US futures

Dow futures -0.5% at 34595

S&P futures -0.9% at 4151

Nasdaq futures -1.7% at 13138

In Europe

FTSE -2.5% at 6947

Dax -2.4 at 15038

Euro Stoxx -2.4% at 3932

Learn more about trading indices

Inflation fears hit stocks

The selloff in tech is set to continue following on from weakness in Asia and Europe. Inflation concerns drove a rotation out of high growth tech stocks in the previous session and that is showing no signs of easing up.

Chinese PPI data overnight spooked the markets further as factory gate inflation came in ahead of forecasts at 6.8% year on year, the fastest rise since 2017.

The data comes ahead of tomorrow’s US CPI. Whilst the Fed have insisted that they view rising inflation as transitory, surging commodity prices are making the market question such a position.

There are several Fed speakers who could calm market nerves still ahead of tomorrow’s CPI release.

Tech sell off continues

The Nasdaq fell -2.5% in the previous session and looks set to under perform again with the futures pointing to a an additional -1.7% decline of the open. Rising inflation concerns are feeding the rotation out of growth into value. The Dow futures are heading for a milder 0.4% loss. However, there could be more to this move. The tech stock are sitting a lofty valuations and also look vulnerable to regulatory risk going forwards. Yesterday Citi downgraded both Facebook & Amazon to neutral from buy.

Jolts job openings

Just days after the shocking weak non-farm payroll report, JOLTS jobs openings are expected to show 7.5 million vacancies, almost at the record high seen in 2019. This highlights the discord in the jobs market amid a mismatch of skills and openings or availability and openings.

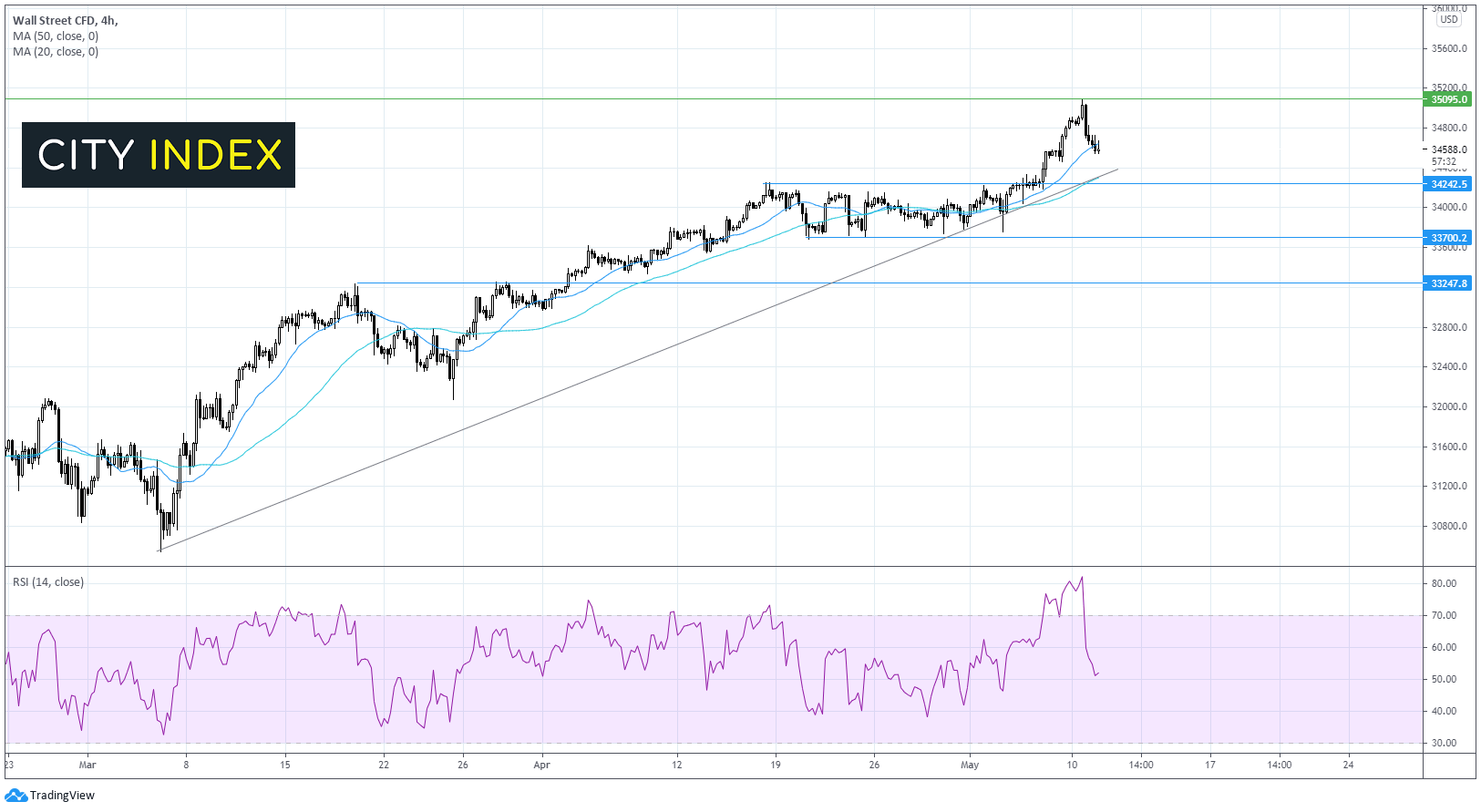

Where next for the Dow Jones?

The Dow futures are heading lower, extending losses from the previous session, edging away from the recently hit all time high over 35000. The Dow still trades above its 50 sma and its multi-month ascending trendline and is testing its 20 sma at 34600. The move lower has bought the RSI out of overbought territory. The uptrend remains intact whilst the price holds above 34250. A move below 37000 could see the sellers gain traction for a deeper selloff towards 33250. On the upside a break above 35000 could see new all time highs reached.

FX – Eur rises on improving German economic sentiment

The US Dollar is trading lower despite rising inflation concerns.

EUR/USD outperforms in the G10 space amid upbeat German ZEW Economic Sentiment gauge. The index jumped to 84 in May, up from 70.7 in April and well ahead of the 71 forecast. The improved outlook comes as the vaccination programme ramps up in the country and as covid cases are falling. Roughly 30% of EU residents have had a least one jab.

GBP/USD +0.18% at 1.4145

EUR/USD +0.31% at 1.2167

Oil falls as pipeline operations to return, India's covid crisis hits demand

Oil is trading lower amid the realization that the Colonial Pipeline disruption will most likely be a temporary knock to operations. Expectations are for operations to start ramping up today and full scale operation be in place by the end of the week.

The ongoing covid crisis in India is adding pressure to the price of oil. Indian oil refiners are cutting output and crude oil imports as surging covid cases have resulted in a drop in fuel consumption. Given that India is the third largest importer of oil this is unnerving the oil market.

Looking ahead, crude oil inventory data is expected to be more supportive of oil prices with a further 2.3 million barrel draw expected following an 8 million draw the previous wee.

US crude trades -0.9% at $64.35

Brent trades -0.8% at $67.67

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 JOLTS Job Openings

15:30 Fed Williams speaks

15:30 BoE Governor Bailey speaks