US futures

Dow futures -0.5% at 34228

S&P futures -0.4% at 4150

Nasdaq futures -0.5% at 13322

In Europe

FTSE -0.6% at 7004

Dax -0.27% at 15373

Euro Stoxx -0.4% at 4000

Learn more about trading indices

Stocks set to decline

US stocks are pointing to a softer start, paring some of the gains from Friday.

The softer risk tone to the market comes after data overnight from China showed that the recovery in the world’s second largest economy is slowing and as investors look ahead to the release of the minutes to the latest Fed meeting.

Chinese industrial production slowed to 9.8% growth YoY in April down from 14.1% in March. Meanwhile retail sales rose 17.7%, down from a 34.2% jump in March missing forecasts of 24.9%. The data highlights the uneven nature of the recovery from the pandemic.

Last week inflation concerns dominated after US CPI surged to a 13 week high and investors fretted over the Fed tightening policy sooner. Fed speakers will be in focus today, particularly following the strong CPI data, but weak retail sales. The minutes to the FOMC meeting are due on Wednesday. Whilst the market will scrutinize the minutes for clues of the next move by the Fed, it is worth keeping in mind that they are pretty out of date given the weak NFP & strong CPI a data since the meeting.

Stocks

Around 90% of the S&P500 have already reported, so things are slowing up on the earnings from considerably.

Discovery (trading +13% pre-market) and AT&T will be in focus after announcing that its content unit WarnerMedia will merge with the factual television company creating a new company values at $150 billion, according to the Financial Times.

Musk sends cryptos lower

Elon Musk rattled cryptoland by hinting on Twitter that Tesla could sell some of its Bitcoin holdings. Eon Musk also re-iterated his concerns over the environmental impact of mining cryptos. Bitcoin has dropped around 20% over the past 2 months, highlighting its volatile nature.

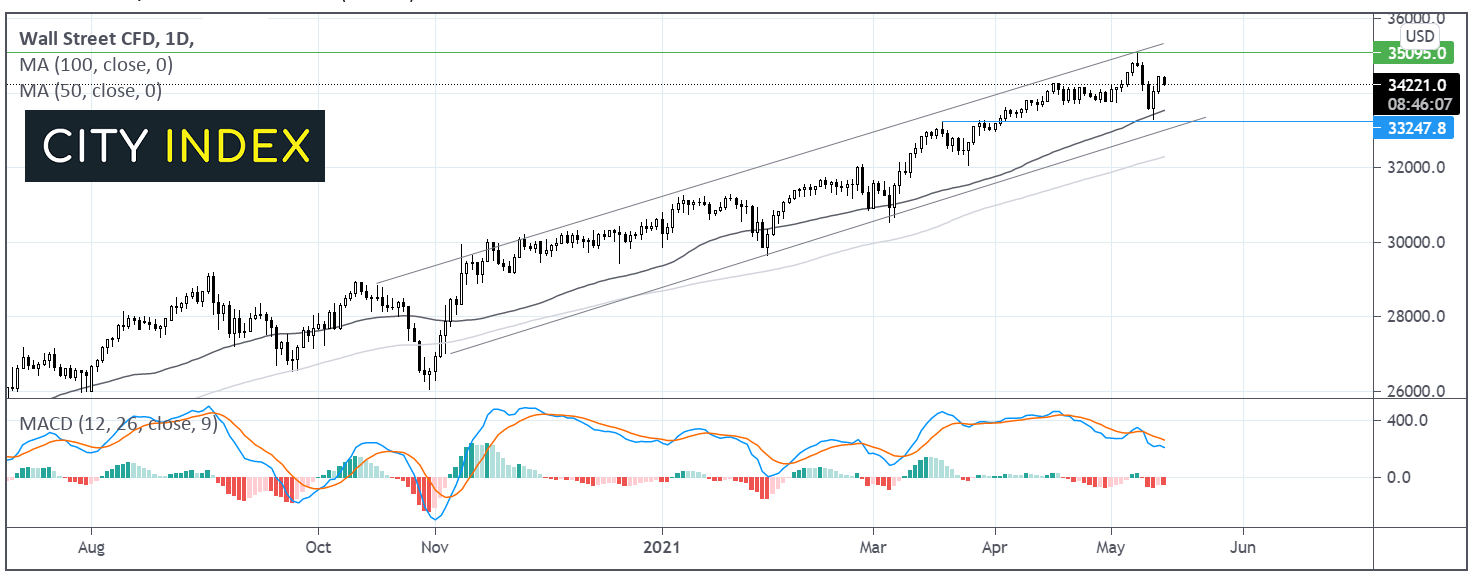

Where next for the Dow Jones?

After hitting 3500 in the previous week, the Dow slipped back to its 50 day ma where it found support sand rebounded. The Dow continues to trade within its ascending channel which dates back to early November, so the established uptrend remains intact. The MACD formed a bearish crossover and is trending southwards suggesting that the upward momentum is fading. The dow futures currently trade -0.6%.

FX – USD weakens, GBP holds gains as more restrictions are eased

The US Dollar is edging mildly lower, extending Friday’s sell off. Weaker than expected US retail sales will make it easier for the Fed to defend its accommodative position. Fed speakers will be in focus today, particularly in light of last week’s strong inflation print.

GBP/USD is holding gains as the UK economy reopens. Pubs, restaurants, and bars have reopened to inside trade (luckily given the awful weather!). However, there are growing concerns that the India variant of covid, which is starting to spread rapidly in parts of the UK, could delay the final reopening in June.

GBP/USD +0.01% at 1.4093

EUR/USD +0.07% at 1.2154

Oil slips on resurgent covid in Asia

Oil trades mildly under pressure at the start of the new week but holds towards post pandemic highs. Whilst the West easing lockdown restrictions is underpinning the price, concerns over rising covid cases and tighter restrictions in Asia are unnerving investors. Singapore has seen restrictions tighten, as has Japan which declared a state of emergency in 3 more prefectures. Several states in India are also set to extend lockdown restrictions raising some concerns of the near term demand outlook.

Baker Hughes rig data on Friday revealed that 3 more rigs were drilling, encoursaging by the recent rise in crude oil prices.

US crude trades -0.15% at $65.22

Brent trades -0.1% at $68.41

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:05 Fed’s Clarida speaks

16:40 BoE’s Vlieghe speaks

17:30 BoE’s Haldane speaks