US futures

Dow futures +0.4% at 34218

S&P futures +0.35% at 4174

Nasdaq futures +0.3% at 13540

In Europe

FTSE -0.06% at 7013

Dax +0.5% at 15422

Euro Stoxx +04% at 4021

Learn more about trading indices

Tech stocks lead the risers after jobless claims drop

US futures are heading higher on Friday, extending yesterday’s rebound. Inflation fears and concerns over the Fed tightening monetary policy appear to have eased. The impact from the FOMC minutes where the Fed indicated its readiness to start talking about tapering asset purchases appears to have been short lived.

The mood in the market is upbeat following encouraging jobless claims numbers yesterday and as investors look ahead to the release of manufacturing and service sector PMIs later today.

PMIs from Europe revealed that the economic recovery gathered pace in May with services sparking back into life as covid restrictions started to ease. The Eurozone composite PMI, a gauge of business activity rose to 56.9, its highest level in 3 years.

The US reading for both manufacturing and services is expected to show just a very mild slowing in the pace oof growth to 60.2 and 64.5 respectively.

Earnings

Coming to the end of earnings season, Deere is the highlight. The farm equipment manufacturer raised its full year profit forecast lifted by surging agricultural markets.

Footlocker is also reporting.

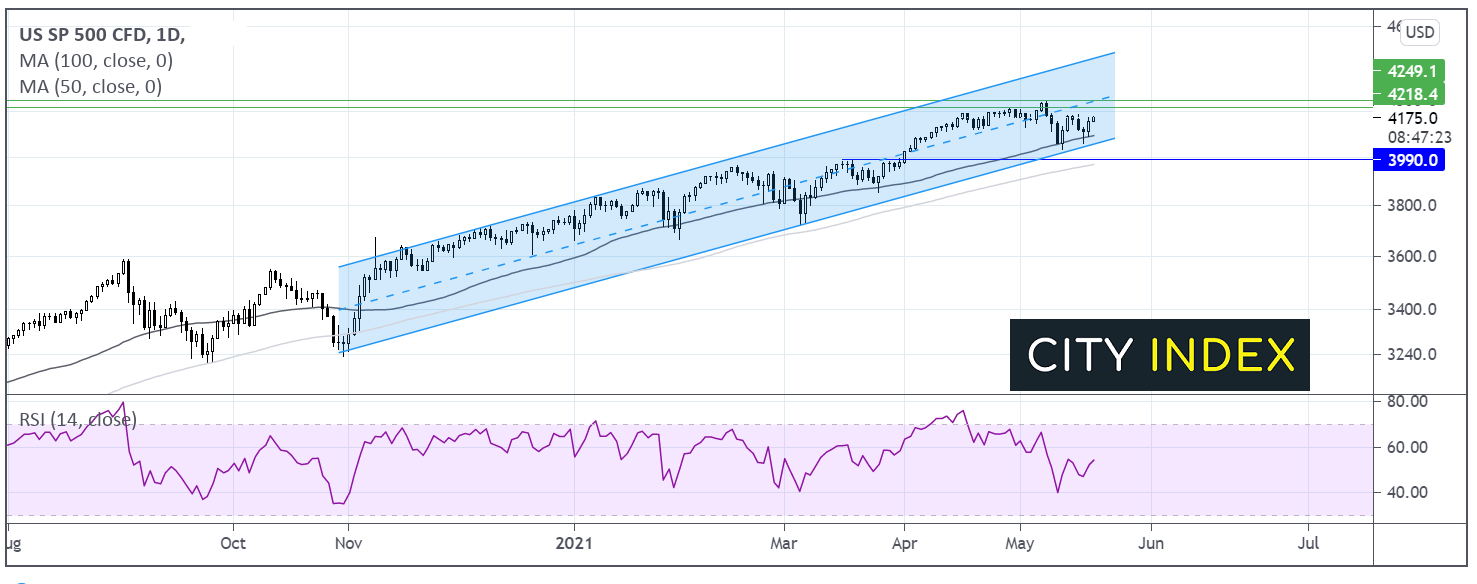

Where next for the SP 500?

The S&P 500 continues to trade in its multi- month ascending channel. The price once again found support on its 50 day ma which keeps the buyers hopeful of a move back towards 4215 April’s high, ahead of 4250 the all time high. The RSI is in bullish territory and pointing northwards suggesting that there could be more upside to come. A move below 3990 horizontal support and 100 day ma could negate the current uptrend.

FX – USD edges higher, GBP supported by strong data

The US Dollar heading high on Friday, picking up from multi-month lows. The greenback is still on track for a weekly loss.

GBP/USD is outperforming its G10 peers after strong PMI & retail sales data finished off a buoyant week for UK macro releases. Retail sales surged 9.2% MoM in April, well ahead of 4.5% forecast and up from 5.4% MoM in March. Consumer spent heavily as retailers reopened their doors in April. This was just the latest in a slew of upbeat numbers from the UK this week.

GBP/USD +0.06% at 1.4195

EUR/USD -0.3% at 1.2293

Oil set for weekly losses

Oil is rebounding after selling off across the week. Despite today’s push higher, both benchmarks are on track for losses of around 4% this week. Reports that Iran could be close to reviving the 2015 nuclear deal mean the oil market is bracing itself for an increase in supply. However, the US still hasn’t commented on any break through and the increase would most likely be towards the second part of H2.

Elsewhere, new Indian covid cases have remained below 300,000 for a 5th straight day leading to hopes that the peak has passed for the world’s third largest importer of oil.

US crude trades +2% at $63.13

Brent trades +1.7% at $66.12

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:45 Markit Manufacturing and Services PMI

15:00 Eurozone Consumer Confidence

15:00 US Existing Home Sales

18:00 Baker Hughes Rig Count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.