US futures

Dow futures +0.03% at 33684

S&P futures +0.05% at 4143

Nasdaq futures +0.25% at 14028

In Europe

FTSE +0.2% at 6914

Dax -0.2% at 15211

Euro Stoxx +0.1% at 3972

Learn more about trading indices

US stocks set for mild gains on the open

US futures are pointing marginally higher in cautious trade as US earning season begins and after a mixed session on Tuesday.

A less than expected CPI overshoot on Tuesday helped calm concerns over the inflation outlook. US CPI MoM came in 0.1% above forecasts, with investors assuming that it was an insufficient beat to prompt the Fed to adjust its supportive stance.

Treasury yields fell to a low of 1.61% supporting demand for tech stocks. Treasury yields have risen slightly so far this morning but remain depressed at 1.63% well fort of the yearly highs of 1.71% seen in March.

Attention today will be firmly on the start of earnings season with US banks kicking off. JP Morgan started the ball rolling with blowout numbers ion both revenue earnings.

Its worth keeping in mind that US banks have firmly outperformed the broader market across this year so far, so strong results could be a case for buy the rumor sell the fact. Morgan Stanley is trading -0.5% lower pre-market. Goldman Sachs and Wells Fargo & Co are also due to release earnings before the open

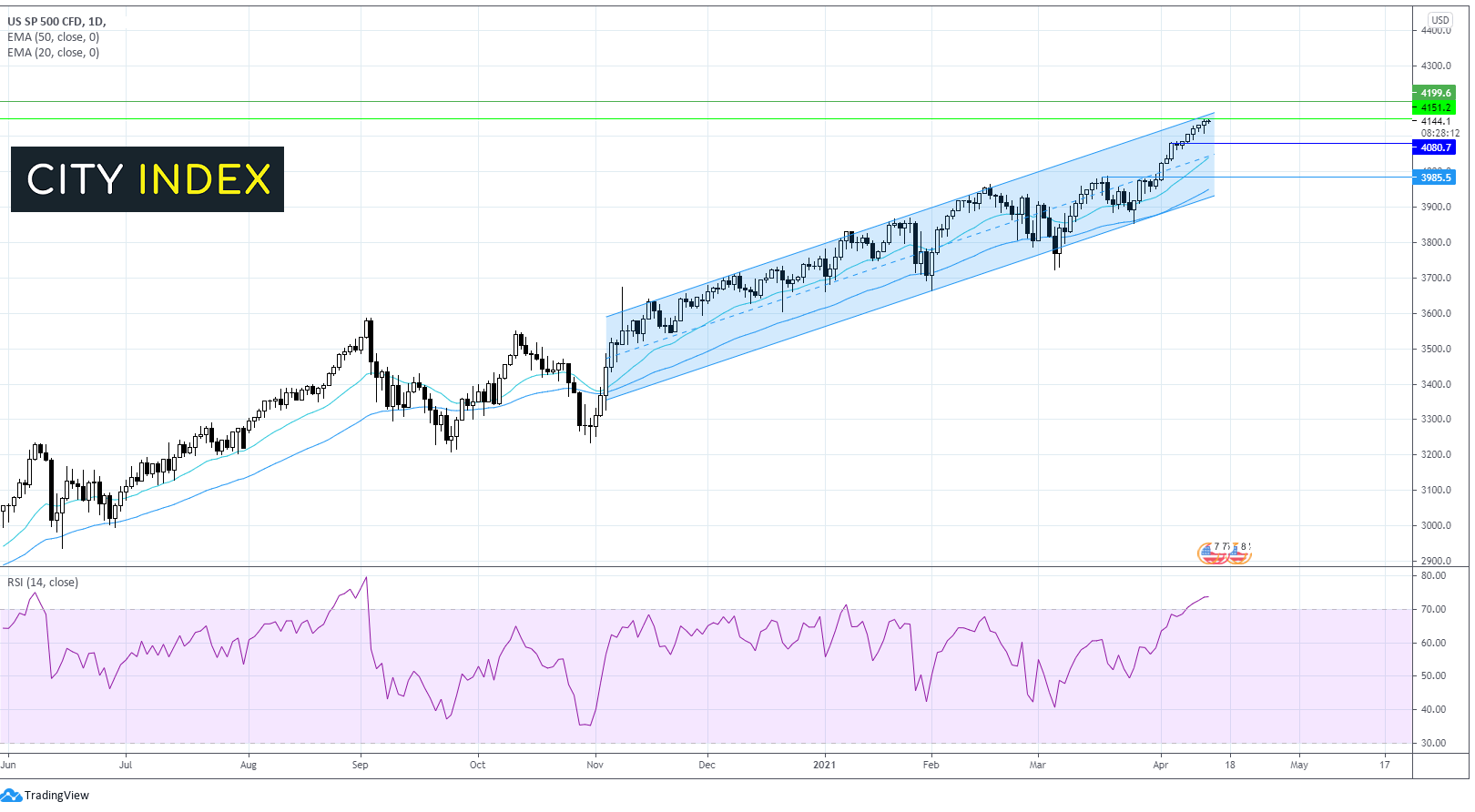

Where next for the S&P?

The S&P 500 is wobbling around record highs of 4150 ahead of the open, it trades at the upper end of the 5 month ascending channel.

There are a couple of warning signs flashing as the index points towards resistance at 4200. Outright volume is not confirming the new highs, instead showing a bearish divergence. The RSI is also firmly in overbought territory.

A pullback could well be on the cards ion the coming sessions before the index continues to trend higher towards 4300.

Support can be seen at 4080 horizontal resistance turned support before 4030 the 20 EMA. A break below this level could indicate the start of a correction phase.

Coinbase IPO

Coinbase goes public today as Bitcoin and Dogecoin hit fresh all time highs.

For more details on the IPO click here

FX – US Dollar traces treasury yields lower.

The US Dollar is edging lower for a third straight session amid easing inflation expectations, lower yields and a slower vaccine rollout on the J&J shock news yesterday.

Currencies in Europe are failing to capitalise on the weaker US Dollar with both the Pound and the Euro only trading marginally higher.

AUD/USD is outperforming thanks to a jump in consumer morale. Australia’s Westpac consumer confidence index jumped to 6.2% in April, an 11 year high. This was a sharp rise from March’s 2.6% reading.

AUD/USD +0.6% at 0.7685

GBP/USD +0.06% at 1.3756

EUR/USD +0.08% at 1.1958

Oil rises and OPEC & EIA raise demand outlook

Oil is trading higher after breaking out of the tight range within which it had been trading over the past week.

Better than expected API inventory data and an upwardly revised OPEC demand outlook is helping lift the black gold ahead of EIA stockpile data later.

Yesterday’s API data revealed a larger than expected draw of 3.6 million barrels in the week April 9.

An upward revision to OPEC’s and EIA’s forecast for global oil demand is also lifting oil prices. Growth in 2021 to 5.95 million barrels per day is now expected. This is up from 5.89 million barrels per day previously expected. The upward revision comes ahead of OPEC’s expected increase to output levels which is due in May and which could keep gains in oil capped going forwards.

US crude trades +1.7% at $61.25

Brent trades +1.7% at $64.54

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:30 EIA Crude oil inventories

16:00 Fed Chair Powell speaks