trendline, above its 50 & 100 sma on the 4 hour chart. The RSI is supportive of further gains whilst it remains out of overbought territory. It would take a move below 4425/30 the 50 &100sma to negate the near term uptrend.

FX – USD struggles for direction, GBP falls on BoE

The US Dollar is edging lower after mild gains in the previous session. The Fed’s mixed messages surrounding inflation and monetary policy outlook has left the greenback struggling for direction.

GBP/USD – the Pound has fallen sharply after the BoE disappointed by voting 8 – 1, like in May, to keep QE unchanged. Investors had been hoping that with inflation above the central bank’s 2% target, the split could change. The BoE’s statement was a little more upbeat than expected, however, crucially it offered no clues on the timing of an interest rate hike, sending the Pound lower.

GBP/USD -0.37% at 1.3913

EUR/USD +0.11% at 1.1940

Oil pauses for breath in ongoing rally

Oil prices are easing back marginally after reaching fresh two-year highs in the previous session. Oil surged higher again as rising demand drains oil stockpiles. EIA data revealed a larger than expected draw in US inventories. Stockpiles fell by -7.6 million barrels, almost double the 3.9 million decline forecast. This comes following a -7.3 million barrel draw last week and marks the 5th straight week of inventory falling.

Demand is ramping up from the US, China and Europe as the economies reopen and fuel demand rises. Currently demand is outstripping supply.

OPEC+ will meet next week and are likely to address the current supply demand equation. It highly likely that several OPEC+ countries will vote to increase output going forward, which could put the brakes on this current rally.

US crude trades -0.17% at $72.87

Brent trades -0.14% at $74.48

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

16:00 US Fed Williams speaks

21:30 US Banks stress test results

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.